TL; PhD

- Following the recent integration of ETH, there could be a major price swing in both directions.

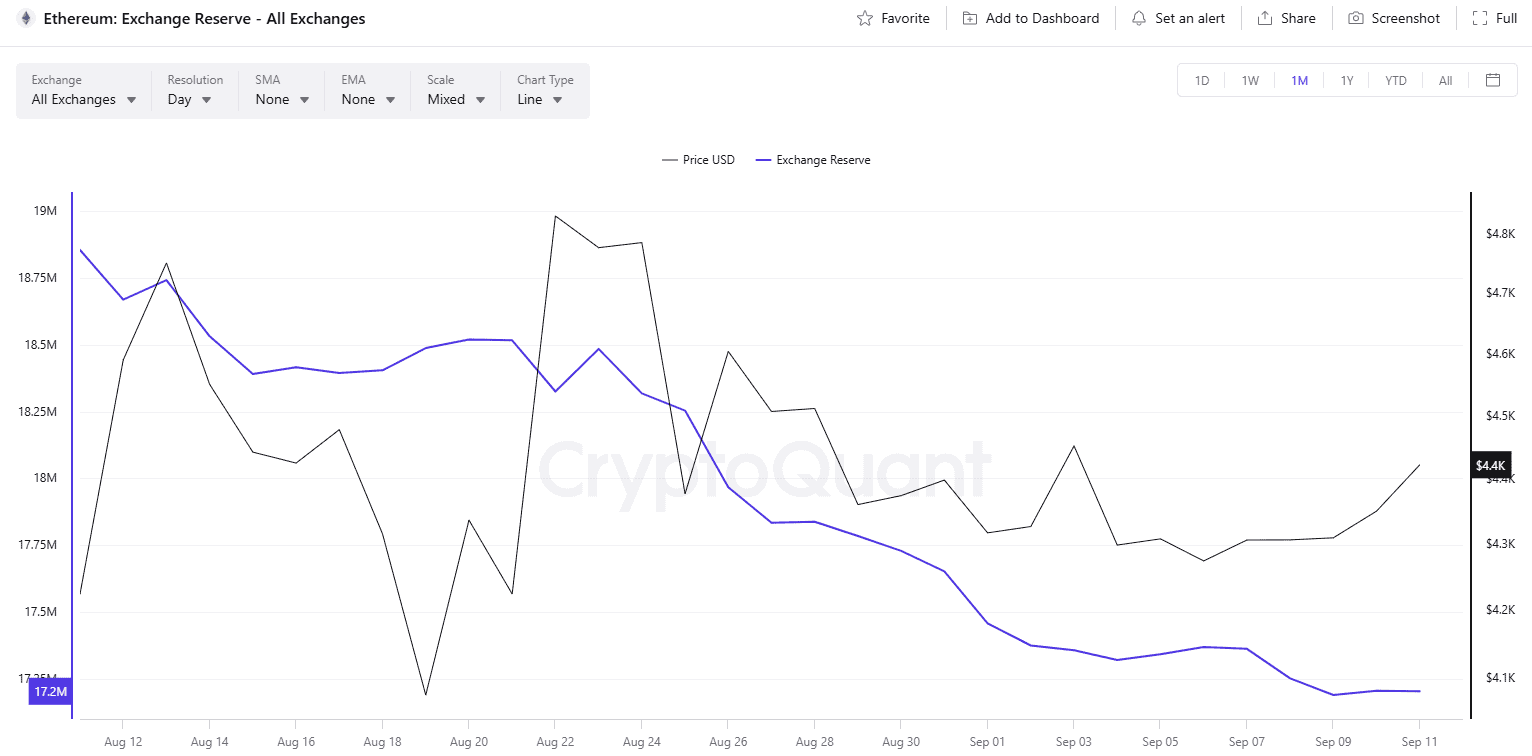

- Some X analysts have compared ETH cycles to BTC’s 2020-2021 rally, projecting targets between $8,000 and $10,000 over the coming months. Meanwhile, Exchange Reserves reached its nine-year low of around 17.1 million tokens, indicating that selling pressure has fallen.

Calm before the storm?

Ethereum (ETH) has been trading in a tight range between $4,300 and $4,500 over the past week, but the technical analysis tool Bollinger Band is Selection subject Price movements could be right there.

Developed by John Bollinger in the 1980s, metrics help traders find situations where they have been oversold or forced to buy. When the band squeezes, it usually indicates a period of low volatility. This could be a precursor to a serious resurrection or substantial fix.

Earlier this week, popular X user Ali Martinez It was revealed The band has tightened and warns the crypto community to “hope for a big move.”

Expect a big move for Ethereum $ETH as soon as the Bollinger Band squeezes! pic.twitter.com/5kgyzuf3vb

– Ali (@Ali_Charts) September 10, 2025

Most of the users commenting on the post predicted that potential swings would be an advantage. Still, a handful are bearish, warning $3,500 of possible drops.

Recent price forecasts

According to X User TED, ETH “correctly mirrors” BTC’s bull cycle from 2020 to 2021. That being said, he I look forward to it The second-largest cryptocurrency, which will explode in the next three to four months, exploded from $8,000 to $10,000. However, he sees the possibility of a short-term revision “to settle high leverage lengths before the reversal and before the new ATH.”

With the Crypto General Mac script A similar prediction has been outlined. The former believes ETH could reach $8,000 by the end of 2025.

“I’m all involved in this deal. Millions of profit or homelessness.” Added.

The reduction in the amount of ETH stored in crypto exchanges supports bullish papers. Cryptoquant data shows that this figure has recently dropped to a fresh nine-year low of around 17.1 million tokens. this This means that investors will continue to move their holdings from centralized platforms to independent ways, reducing immediate sales pressure.