Ethereum entered the consolidation phase after a short recovery, with prices below major resistance levels. However, given market sentiment, assets could be on the crisis of deeper decline.

Technical Analysis

By Edris Dalakshi

Daily Charts

ETH’s daily charts show that prices are struggling to surpass their $2,200 resistance zone. The recovery from the $1,800 low has lost momentum, with ETH still well below its 200-day moving average at close to $2,900.

The RSI is cooled just below 50 levels, reflecting the lack of a strong trend direction. For buyers to regain control, ETH must go beyond $2,200 and continue to $2,400. Otherwise, slow bleedbacks will take the risk towards the $1,800-$1,900 support zone.

4-hour chart

In the four-hour time frame, Ethereum is currently broken below the lower limit of the upward channel, indicating a potential change in the short-term trend. The breakdown from this rising structure around the $2,000 mark shows that bullish momentum has weakened and buyers have been unable to protect the channel’s support.

Additionally, the RSI is moving downwards, enhancing bear pressure. If this breakdown is met, ETH can then revisit the $1,900 demand zone. Neutralizing the bearish structure requires a recovery of over $2,100, but at the moment there is an even greater downside risk.

Emotional analysis

By Edris Dalakshi

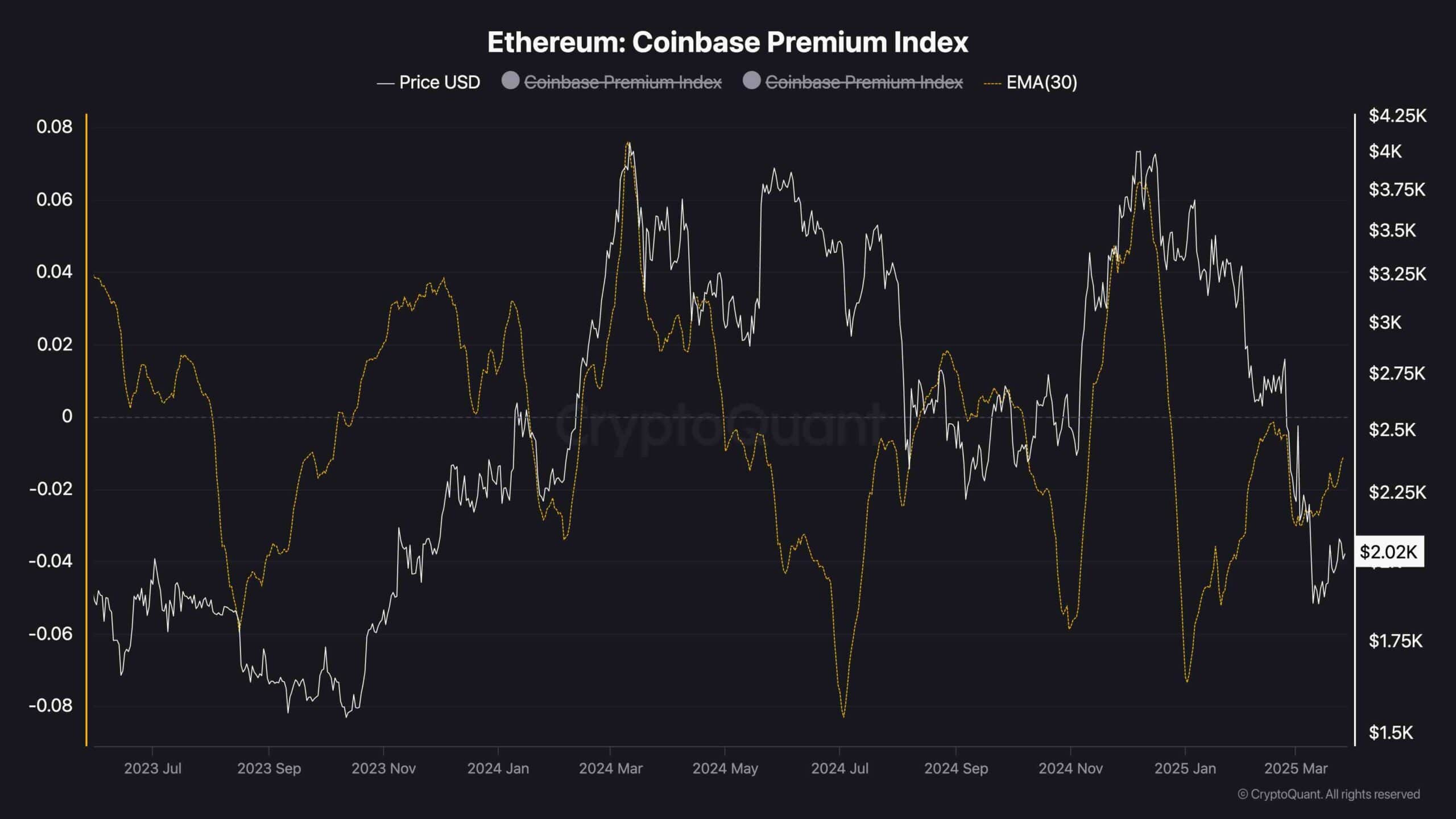

Coinbase Premium Index (30 Day EMA)

The Coinbase Premium Index remains in the negative territory, indicating that Ethereum is still trading at Coinbase discounts compared to other major exchanges. This suggests that US-based investors (often considered institutional or more conservative) exhibit or distribute limited demand.

The sustained negative premium usually reflects the interest of weak spot markets from the US, where price action can be emphasized, especially at the uncertain market stage. Until this metric is held inverted front, it indicates a lack of strong spot-driven accumulation, adding to the bearish undertones in current ETH environments.