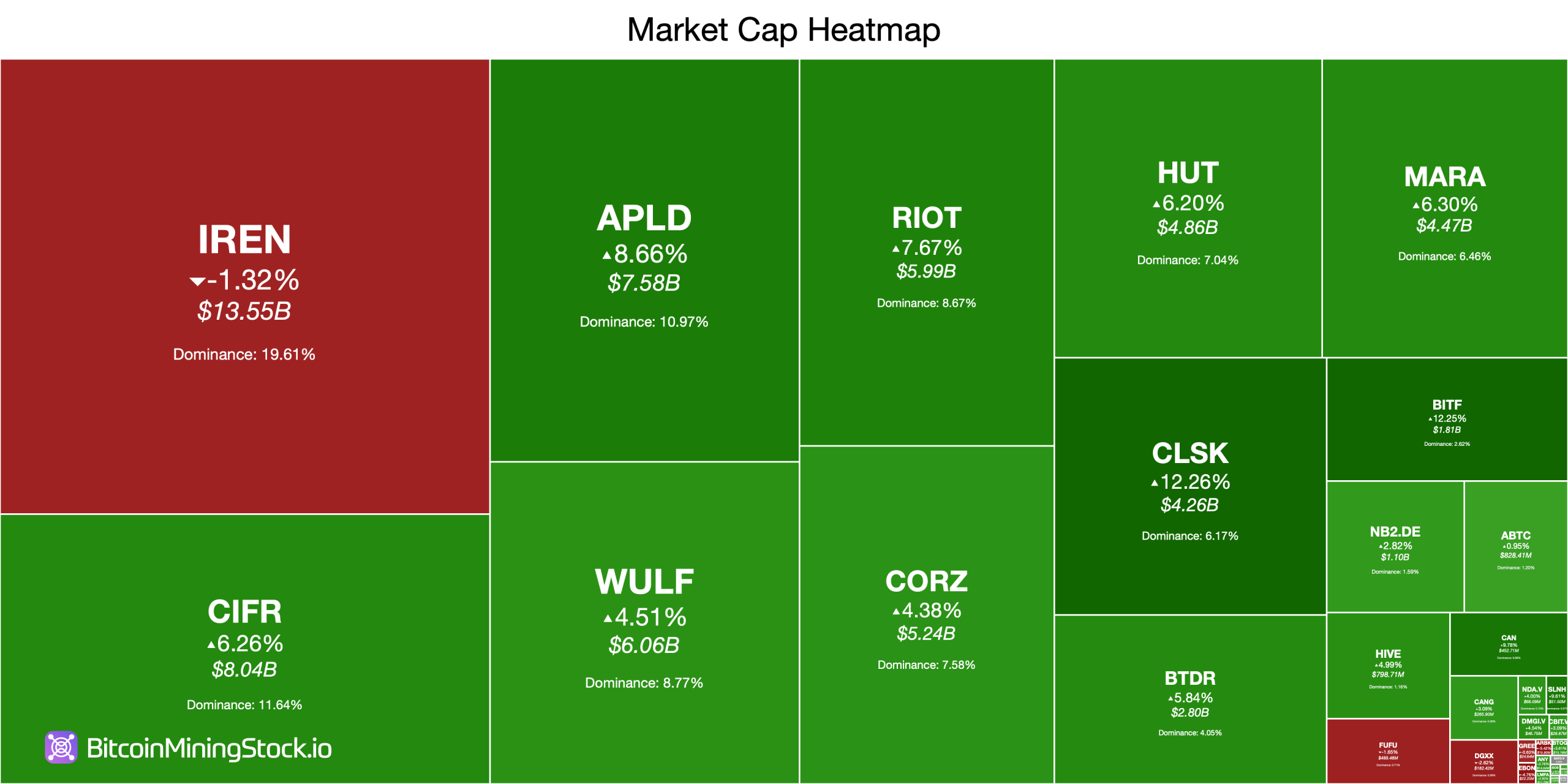

On Friday, and over the past week, publicly traded Bitcoin miners have been able to shake off the previous week’s turmoil and rack up solid gains. The top 10 miners by market capitalization have all spent the past seven days comfortably swimming in the green.

Bitcoin miners surge in weekly rally

During the same period, Bitcoin rose 8% against the US dollar, a momentum that spilled over into the mining sector. Not to be outdone, US stocks also showed a ferocious rise and ended the week on the uptick. The leaders of the group of miners prepared for scrap.

Take IREN Limited, for example, which stood out as the only laggard on the day with a -1.32% decline, but remains firmly in strong territory with a weekly gain of 13.13% and a market cap of $13.55 billion. IREN’s latest Q1 2026 report revealed strong year-over-year revenue growth, supported by new artificial intelligence (AI) cloud deals, including a $9.7 billion deal with Microsoft.

Crypto mining posted a confident daily gain of 6.26% and 7-day gain of 43.81% on Friday, all backed by a valuation of $8.04 billion, according to stats from bitcoinminingstock.io. The week’s gains come after Cipher signed a 10-year high-performance computing (HPC) colocation agreement with Fluidstack.

Applied Digital, backed by a market capitalization of $7.58 billion, was up 8.66% on a daily basis and 28.49% on a weekly basis. Terra Wolf joins the mix, adding 4.51% today and 37.37% this week, bringing the cap to $6.06 billion. Applied Digital just announced the completion of the second phase of its Polaris Forge 1 AI Factory campus in North Dakota, and Terrawolf highlighted Q3 progress with its Bitcoin mining and HPC efforts.

Riot Platforms posted a daily gain of 7.67% and a weekly gain of 26.90% to just under $6 billion. Core Scientific gained 4.38% for the day and added 14.66% for the week, backed by a valuation of $5.24 Billion. Riot recently released a financial update and third quarter results, delivering record results. Meanwhile, Core Scientific announced the termination of its merger agreement with Coreweave.

read more: Silver hits record price at historic Cup & Handle event

Hut 8 surged 6.20% on Friday and gained 31.04% for the week on the back of a market cap of $4.86 billion. The company also announced plans to develop four new sites expected to have a total capacity of more than 1.5 gigawatts. MARA Holdings traded at $4.47 billion, up 6.30% in 24-hours and 17.27% over the week.

The company also reported that third quarter 2025 sales reached $252 million, an increase of 92% year over year. In ninth place was Cleanspark, which surged 12.26% on the day and 55.19% for the week, pushing its valuation to $4.26 billion. Rounding out the top 10, Bitdeer posted a daily gain of 5.84% and a weekly gain of 30.32% on the back of a market capitalization of $2.8 billion.

Cleanspark reported strong growth with fiscal 2025 revenue reaching $766.3 million, an increase of 102% year-over-year. Meanwhile, Bitdeer recently announced the pricing of a $400 million convertible note. The week ended with miners riding strong momentum, driven by AI contract expansion, new HPC builds, and a steady Bitcoin rally that keeps the sector active.

But as these companies move toward AI and high-performance computing, unanswered questions remain. How will this evolving set of priorities shape the Bitcoin mining market in the long term? For now, the industry’s biggest players seem content to move forward, but whether they can find balance in the coming months could determine the next chapter for the sector.

Frequently asked questions ❓

- What drove miners’ gains this week? Bitcoin’s solid price movement, expansion of AI contracts, and new HPC developments contributed to gains in major mining stocks.

- Which Miner led in weekly performance? Companies like Cipher Mining, Cleanspark, Hut 8, and Bitdeer posted the strongest seven-day gains.

- How has the broader market affected mining stocks? U.S. stocks rose alongside Bitcoin, providing a tailwind for miner valuations.

- Why is AI and HPC adoption important for miners? The increased focus on AI and HPC raises long-term questions about how these priorities will shape the Bitcoin mining sector.