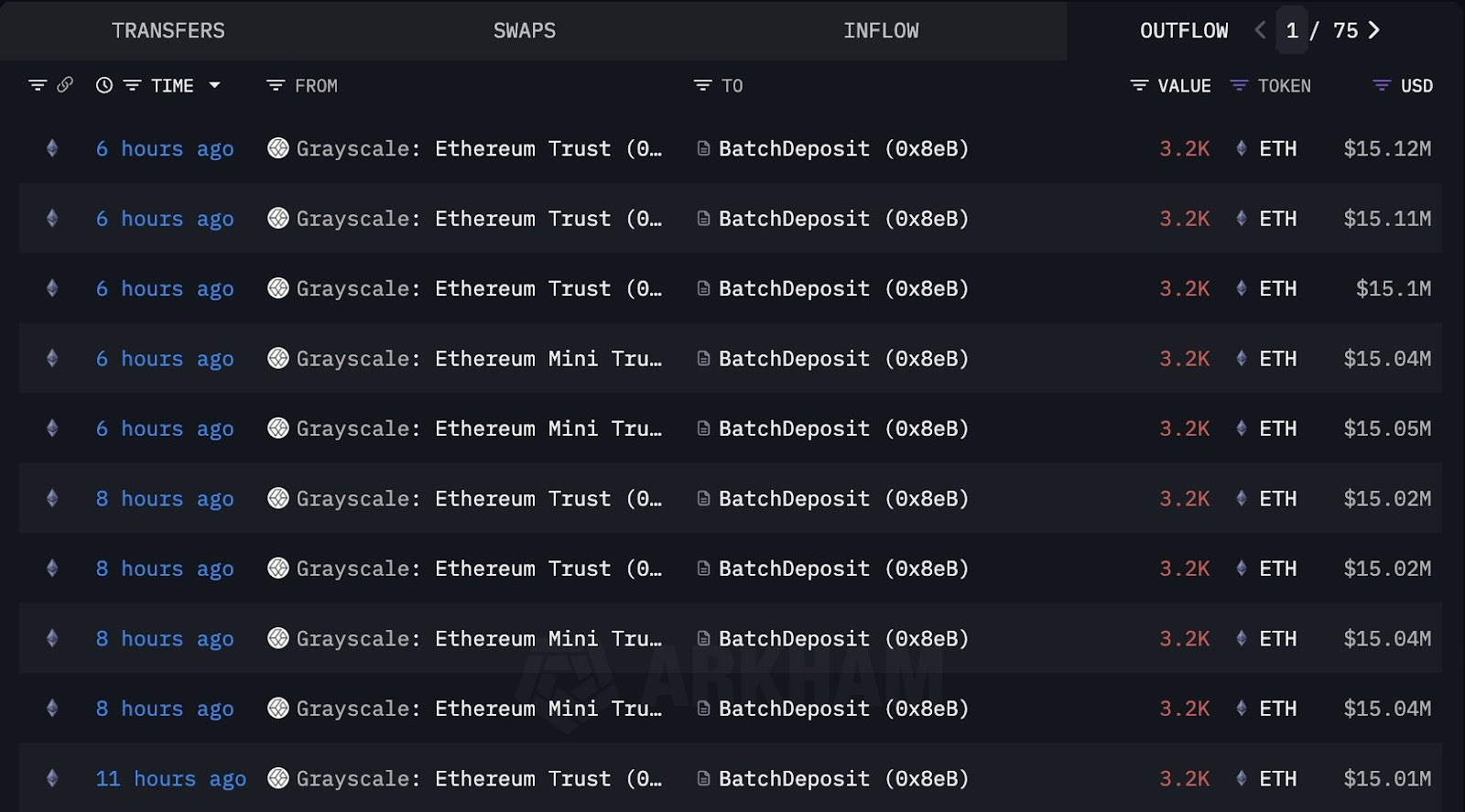

Grayscale, an asset management firm specializing in cryptocurrencies, has staked $150 million worth of Ether after introducing staking exchange-traded products (ETPS) on Monday.

According to blockchain data platform Lookonchain, the asset management company has staked 32,000 ether (ETH) worth $150 million.

The move comes a day after Grayscale introduced staking to its Ether ETP, making Grayscale the first US-based cryptocurrency fund issuer to offer staking-based passive income to its funds.

The move will allow Grayscale ETP and its shareholders to earn passive income by staking $150 million in rewards. According to Grayscale’s ETP staking policy, these staking rewards are treated as “fund assets.”

Based on the fee structure disclosed in the SEC filing, net of sponsor and custodian fees, fund shareholders will earn up to 77% of the total staking rewards generated on Grayscale’s Ethereum Trust and approximately 94% on the Ethereum Mini Trust.

sauce: look on chain

Both the Grayscale Ethereum Trust ETF (ETHE) and the Grayscale Ethereum Mini Trust ETF (ETH) are exchange-traded products registered under the Securities Act of 1933, rather than the Investment Company Act of 1940. The latter is the regulatory framework used for traditional mutual funds.

As such, ETPs are structurally different from ETFs that comply with the 1940 Act.

Grayscale’s move marks the launch of the first staking ETP in the United States. However, at least two additional Ether staking funds are expected to receive responses from the U.S. Securities and Exchange Commission (SEC) in October.

Related: South Korean retail capital drives Ether prices and government bond demand: Samsung Mo

SEC to set deadline for 16 altcoin ETPs in October

October is shaping up to be a promising month for cryptocurrencies, with 16 crypto ETP filings listed on the SEC calendar for the month.

At least two of the 16 crypto staking funds are awaiting decisions this month. These include 21Shares’ Core Ethereum ETF (TETH) staking application scheduled for October 23rd and BlackRock’s iShares Ethereum Trust (ETHA) ETP amendment to add staking rewards scheduled for October 30th.

21Shares’ Ether fund is registered under the Securities Act of 1933 and is an ETP similar to Grayscale’s ETH and ETHE ETP, which were launched yesterday.

Related: Aging baby boomers and global wealth are expected to boost cryptocurrencies through 2100

Meanwhile, the REX-Osprey Solana staking ETF was launched in July as the first Solana (SOL) staking ETF under the Investment Company Act of 1940. This allows the crypto ETF to directly hold a large portion of the spot assets and distribute staking rewards where applicable.

Grayscale’s Solana fund, Grayscale Solana Trust (GSOL), also enables staking and is awaiting regulatory approval for uplisting to the ETP.

However, the ongoing government shutdown could delay the regulator’s response to crypto ETP applications, as the SEC said it would operate under “modified conditions” with “very limited staff” until the funding bill is passed.

The Senate is scheduled to reconvene later Tuesday on the funding bill with no clear solution in sight after Republicans and Democrats failed to reach an agreement for the fifth time on Monday.

Due to the government shutdown, increased uncertainty has also increased investor appetite for crypto funds and decentralized assets.

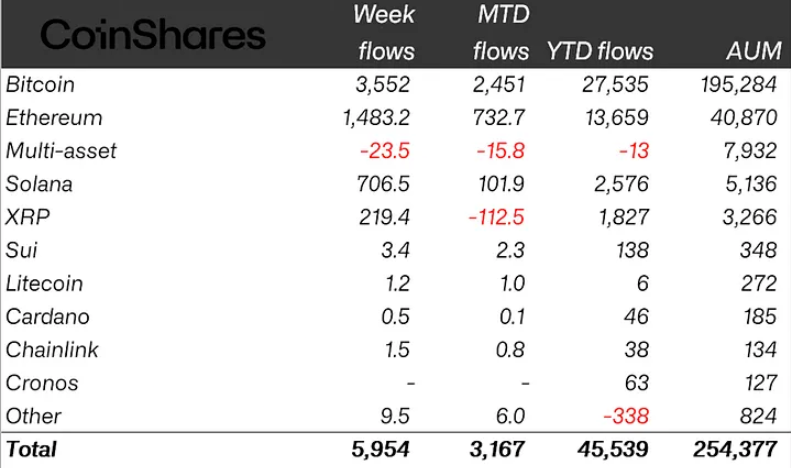

Crypto ETP flows by asset (in millions of USD) as of Friday. Source: CoinShares

Last week, post-government shutdown crypto ETP inflows hit a record high, with cumulative investments worth $5.95 billion, Cointelegraph reported on Monday.

Magazine: The 2025 altcoin season is approaching…but the rules have changed