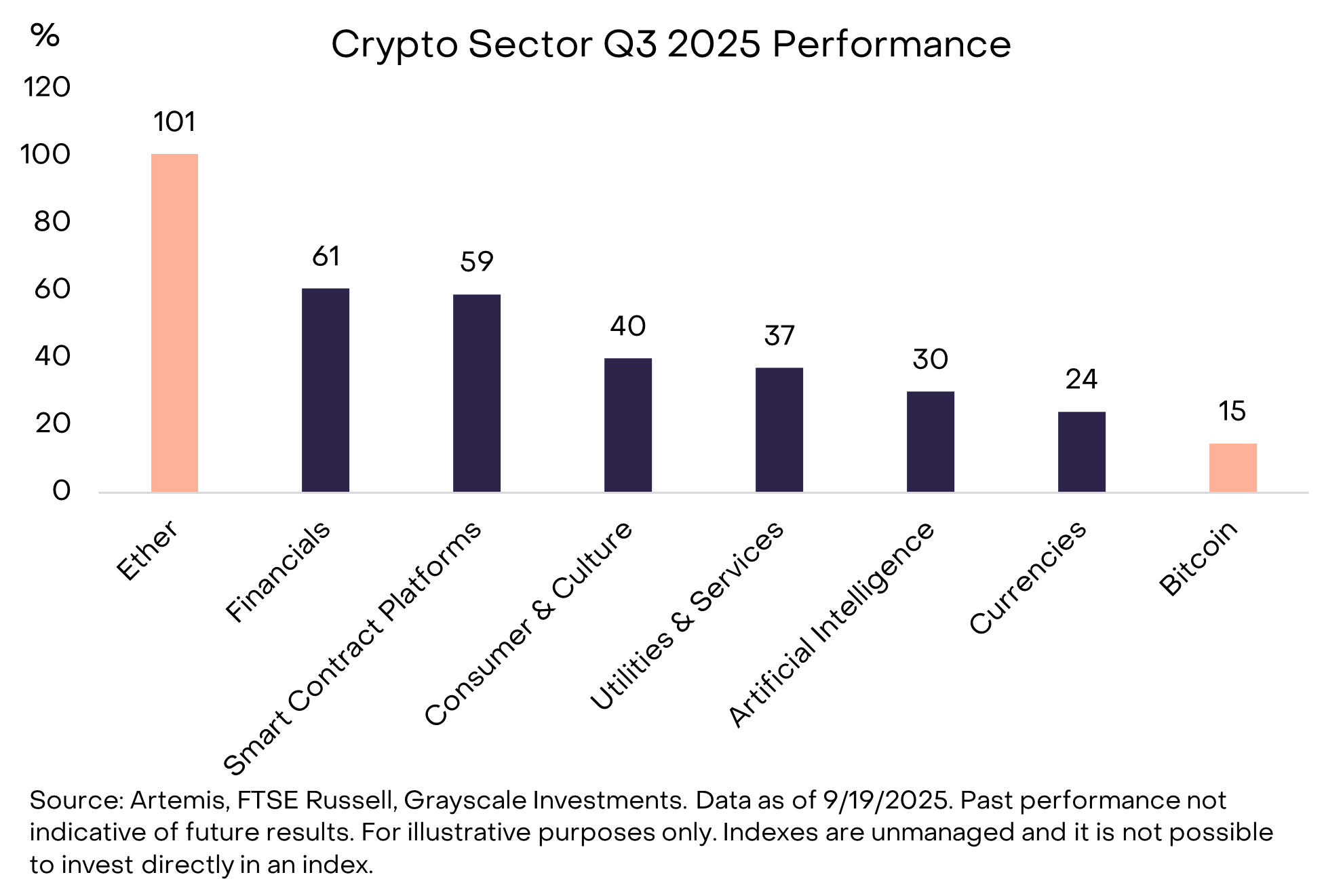

Grayscale revealed in the index that Altcoins provided the highest returns in the third quarter of 2025. Bitcoin’s inadequate performance became the most decisive feature of the quarter.

Indexes were generally dominated by tokens used for financial applications and smart contract platforms. Their theme narrative, centered around the adoption of Stablecoin, exchange volumes, and the Department of Digital Assets Treasury (DATS) have driven this outperformance overwhelmingly.

Altcoins dominated Q3 performance

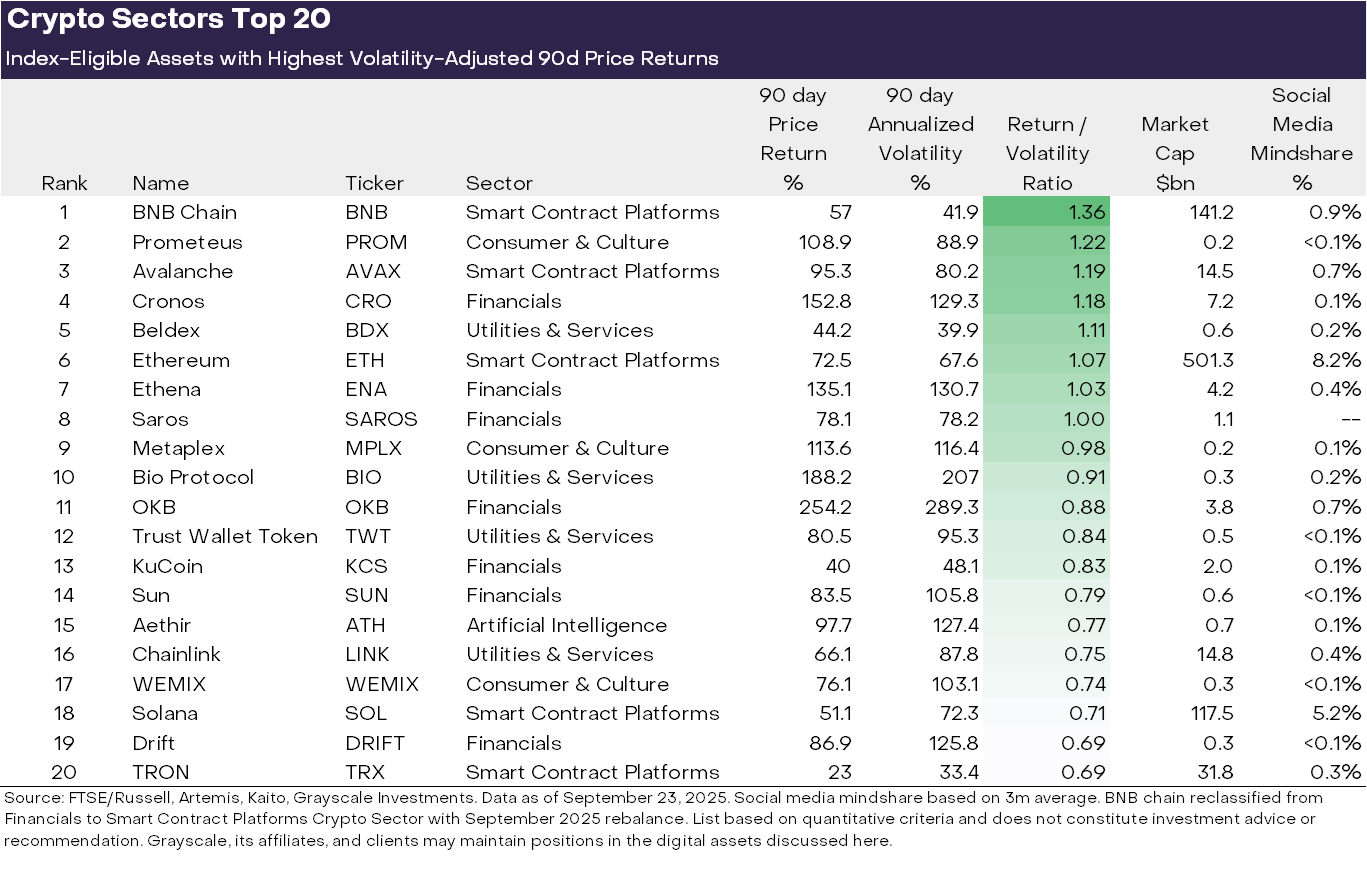

The third quarter of 2025 proved to be a period of broad strength in the digital asset market. According to an index developed by Grayscale Research, several clear winners produced the best volatility-adjusted price returns.

In the ranking of top 20 best-performing tokens, BNB chains took the lead and provided the most advantageous returns with relative stability compared to those that benefited by excessive risk.

It followed Prometeus, Avalanche, Cronos, Beldex, and Ethereum.

Top 20 performances for tokens. Source: Grayscale Research.

Grayscale organizes the digital asset market into six segments based on currency, finance, finance, consumer and culture, utilities and services, and artificial intelligence, including the core functions and use cases of the protocol.

Seven top-performing tokens formed part of the financial segment, and five came from the smart contract platform. These results effectively quantified shifts from currency. Most notably, Bitcoin did not cut it.

Why did Bitcoin fall behind?

The most important data points of Grayscale’s research were not who was noticeably absent, who was not present, or who made Bitcoin.

All six sectors produced positive returns, but the currency is particularly lagging behind, reflecting a relatively modest price increase in Bitcoin compared to other segments. When measuring performance by risk, Bitcoin did not provide a compelling profile.

Cryptographic Sector Q3 2025 Performance: Source: Grayscale Research.

The assets that created the list were overwhelmingly driven by narratives of themes related to new utilities and regulatory clarity. These stories focus specifically on the adoption, exchange volume and data of Stablecoin.

According to a Grayscale study, the rise in centralized exchange volumes benefited tokens such as BNB and CRO. Meanwhile, the rise in DATS and widespread adoption of Stablecoin has driven demand for platforms such as Ethereum, Solana and Avalanche.

Certain Decentralized Finance (DEFI) categories also showed strength, such as decentralized permanent futures exchanges, such as high lipids and drift, which contributed to the strength of the financial sector.

Bitcoin was less exposed to these specific catalysts as a peer-to-peer electronic cash and valuable asset. This lack of exposure allowed altcoins tied to functional platforms and financial services to surge risk-adjusted performance.

Post-Grayscale ranks among the top 20 tokens that offered the best returns in Q3.