According to a recent report from Deutsche Bank, central banks around the world have been increasing their gold reserves over the past few years, a trend that could have a major impact on Bitcoin.

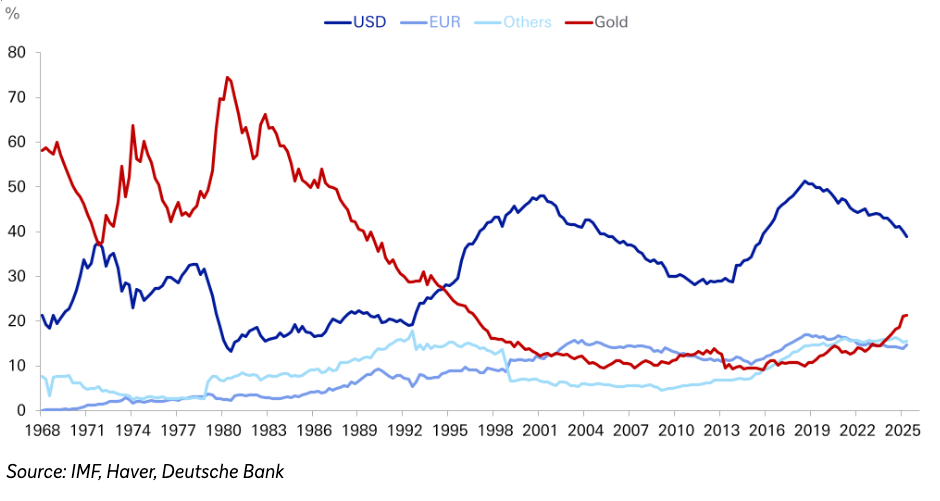

Deutsche Bank strategists reported Thursday that gold’s share of central bank reserves reached 24% in the second quarter of this year, the highest percentage since the 1990s.

With public demand for gold running at double the 2011-2021 average, some Deutsche Bank analysts see gold becoming increasingly similar to Bitcoin (BTC), which posted a record performance in 2025.

Deutsche Bank strategists write that the new gold accumulation signals a major shift in global finance, mirroring behavior seen for much of the 20th century, and that Bitcoin’s momentum highlights that it shares many of the same dynamics.

Gold returns to inflation-adjusted highs

Gold has been parabolically hitting new highs in fiat terms, but it was only recently that the asset surpassed its inflation-adjusted all-time high (ATH) since 1980.

“Gold has finally surpassed its real-adjusted high since this point 45 years ago in recent weeks,” Deutsche Bank strategists wrote.

Composition of world official reserve assets (market prices). Source: Deutsche Bank

Deutsche Bank cited decades of central bank selling, forced gold sales by institutional investors, and the advent of the fiat era as the main reasons for the significant lag in gold’s inflation-adjusted ATH.

“Gold’s formal role as a reserve asset ended in 1979, eight years after the collapse of Bretton Woods, when IMF (International Monetary Fund) member countries were prohibited from pegging their exchange rates to gold,” Deutsche Bank analysts said.

What makes Bitcoin a backup candidate?

As gold soars to new inflation-adjusted all-time highs, Deutsche Bank macro strategist Marion Labour highlights a series of similarities between these assets that could make Bitcoin an attractive store of value.

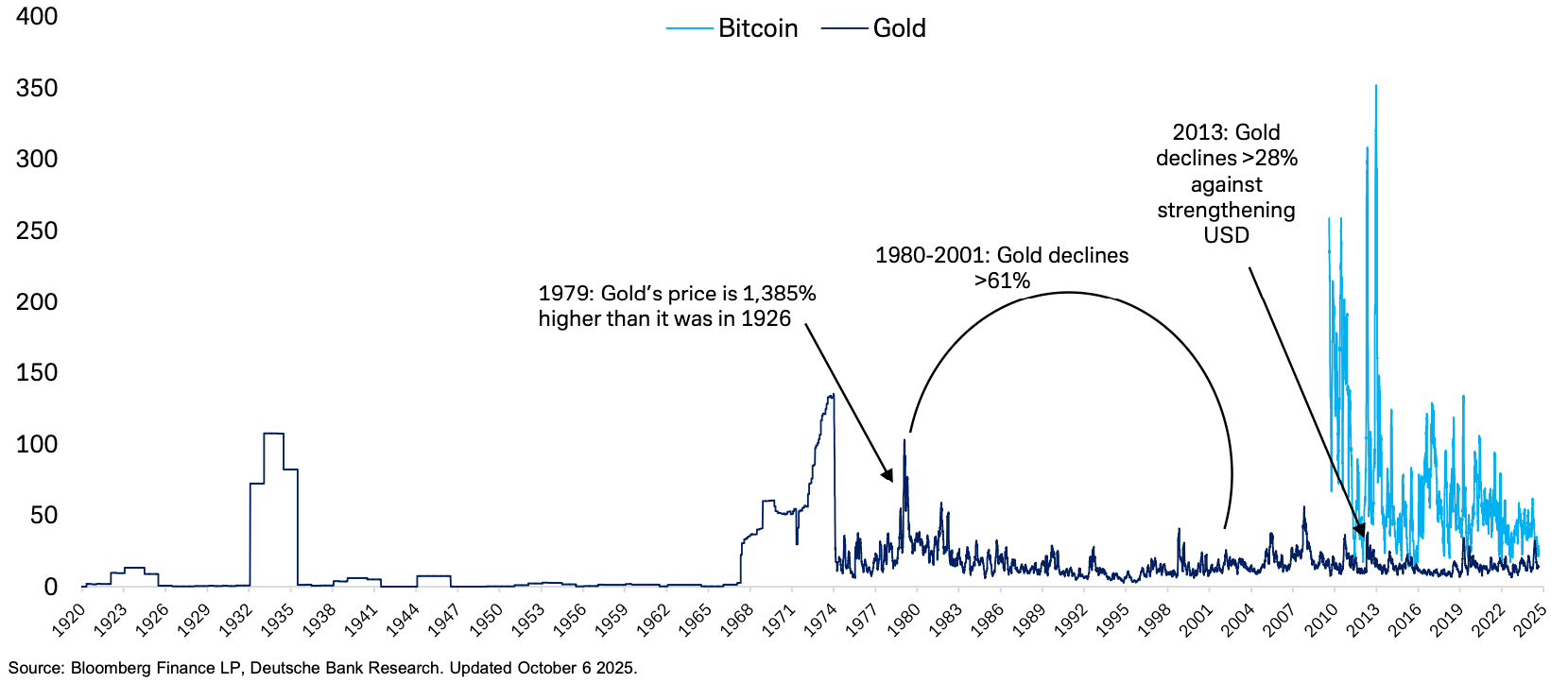

In a report entitled “Money Reigns, Bitcoin Rise,” Labour observed striking similarities in the performance trajectories of the two assets since their inception.

30-day volatility of Bitcoin and gold. Source: Deutsche Bank

Another notable similarity is that both gold and Bitcoin have experienced high volatility and poor performance, the strategist noted.

Related: Bitcoin may become ‘boring’ as institutional investor interest grows: Michael Saylor

Additionally, Labour said that both gold and Bitcoin have low correlation to traditional assets, offering significant diversification benefits.

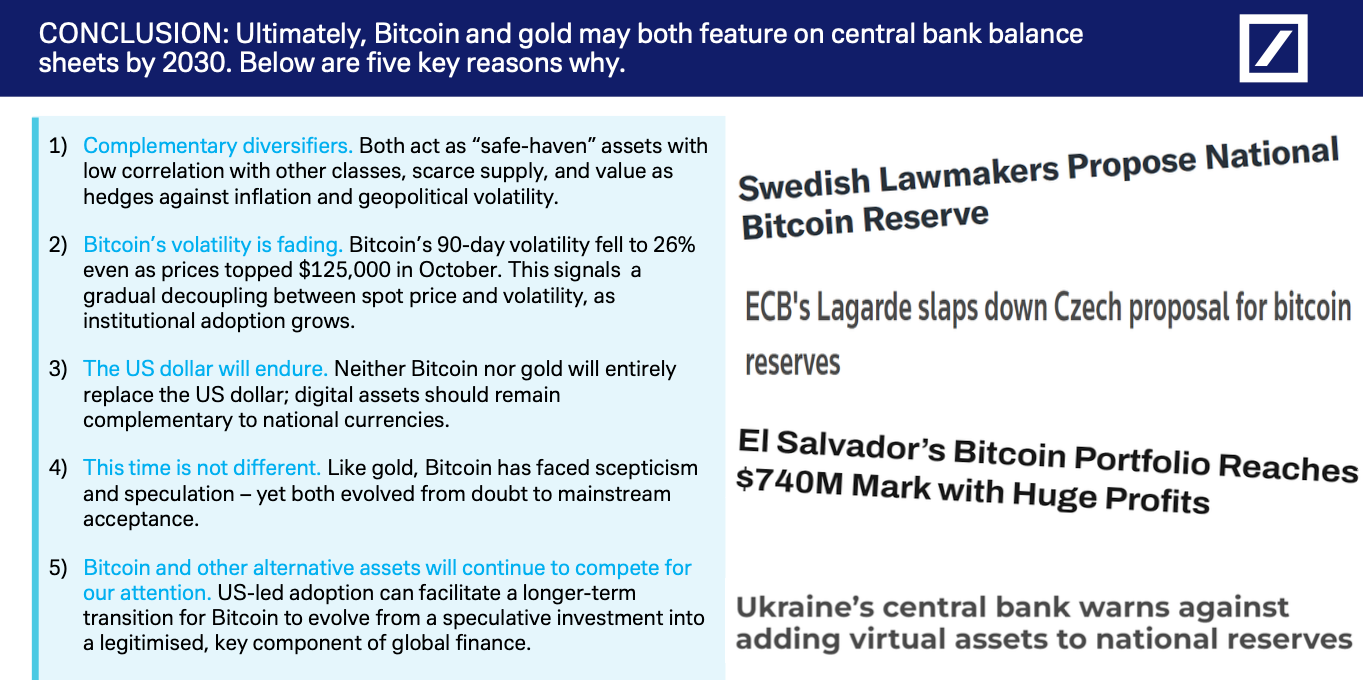

Prediction: Bitcoin and gold will be added to central bank reserves by 2030

As for Bitcoin’s potential as a central bank reserve asset, Labour’s main arguments against it are its high volatility and “no substantiation.”

“However, volatility has now fallen to historic lows,” he added, noting additional concerns such as limited usage, risk perception, speculative nature, cyber vulnerabilities and liquidity constraints.

Related: Bitcoin strategic reserves could be negative for BTC and USD: Crypto executive

Despite these issues, Laboule suggested that bitcoin and gold “could both be on central bank balance sheets by 2030,” pointing to common characteristics including their role as “safe haven” assets.

Deutsche Bank macro strategist Marion Labour has predicted that both Bitcoin and gold could be on central bank sheets by 2030. Source: Deutsche Bank

Labour’s views on Bitcoin and gold come amid growing adoption of BTC by institutions and growing interest from some governments in holding Bitcoin as part of their strategic reserves.

However, Bitcoin’s volatility remains a major concern for many central bankers whose primary objective is to preserve the value of their reserve assets.

magazine: US risks being put on the ‘front line’ by other countries for its Bitcoin reserves: Samson Moe