The escalation of tensions in the trade war caused widespread market volatility and sparked growing concern among investors. However, one analyst suggests that these highly uncertainties could serve as catalysts for the growth of Bitcoin (BTC) values.

As Bitcoin struggles to gain momentum, prospects have emerged, with both traditional and cryptocurrency markets showing signs of widespread losses.

Could the trade war be a big break for Bitcoin? Five key factors driving value growth

In a detailed analysis posted on social media platform X (formerly Twitter), Bitcoin Libre analyst and CEO Ben Sigman outlined five different factors where a tariff-driven dispute could lead to an increase in Bitcoin’s value.

His first point revolved around the potential trajectory of the US dollar. He said the trade war would strengthen the dollar. But the subsequent collapse would reverse this.

“Taxes will spike the dollar. EMS will dip under USD debt of less than $12 trillion. Trust in Fiat Slip. Capital scramble for the safety of fixed supplies,” he said.

Sigman suggested that in this case, capital would be evacuated to assets with fixed supplies such as Bitcoin and be placed as guardians against financial instability.

He then pointed out the possibility of Bitcoin as a hedge against inflation. Tariffs often disrupt global supply chains, increase product costs and curb economic growth. In response, central banks, including the Federal Reserve, could lower interest rates, which could underestimate the country’s currency.

Sigman argued that Bitcoin’s inherent rarity and global accessibility make it a compelling hedge in such a scenario.

Third, Sigman highlighted the accelerated trend of de-sharing. He explained that countries such as China, where 56% of trade bills are now on Wednesday, are increasingly seeking alternatives to the US dollar.

He said the BRICS (Brazil, Russia, India, China and South Africa) coalition will also develop alternative financial systems. However, this shift is not without risk. This is because it could lead to capital flights.

“Bitcoin thrives as a neutral and global option in a fragmented world,” he argued.

Fourth, Sigman predicted market panic. He estimates that a single tariff cycle erases a market value of $5 trillion, flattens bond yields, and traditional safe haven assets such as gold are not attractive.

In this environment, Bitcoin volatility could attract investors for high-risk, high-reward opportunities, which could drive significant capital inflows.

Finally, Sigman argued that the trade war could expose systemic vulnerabilities in global institutions. Tariffs sedimentate debt defaults, erode trust in a Fiat-based system, and encourage investors to turn to Bitcoin.

“Bitcoin was built for this – no permission, borderless, banker,” he concluded.

Nevertheless, not all analysts share Sigman’s optimism. Another well-known commentator, Fred Kruger, recently outlined nine forecasts regarding the potential imposition of tariffs above 100% in China next year. He predicted that the scale could lead to a significant decline in other cryptocurrencies like Bitcoin and Solana (SOL).

“It all comes together. At some point this ends. Trump is unfortunately insane and he’s badly advised,” Kruger wrote.

When asked if Bitcoin would go to zero, he said,

“I’ll take it all for a dollar.”

As trade tensions between the US and China intensify, further tariffs on Chinese goods and broader geopolitical frictions will remain vigorously scrutinized. It remains to be seen how the biggest cryptocurrency will work in the long run.

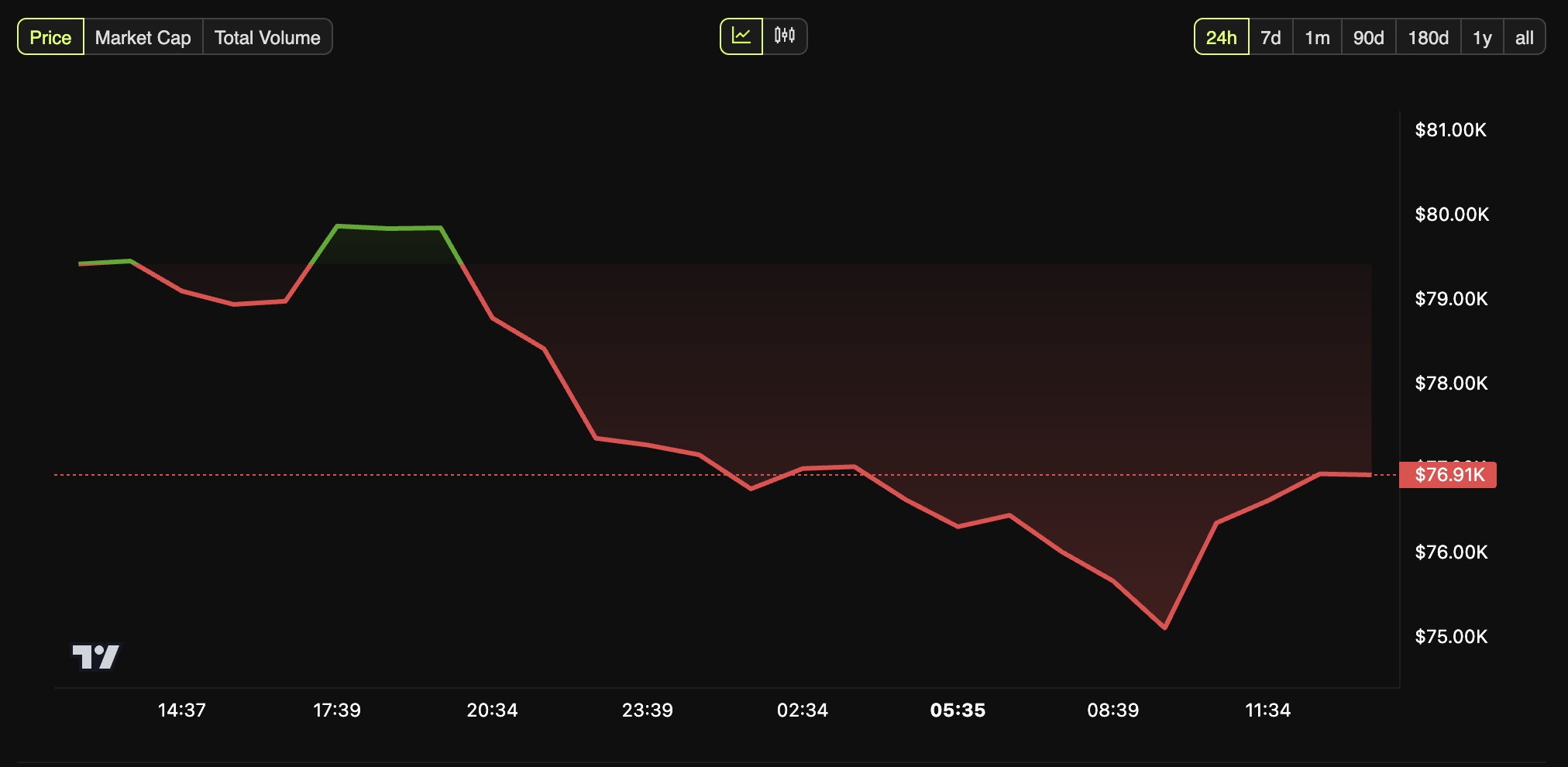

Bitcoin price performance. Source: Beincrypto

For now, the market looks very bearish. Beincrypto data showed BTC fell 3.1% in the past day. At the time of writing, it was trading at $76,914.