Major Bitcoin holding institutions may eventually lose patience with Bitcoin developers who don’t quickly address quantum computing concerns, according to venture capitalist Nick Carter.

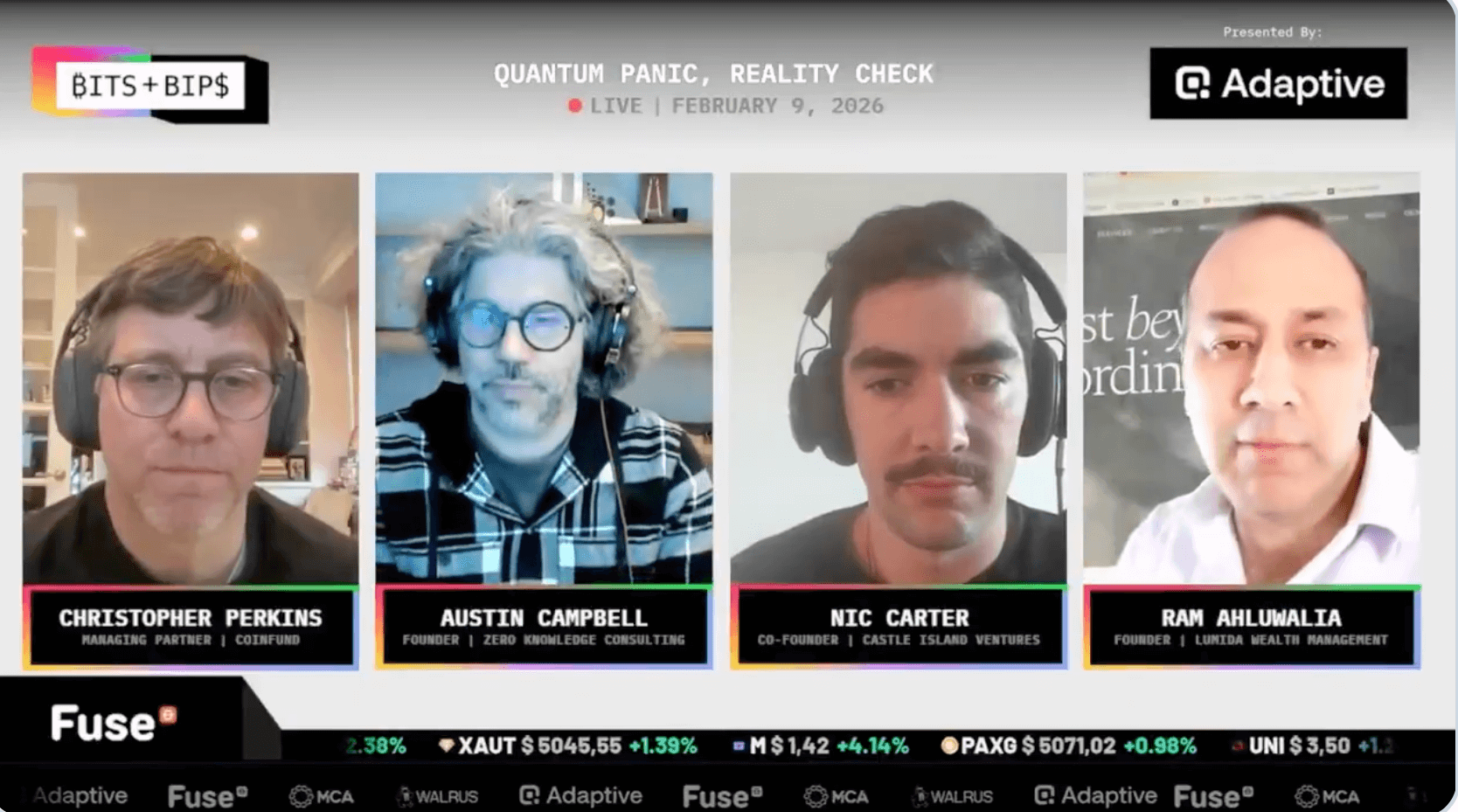

“The big institutions that currently exist in Bitcoin are going to get fed up and fire developers and bring in new ones,” Carter said during his speech. bits and bips Podcast episode published Thursday.

“I don’t think the developers will continue to do anything,” Carter said.

sauce: cointelegraph

“If you’re BlackRock and you have billions of dollars of client assets in this problem and it’s not being resolved, what choice do you have?” he said.

Carter also talks about the possibility of a “corporate takeover”

BlackRock, the world’s largest asset management company, holds approximately 761,801 Bitcoins (BTC), worth approximately $50.15 billion at the time of publication. This corresponds to approximately 3.62% of Bitcoin’s total supply.

Carter warned of a “corporate takeover” if Bitcoin developers do not move quickly to implement quantum-proof cryptography, which he claimed will “succeed.”

Nick Carter appeared on the Bits and Bops podcast on Thursday with three other crypto executives. sauce: Laura Shin

Austin Campbell, founder of Zero Knowledge Consulting, echoed similar sentiments. “If there’s a structural problem here and they have a bigger perspective, eventually they’re going to be asked to speak up,” Campbell said.

Carter has recently been vocal about the threat quantum computing poses to Bitcoin. On January 21, he said Bitcoin’s “mysterious” price underperformance was “quantum driven” and “the only story that matters this year.”

According to CoinMarketCap, Bitcoin was trading at $70,281 at the time of publication, down 26.25% in the past 30 days.

But not everyone agrees that institutions try to influence networks. Ram Ahluwalia, founder of Lumida Wealth Management, said the main institutions in Bitcoin are “passive” investors. “They’re not activists,” he said.

Industry split over the urgency of Bitcoin quantum risk

This comes amid an ongoing industry-wide debate about how imminent the threat to Bitcoin really is.

Related: Bitcoin exceeds $69,000 due to slump in US CPI, but probability of Fed rate cut remains low

Charles Edwards, founder of Capriol Investments, believes quantum computing is a potential “existential threat” to Bitcoin and argues that upgrades are needed now to strengthen network security.

Meanwhile, Christopher Bendixen, head of Bitcoin research at CoinShares, claimed in a post on Friday that of the 1.63 million Bitcoins, only 10,230 Bitcoins reside in wallet addresses with publicly exposed cryptographic keys that are vulnerable to quantum computing attacks.

Some Bitcoiners, including Strategy Chairman Michael Saylor and Blockstream CEO Adam Back, believe the quantum threat is overstated and won’t disrupt the network for decades.

magazine: Brandt says Bitcoin hasn’t bottomed out yet, but there’s hope for polymarkets: trade secrets