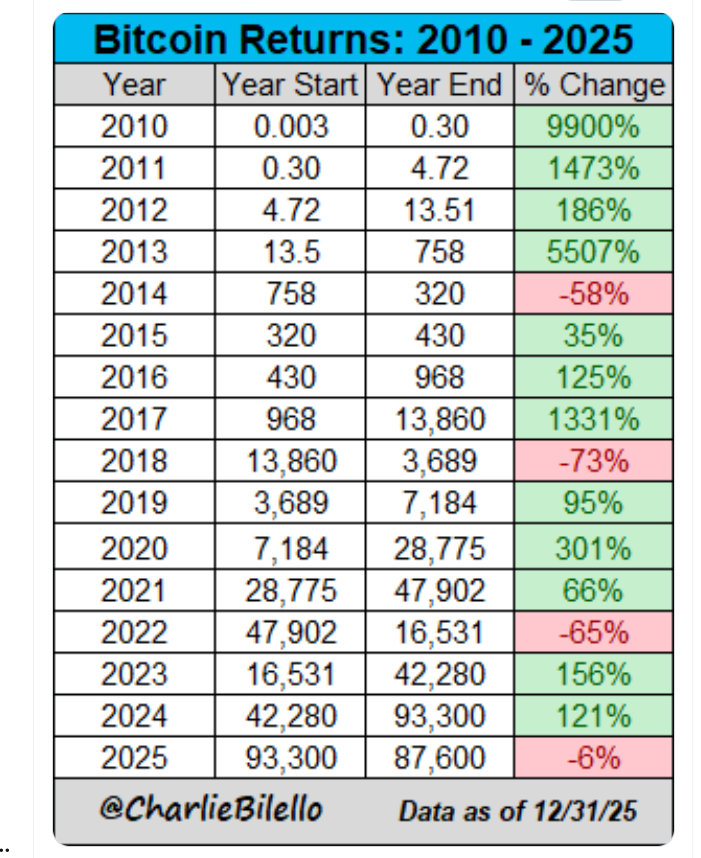

Bitcoin ended 2025 cheaper than it started, marking its first decline in the year following the halving.

Bitcoin (BTC) halving occurs every four years, cutting mining rewards in half and fewer new coins entering the market. Historically, this resulted in a cycle of accumulation. In other words, the post-halving bull market peaks, followed by a sharp correction and a multi-year bear market.

After the 2012 halving, Bitcoin skyrocketed and ended the following year at a new high. A similar pattern was repeated in 2016 and 2020.

But this time, that pattern broke.

Despite the latest halving date in April 2024, Bitcoin is currently down more than 30% from its all-time high of $126,080 on October 6, ending the year lower than it was at the beginning of the year, according to CoinGecko data.

sauce: Charlie Bilello

The four-year cycle has been frequently used to predict and analyze how the cryptocurrency market will move broadly.

Analysts had been hinting at a four-year cycle of death for months.

Vivek Sen, founder of Bitcoin PR firm BitGrow Labs, said in an X post on Wednesday that Bitcoin is ending the year on the decline, indicating that the 4th cycle is now “officially dead.”

sauce: Vivek Sen

Investor Armando Pantoja, on the other hand, shared a similar view, blaming the influx of new institutions and traders.

“There are new players in the market, and crypto is no longer 2016 or 2020. ETFs, institutional investors, and corporate balance sheets don’t trade like hype-driven retail. In Bitcoin trading macro, BTC is currently responsive to liquidity, interest rates, regulation, and geopolitics, and it’s not a perfect halving calendar,” he said.

Related: Bitcoin’s four-year cycle may not be over after all: Glassnode

Pantoja added that while the halving is still important in the grand scheme of things, “supply is increasingly locked in, miners have financing options, and price movements are not as automatic as they used to be.”

Other crypto executives are divided on a 4-year cycle

Throughout 2025, crypto executives including ARK Invest CEO Cathie Wood, BitMEX co-founder Arthur Hayes, and Bitwise’s Matt Hougan and Hunter Horsley said four-year cycles were a thing of the past.

However, some industry insiders argue that the situation is alive and well and is just unfolding differently than in previous years.

Markus Thielen, head of research at 10x Research, said in the December edition of The Wolf Of All Streets podcast that the cycle remains in place, but is no longer driven by planned supply cuts.

magazine: The big question: Can Bitcoin survive a 10-year blackout?