This is a segment of the 0xResearch newsletter. Subscribe to read the full edition.

A recent report from Fidelity Investments proposes to evaluate blockchains based on GDP.

“…Because of the embedded currency, it would be better to compare decentralized blockchains with sovereign countries and their economies, rather than web2 companies or products.”

Here is the GDP equation: C+I+G+(XM)

C is consumption, I is business investment, G is government expenditure, X is export, M is import, XM is net export.

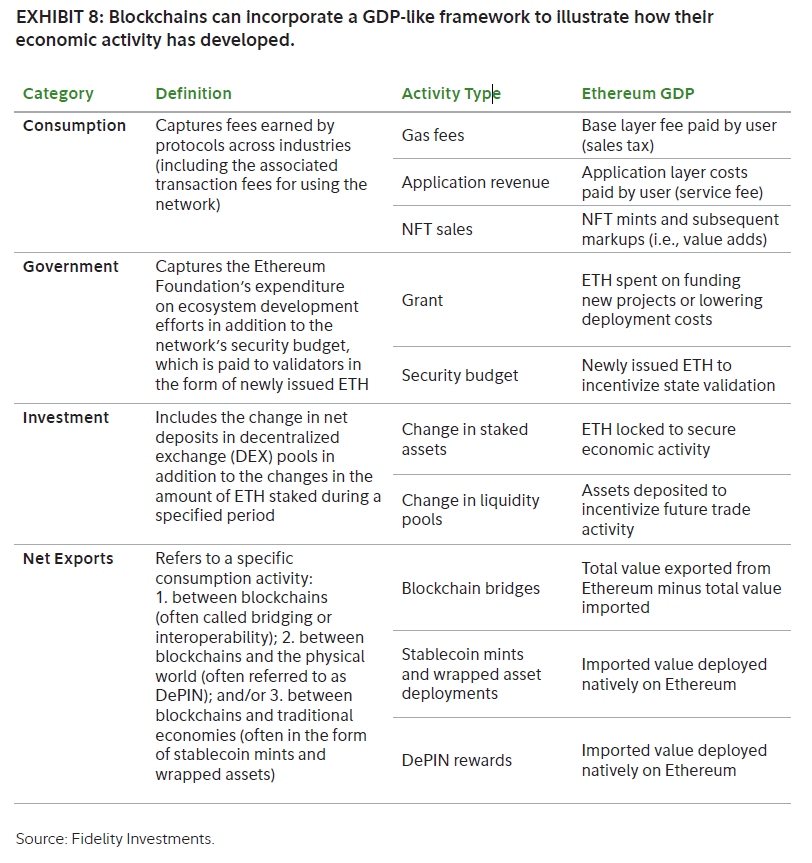

Fidelity uses ETH as an example. So, if you want to transpose the GDP formula into an Ethereum blockchain metric:

- c = what users spend as gas, use UNISWAP, build NFTs, etc.

- i = amount of piling assets or capital in the liquidity pool.

- G = Ethereum Foundation expenditures issued an ETH to the validator.

- xm = some stupid things/burn of what was built, and bridges flow to other chains and depin rewards.

You can see the entire table here:

A comprehensive effort by Fidelity, but raises some questions.

GDP is a measure of domestic production. Think of it as “all the value created here.” When a country exports, it is domestic production. When it is imported, it is expenditure. Therefore, we will “net” import GDP.

But when millions of idiots are bridged to Ethereum that sucks up blockchain’s “GDP” even though nothing on-chain productive occurs.

That is in contrast to when Stablecoin is built on Onchain or when helium miners are paid in tokens to provide useful mobile cellular services. These are productive “imports” that count properly in the “GDP” of the blockchain.

So, while the measurement of “net export” by Bridge Flows is conceptually sound, as well as Blockworks’ Dan Smith appropriately pointed out, CEX cold wallet sweep should be explained.

Loading Tweets…

Fidelity’s valuation model also claims that L1 tokens should be evaluated based on “money,” or more specifically, exchange and storage of value.

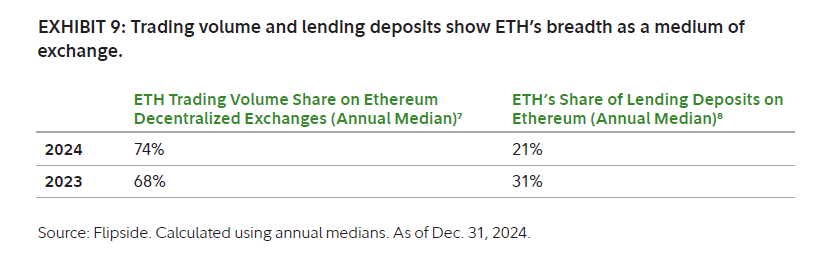

Fidelity insists: “Ether is the dominant trading pair of exchanges and serves as a major asset to oppose it.”

At best I justify the “medium of exchange” aspect of money, but I think I’m silent about the “unit of account” aspect.

Early crypto investors question the ability of L1 tokens to act as unit of accounts. As John Pfeffer wrote in 2017:

“So it’s very simple to assume that people save what they use to make payments, rather than converting their value stores through the payment railway in as few as possible with the exact amount needed when paying.”

Account Abstraction (ERC-4337) formalizes this reality as you can pay gas fees with ERC-20 tokens. This greatly improves the user experience, but requires storage of ETH, which undermines the “monetary premium” of the L1 token.

Loading Tweets…

The final aspect of why I think GDP analogy considers muddy ETH under the GDP “investment” bucket.

Staking locks existing assets, but does not create new capacity.