Short seller James Chanos vindicated his bearish argument by closing out his short position in Strategy Inc. after the company’s premium for Bitcoin holdings narrowed.

James Chanos takes profits with short strategy after price compression

James Chanos, founder of Kynikos Associates and one of Wall Street’s most prominent skeptics, has long criticized Strategy for what he calls an overreliance on Bitcoin as its core business model.

Under CEO Michael Saylor, the company has amassed over 641,000 BTC through debt purchases and equity issues, turning its stock into a leveraged agent for Bitcoin.

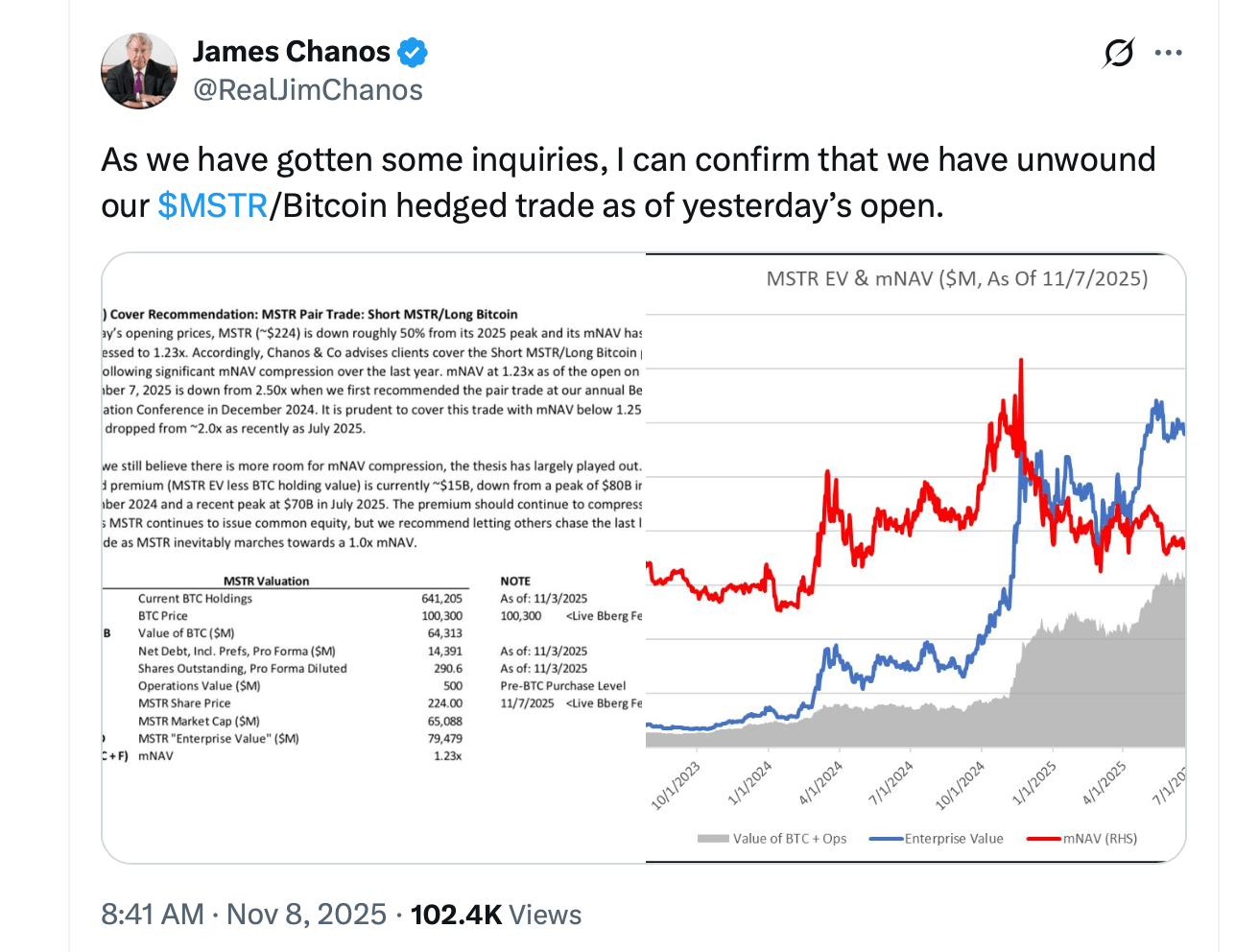

In May 2025, Chanos took the action of going long Bitcoin while shorting the strategy. The approach was a classic arbitrage bet that Strategy’s stock price, which was trading at about 2.5 times its adjusted net asset value (mNAV) at the time, would eventually approach parity with Bitcoin reserves.

By November 7, 2025, Chanos had ceased trading. The strategy’s mNAV multiple has compressed by approximately 1.23x, down from its lofty highs at the beginning of the year. Bitcoin’s spot price has hovered around $63,405, while Strategy stock has fallen about 50% from its 2025 peak. The premium on the company’s Bitcoin holdings, which once hovered around $80 billion, has shrunk to just $15 billion, effectively confirming Chenos’ claim.

The deal essentially achieved its original goal as Strategy’s premium trended toward parity. His exit likely locked in the gains from spread compression and avoided rebound risk if Bitcoin prices recovered or investor enthusiasm for the strategy rekindled.

Chanos’ recent wins reflect his longstanding reputation for spotting bubbles before they burst. From Enron to Strategy, his strategy has been consistent: identify overvaluation, bet on gravity, and step down before the crowd catches up.

Whether Strategy’s model represents a forward-looking form of Bitcoin leverage or an over-the-top debt play is still up for debate, but for Chanos, the math already speaks for itself, at least in the short term. On the same day, Mr. Saylor said to Mr.

“₿Come on.”

Frequently asked questions ❓

- What did James Kanos shorten?He took a long position in Bitcoin while shorting Strategy stocks.

- Why did Chanos target Strategy?He considered Strategies stock to be overvalued due to its premium over Bitcoin’s market value.

- When did Chenos end his strategy prematurely?He exited his position on November 7, 2025 after the premium had compressed to near parity.

- What is Strategy’s Bitcoin exposure?The company holds over 641,000 BTC acquired through bond and stock issuance.