The Genius Act is expected to drive the use of global Stablecoin to new heights. Due to the already established market dominant position, Ethereum is in a position to disproportionately benefit from this transition.

In a conversation with Beincrypto, Sanjay Shah, a researcher in electricity capital for venture capital firms, stressed that the Ethereum blockchain has unique architectural benefits that strengthen the network’s role as the foundational layer of the incoming stubcoin economy.

Ethereum’s market advantage

When US President Donald Trump signed the Genius Act last month, it sparked a major price rally across the cryptocurrency market.

However, Ethereum’s performance was unparalleled. It experienced the most positive and lasting effects, outperforming its competitors shortly after.

In the days before the bill passed, Ethereum prices surged, climbing over 20% and exceeding $3,500. The momentum continued even after the momentum was signed, and the network’s value peaked at $3,875 the following week.

At the time of writing, it costs $4,465.

Ethereum price chart. Source: Beincrypto

This strong market response has strengthened trust in Ethereum’s ability to capitalize on investors’ new regulatory environment.

The Genius Act effectively removes major hurdles and opens up an easier way to adopt more broad Stablecoin and global access to the US dollar, with investors leading the way by betting on Ethereum.

Does genius make Ethereum a financial anchor?

Stablecoins are set up to be a central component of the global financial system and act as the mainstream dollar rail for a variety of transactions, from savings and salaries to cross-border payments.

The clarity of regulations provided by the Genius Act is key to unlocking this broad adoption, making it possible for regulated agencies to confidently issue and make available to stubcoins.

Ethereum is ripped, and the genius may be the main reason.

Here’s what I’m driving $eth (and why do I think it’s just started):

It appears that speculators are already frontrunning the story (which is quite likely that many people had positioned it a few weeks ago);

– Crypto Auris (@crypto_auris) July 16, 2025

According to Shah, the transition will establish a new open financial infrastructure in which Ethereum will act as an anchor.

“Regulated issuance unlocks distribution through banks and fintech. Ethereum can lock open global aspects of its system, L2S handles high-throughput activity, and L1 provides security and finality.

Ethereum already hosts most Stablecoin liquidity, thus gaining a lion’s share of this increased activity.

Why Ethereum is in a leading position

Ethereum’s existing hubs are built on three key characteristics that are essential for global institutional adoption. Global accessibility, agency safety, and resistance to government interference.

Laws focusing on compliance and security enhance these qualities and attract more participants to the network’s trajectory. As it stands, Ethereum is already in charge of the market.

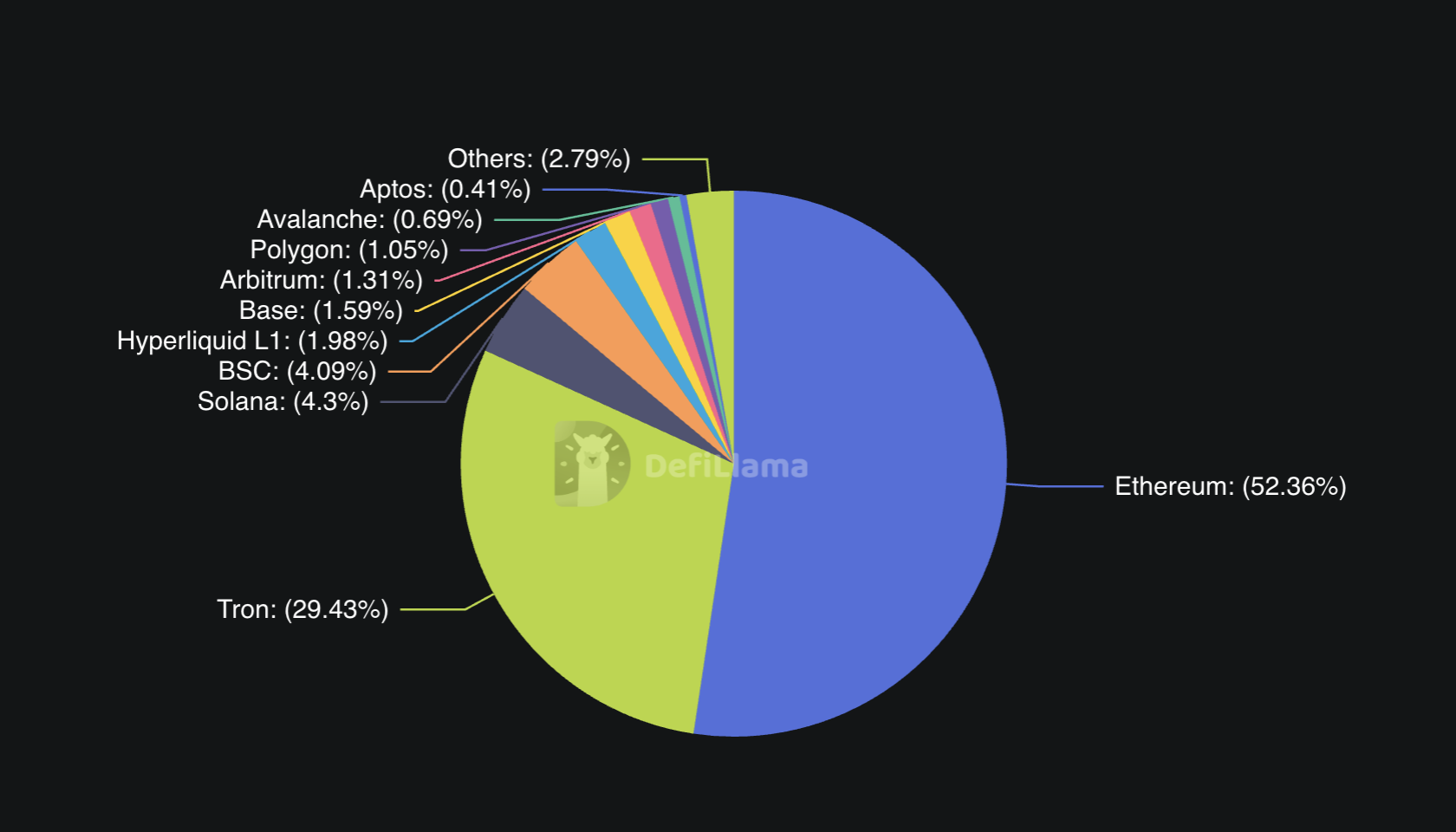

According to recent data from Defilama, Ethereum is responsible for more than 52% of its $278 billion Stablecoin market capitalization.

Ethereum currently controls more than half of the Stablecoin market. Source: Defi Llama.

“Ethereum could be disproportionate from the Genius Act as it already controls the crypto economy that the law is likely to accelerate, like US-backed stubcoin,” Shah said.

He further strengthened this point by saying that growth naturally drifts into established leaders.

“Ethereum already hosts a large portion of Stablecoin’s issuance and liquidity, so much of its growth could flow into its ecosystem and strengthen the leads it already has.”

However, a wave of stable demand will inevitably put a lot of pressure on the network to effectively handle it. This reality is a key issue for Ethereum given the history of scalability issues.

According to Shah, it could easily stand up on this opportunity.

L2S: Addresses scalability issues

The issue of scalability for Ethereum was a well-known concern in the crypto industry. The mainnet has traditionally been limited to processing small transactions per second, but in many cases it has led to network congestion and increased trading fees during periods of high demand.

Once the Genius Act is implemented, the expected boom in the use of Stablecoin will put unprecedented pressure on network capabilities.

According to official statements from Vitalik Buterin and the Ethereum Foundation, the long-term answer for networks that end the track record of scalability challenges lies in Layer 2 Solutions (L2S).

These L2S handle most of the consumer and institutional stability transactions in a very efficient and low-cost way. This approach allows networks to handle mass adoption without compromising on core principles of decentralization and security.

Ethereum MainNet (L1) plays a different, but equally important role than the secure payment layer that handles the finality of transactions processed in L2S.

According to Shah, this synergy makes the scaling solution viable.

“The majority of consumer and institutional stubcoin throughput is designed to live in Ethereum L2 (basic, optimism, arbitrum, etc.), and the L1 acts as a settlement and security layer, so scale comes from roll-up while maintaining Ethereum’s guarantee of trust,” he said.

He also noted the flexibility and benefits the system offers to institutions.

“Today’s roll-up architecture is built for high volumes of low-cost payments and financial apps, allowing agencies to choose the right trade-offs (throughput, pricing, compliance features) without leaving the Ethereum security umbrella.”

Despite the growing number of competing blockchains, Ethereum’s advantage could be solidly solid in light of this enhanced infrastructure.

What needs to happen to unlock Ethereum?

Rival blockchains like Solana and Tron have invaded the Stablecoin market, but the challenge to dominance by Ethereum is unlikely to succeed in the long term.

Long-term success in network finance depends on its basic qualities. Decentralization and security create a noble cycle that attracts capital and talent. Ethereum’s proven security records and distributed nature draw you into a large pool of capital and fosters an environment of institutional trust that creates deep liquidity.

This rich ecosystem attracts developers and builds applications and financial services on the platform. Shah argues that these core factors make it difficult to challenge Ethereum’s position.

“Speed and cost are also important factors, but it can be difficult to drive Ethereum’s lead in finance, as there is no same decentralization, security history, and institutional customization options.”

This reality presents a compelling case of why regulated agencies may find themselves more likely to choose Ethereum, despite being able to launch their own private stubcoins.

A path with less friction

Traditional financial institutions can explore launching their own private blockchains, but they can be drawn to publicly public networks.

“Some banks operate proprietary or permitted rails, but settlement liquidity tends to coalesce where counterparties already exist. Private networks usually bridge where liquidity clears,” Shah told Beincrypto.

While genius opens new opportunities for institutions, launching and operating private stubcoins requires substantial operational commitment.

“The law lowers barriers issued by banks and fintechs, but the path of minimal friction will continue to issue Ethereum liquidity hubs and L2s, or at least work together to access global counterparties and combined finance,” he added.

Based on current trends, all indications suggest that Ethereum will strengthen its position as a major payments tier for digital dollar trading. This trajectory is strengthened by rising assets prices and increasing institutional interest in networks.

Post experts predicted that Ethereum had a major victory in the new Stablecoin economy.