ETORO (NASDAQ:ETOR) filed a registration statement with the U.S. Securities and Exchange Commission (SEC) on Tuesday to register shares in its newly formed employee share purchase plan, following its public list earlier this month.

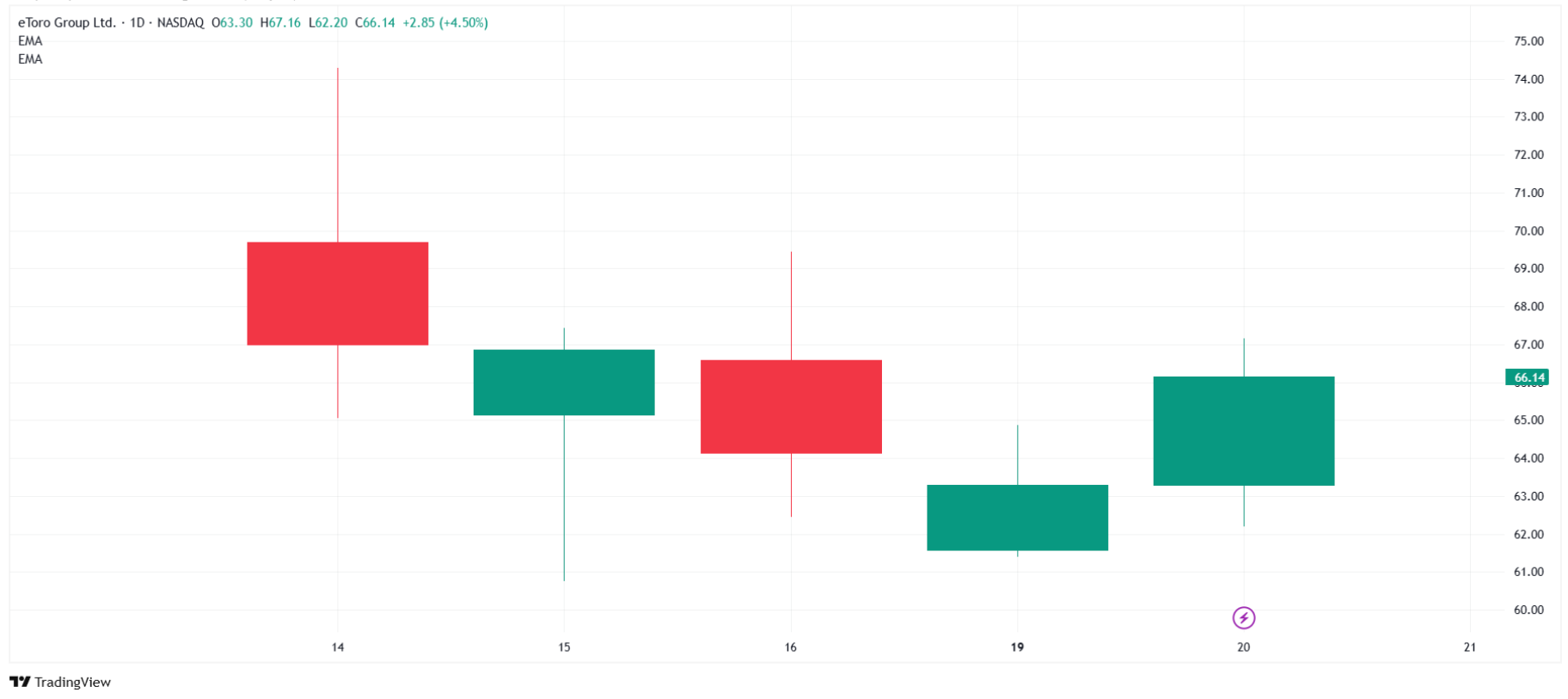

At the same time, FinTech’s stock price rebounded 4.5% on Wall Street during yesterday’s session, closing at $66.14. It marked the largest daily profit since last week’s IPO.

Etoro Group Ltd., owned by the British Virgin Islands, which operates a social trading and investment platform, filed a May 20th S-8 Registration Statement to register shares under three employee benefit plans, including the 2025 Employee Share Purchase Plan (ESPP).

The submission comes days after Etoro completed the initial offer, and the prospectus was filed with the SEC on May 13, 2025, with the shares commenced trading on May 15.

2025 ESPP approves the issuance of 2,201,301 Class A common stock and approves provisions for potential annual increases through January 2035. From January 1st to 2026 each year, the plan allows additional shares equivalent to 1% or a small number of shares in outstanding shares.

“The purpose of this plan is to support eligible employees of the Company and its designated subsidiaries.

Details of Etoro Employee Stock Purchase Plan

This plan consists of two components. A Section 423 component intended to qualify under US tax laws and a Non-Section 423 component for international employees. Eligible employees can donate up to 20% of their compensation through pay deductions to purchase company stock at a discounted price.

According to the planning documents, the purchase price is at least 85% of the fair market value of the shares on the date of registration or purchase, whichever is lower.

The company’s chairman and CEO Jonathan Alexander Assia has signed a registration statement along with CFO Melon Shani and other board members.

The company’s dual-class stock structure grants 10 votes per Class B share compared to one vote in Class A share. This structure allows founders and early investors to maintain control while raising capital from the open market.

eToro Shares Rise 4.5%

During Tuesday’s session, Etro’s stock price rose 4.5%, ending at $66.14 the day despite a modest decline in the Nasdaq 100 and S&P 500 Index. The stock is recovering after a higher than expected IPO rating caused quick profits last week, bringing down the price to $61.40 on Monday.

Etoro shares the charts. Source: tradingView.com

However, Etoro is actively working to attract investors. This week alone, the platform launched its repeat purchase capabilities for stocks, ETFs and crypto. A day ago, we introduced a new savings service to our French clients. To support this offering, the company opened a local branch and partnered with Generali.

Etro’s Wall Street debut also attracted the attention of famous investors. Cathie Wood’s Ark Invest purchased approximately $10 million worth of shares during its IPO.