Ethereum is facing major challenges this month. It has dropped 10% of its value in the last 20 days and is currently trading at $2,021.

This price extension has rattled investors’ trust and has led to a consistent capital outflow from Spot ETH Exchange Trade Funds (ETFs) since its launch in March.

Investor trust in ETH as Spot ETFS bleeding

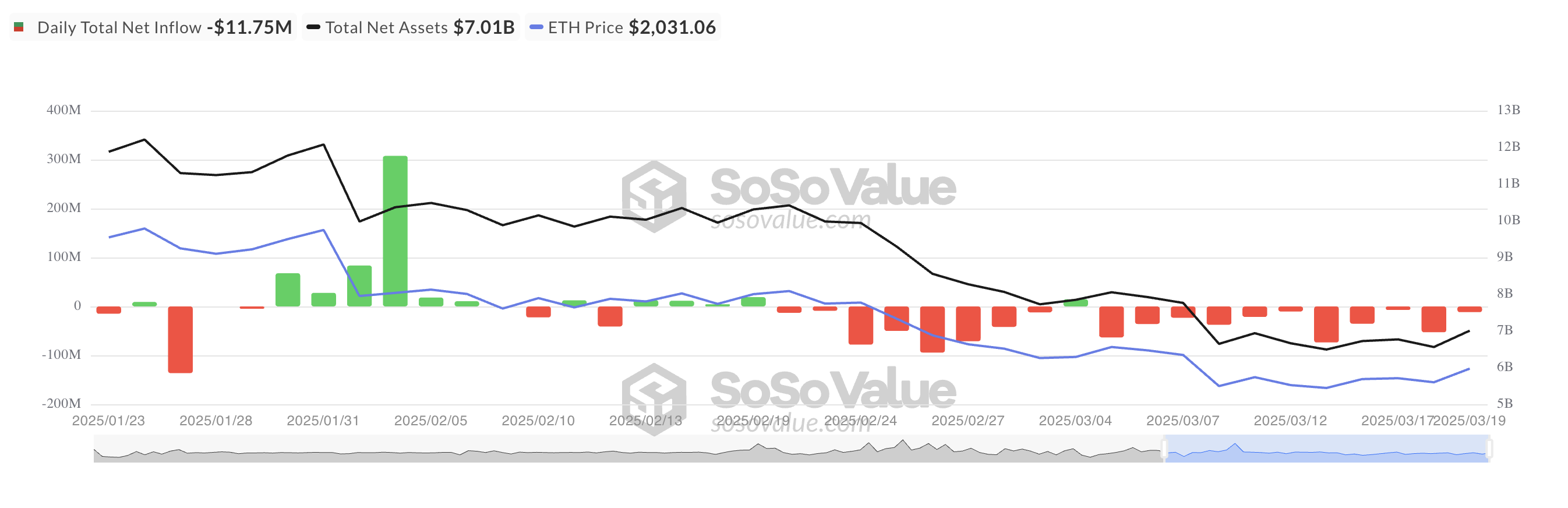

According to SoSovalue’s on-chain data, Spot ETH ETF currently has 11 consecutive days of leaks, with total withdrawals exceeding $370 million.

All Ethereum spot ETF net flow. Source: SosoValue

Investor sentiment remains overwhelmingly bearish, with only one day influx recorded this month. All US SPOTETFs currently have a total asset value of $7.01 billion, with a 44% drop since the start of the year.

When Spot ETH ETF experiences a net outflow, investors will reduce their confidence in the coin’s price performance and withdraw more money than they contribute. Continuous outflows are a major indicator of investors’ bearish sentiment and can strengthen sales pressure on ETH prices.

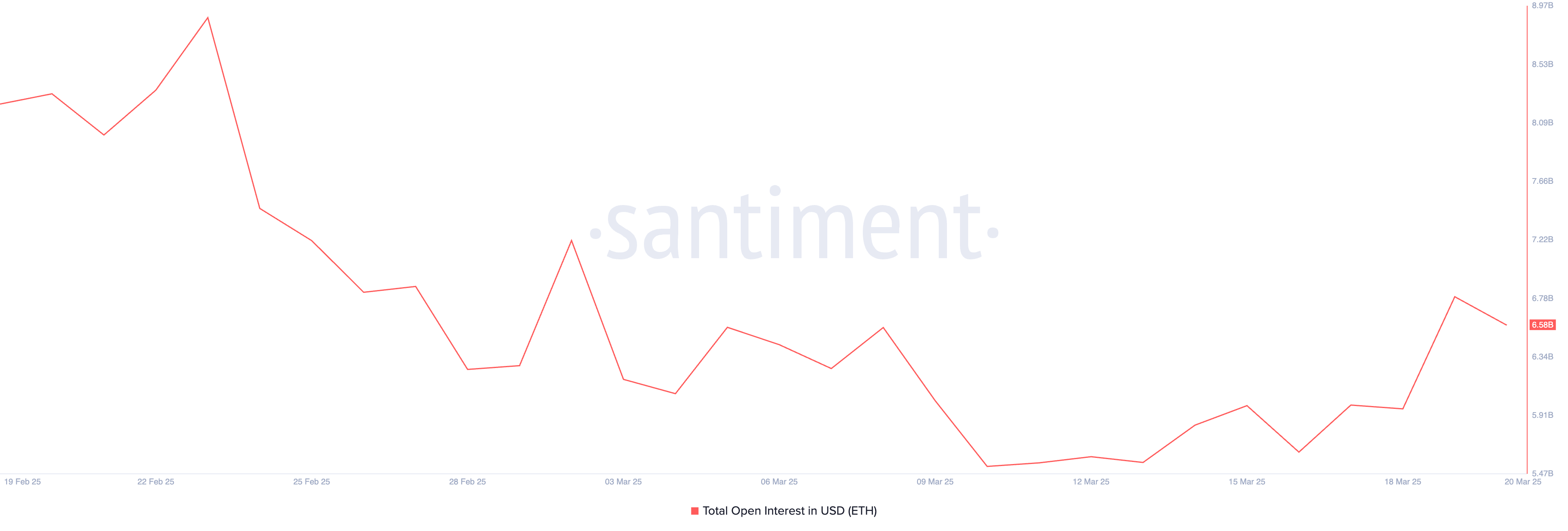

Furthermore, the decline in open interest (OI) of coins reflects declining demand. At the press conference, this was $6.58 billion, a 20% drop in the past month.

ETH open interest. Source: Santiment

The OI of an asset measures the total number of unresolved derivative contracts, such as unresolved futures and options. When it falls, it indicates that the trader is closing the closed position rather than opening a new position.

This indicates reduced market participation and weakening ETH’s momentum. It suggests uncertainty and lack of convictions in the price direction of major altcoins, which contributes to the decline.

Eth Eyes Recovery for Macd Golden Cross to Buy Sparks

Amid a wider market recovery last week, ETH’s moving average convergence divergence (MACD) formed a golden cross. Its MACD line (blue) is located above the signal line (orange) on the daily chart as bullish pressure is beginning to gain momentum.

The MACD indicator measures the strength and direction of the asset’s momentum. This helps traders identify potential trend reversals and changes in momentum. It suggests that the appearance of golden crosses is often interpreted by traders as a purchase signal.

If we increase the pressure, ETH could reverse the current downward trend, potentially rising to $2,224.

ETH price analysis. Source: TradingView

Conversely, if prices drop, ETH could trade at $1,924, below $2,000.