Old Ethereum addresses are being distributed at the fastest pace since 2021. The market needs to absorb around 45,000 ETH from early investors every day.

Old Ethereum wallets are entering a phase of accelerated circulation, with sales returning to levels not seen since 2021. There are also signs of staking by storing ETH in storage addresses, vaults, and smart contracts, but older whales are causing peak volumes.

Following the recent wave of selling, ETH fell to $3,152.17 due to a combination of weak market conditions and prolonged liquidations. After the latest liquidation round, ETH open interest has decreased to $17 billion.

Based on Glassnode data, the majority of sales came from older wallets. 3-10 years. These sellers are realizing profits to avoid getting caught in another bear market.

While Ethereum supporters still see this as a long-term bet, whales are losing the appetite to ride out another bear market. Distribution began in August but accelerated last month due to deteriorating sentiment and the impact of the record liquidation event on October 11th.

Ethereum still has high unrealized gains

Ethereum whale strategic trading means the token now has more opportunities to realize profits. The Market Value to Realized Value Ratio (MVRV) indicates the accumulation of wallets with large amounts of unrealized profits. Negative MVRV is a sign of market capitulation, which ETH had not even reached during previous declines. Historically, especially during long bear markets, ETH spends several months with negative MVRV.

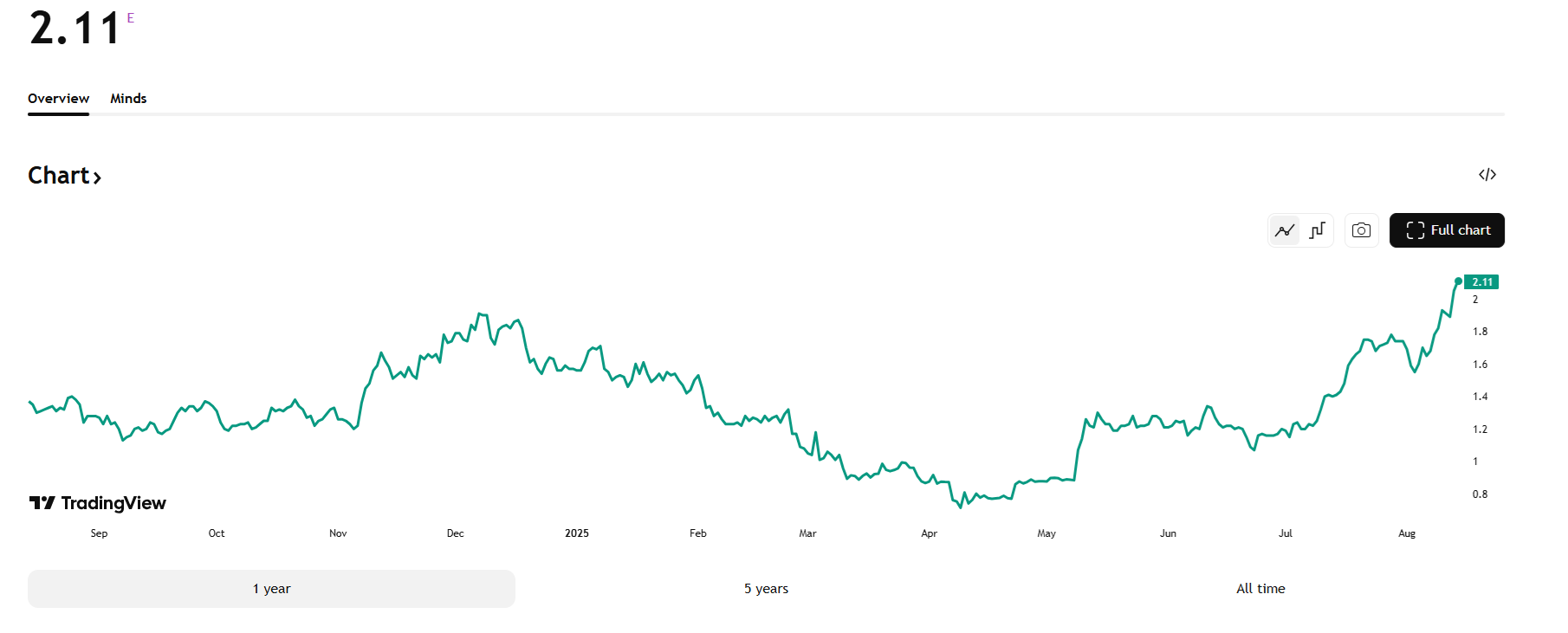

The MVRV ratio is at its highest level in 2025 at 2.1 points, which could create selling pressure if some whales decide to raise their average prices. ETH continues to be actively traded and some of the supply is still used for short-term swaps.

Based on the MVRV ratio, ETH still has significant unrealized value. Whales are active in taking profits, but they are also on the buy side when the market is down. |Source: TradingView.

Ethereum also showed weakness as the altcoin season is not looking promising. As funds change hands, token trading may become more active. Ether sentiment is currently at its lowest level in a year. ETH’s Fear and Greed Index is at 29 points, indicating that trading sentiment is anxious.

Seven brothers’ wallets buy decline

ETH confirmed continued whale activity during the market decline. Last week, major whales expanded their positions to include borrowed funds from Aave.

one of seven brothers wallet It has accumulated ether from Uniswap in the past 24 hours and currently holds over $260 million in wrapped ETH in various forms.

The other wallet used the Cow protocol for multiple Ethereum purchases and is currently being held. $322 million Included in various wrapped ETH tokens and other assets. The Seven Siblings wallet absorbed 1.2 million Ether in the recent crash, making it one of the biggest online buyers. This time, Whale actively used the purchase of ETH. borrow $10 million for Spark protocol, demonstrating confidence in eventual market recovery.

Historically, the involvement of the Seven Brothers Connected Wallet indicates a localized bottom in the market. Other whales also bought dip, absorb 2.53 million coins at $3,150 per Ether, establishing a new support zone.

a wallet The one linked to BitMine also showed purchase activity, and another famous whale also added 16,937 Ethereumnear weekly production of new tokens.