Ethereum’s price has remained quiet this week, down 3.7% and hovering around $3,875, showing little continuation from last week’s decline. However, behind the calm, some major wallets have started buying again.

Whale accumulation of around $660 million has reignited optimism that ETH may be poised for a recovery, but not everyone is convinced.

Whales are buying, but short-term holders continue to sell.

On-chain data shows that between October 21st and October 23rd, Ethereum whales added approximately 170,000 ETH, increasing their collective custody assets from 100.3 million ETH to 104.7 million ETH. At current Ethereum prices, this equates to approximately $660 million worth of new accumulation, making it one of the largest 48-hour whale gains this month.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum whales are back to buy: Santiment

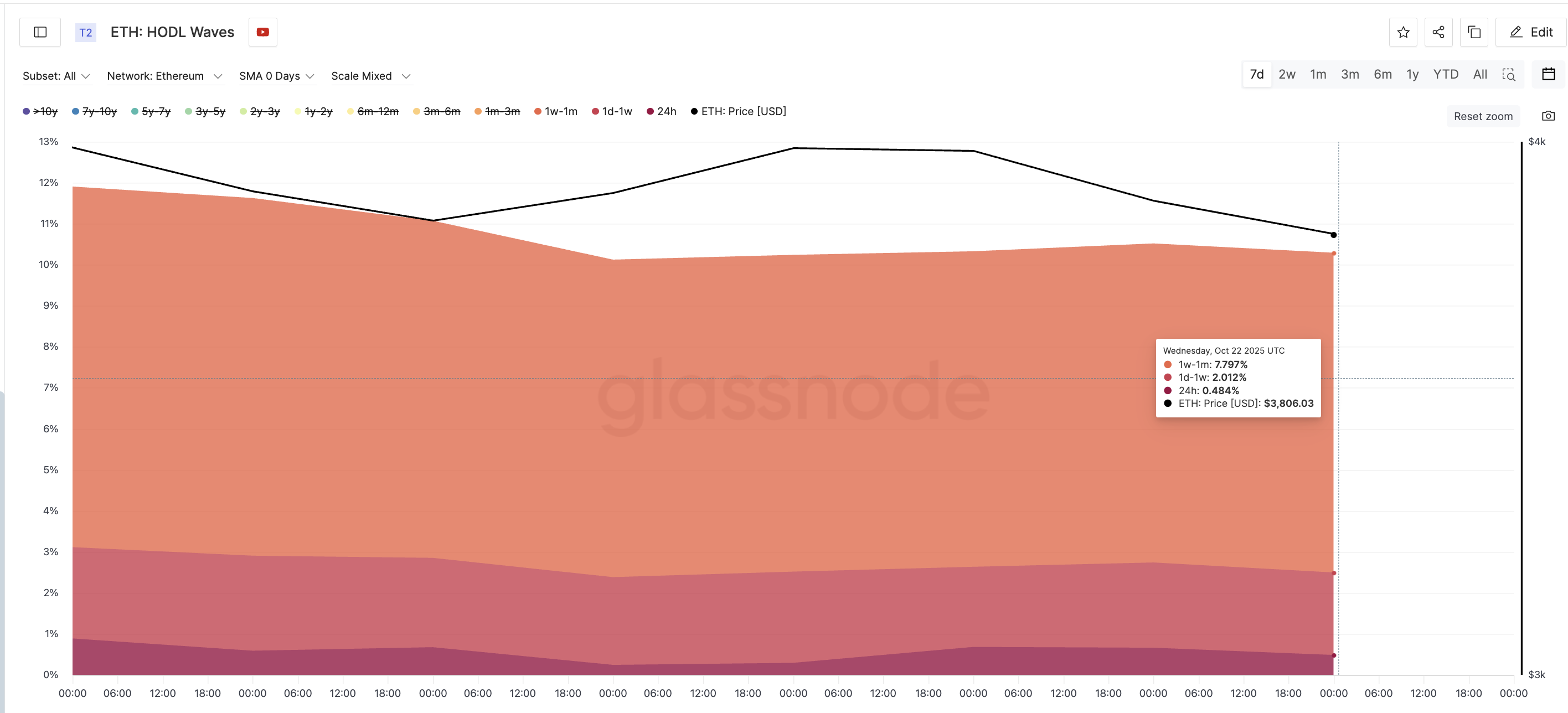

But while large wallets are coming in, short-term holders are going down a different path. According to HODL Waves, which shows how long different wallet groups are holding coins, all three fast-moving groups have reduced their supply share since mid-October.

- 24-hour holder: decreased from 0.887% to 0.48%

- Holders from 1 day to 1 week: decreased from 2.22% to 2.01%

- Holders for 1 week to 1 month: decreased from 8.79% to 7.79%

Dumping short-term ETH cohorts: Glassnode

The pattern is clear. Whales are buying, but short-term traders are selling on every upswing (Wall of Doubt). This push-pull dynamic keeps Ethereum within a narrow range and prevents capital inflows from leading to higher prices. Until these small holders regain confidence, whale demand alone may not be enough to cause a full rebound in Ethereum price.

Ethereum price structure remains bullish but needs confirmation

Despite the pressure, Ethereum’s technical structure remains supportive. On the daily chart, ETH made a low from September 25th to October 22nd, but the Relative Strength Index (RSI), which measures price momentum, made an even higher low during the same period. This bullish divergence often signals that the sell is losing momentum, even before a reversal begins.

ETH is also trading within an ascending triangle, and this pattern typically resolves to the upside once the resistance level (triangle base) is cleared. The main ETH price ranges to watch right now are $3,989 and $4,137, both of which coincide with important Fibonacci retracement levels. Therefore, a breakout of each resistance level signifies a breakout of the triangle.

Ethereum Price Analysis: TradingView

A daily close (breakout) above $4,137 may be key for Ethereum’s rebound to materialize. This is an increase of around 7% from current levels, and this level is needed for ETH to confirm the strength of the breakout. If successful, ETH could target $4,495 or even $4,950 in the coming weeks.

However, if you fail to hold $3,806, ETH could fall to $3,511 or $3,355. If this happens, the bullish setup will be invalidated and broader bearish pressure will return.

The post Ethereum’s $660M Whale Push Hits a Wall of Questions — What’s Next for the Price appeared first on BeInCrypto.