Ethereum climbing towards the much-anticipated $5,000 mark could face further stalling as signals in the chain suggest headwinds.

Data shows that long-term holders of ETH (LTH) are actively distributing coins, creating potential sales pressure for weight in the market. At the same time, persistent bearish feelings among futures traders add another layer of attention, putting its recent benefits at risk.

Earning profits by long-term holders will put ETH breakout on hold

Eth’s one-month price consolidation has created an opportunity for long-term holders (LTHS) to lock in profits following Altcoin’s late August rally.

This trend is evident on Coin’s vibrant scale. This rose to a peak of 0.704 from the start of the year, according to Glassnode.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

The vibrancy of ETH. Source: GlassNode

Asset vitality tracks the movement of previous dormant tokens by measuring the ratio of the assets’ coin days to the total coin days accumulated. Once that falls, LTHS is moving assets out of exchange. This is an indication that accumulation is ongoing.

Meanwhile, as the vibrancy of the assets climbs, more dormant coins will be sold, indicating an increase in profits from LTHS.

Thus, the increase in vibrancy of ETH suggests that its LTH is actively achieving profits rather than rising further. This sales pressure could limit ETH’s ability to stage critical breakouts towards the $5,000 level in the short term.

Futures traders maintain heavy sold out pressure

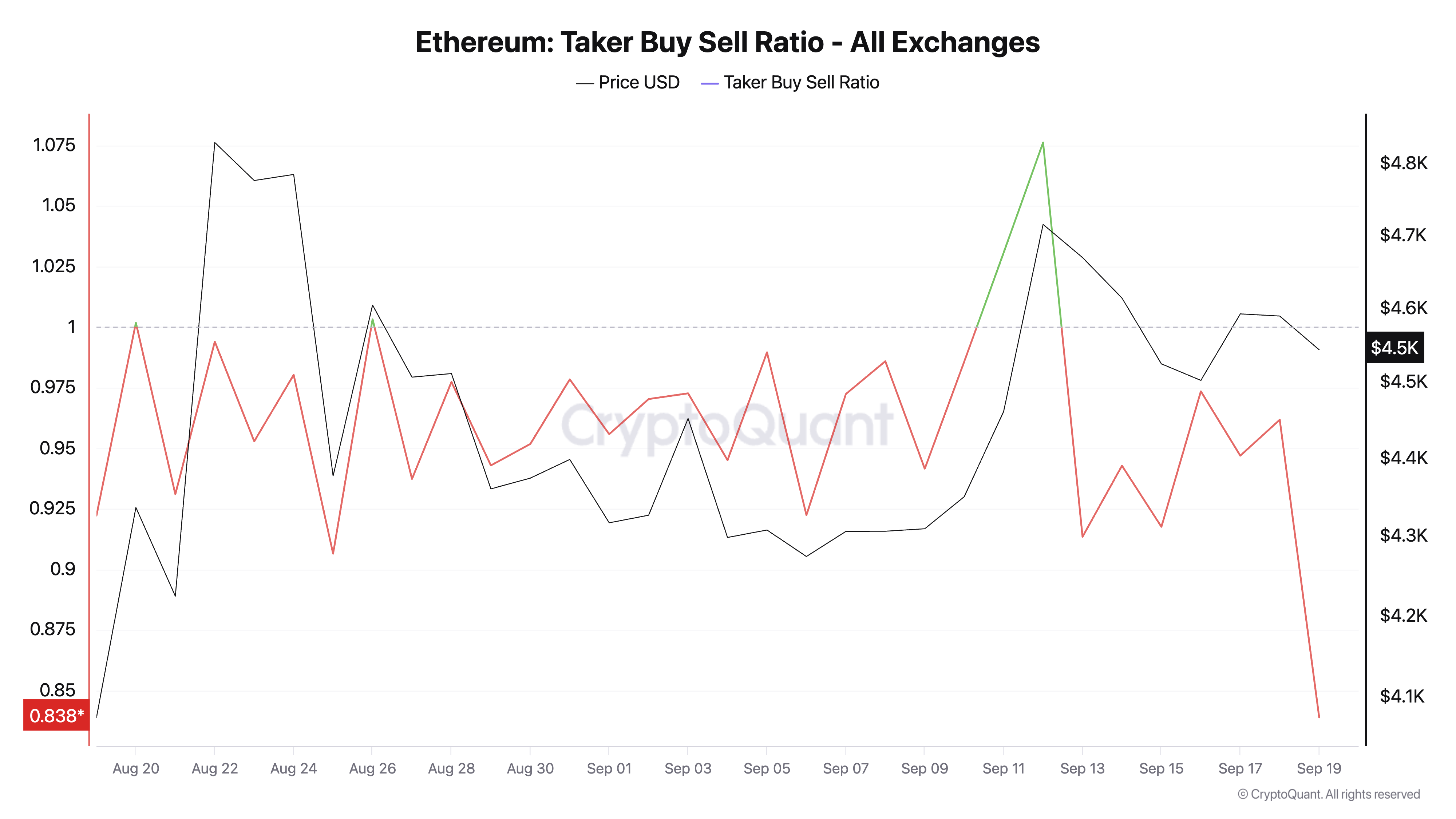

The persistent bearish sentiment in the derivatives market adds to this pressure. Cryptoquant measurements show that ETH taker buy and sell ratios remained primarily in red for the majority of the past month, highlighting a sustained exit among futures traders.

Ethereum Taker buying and selling ratio. Source: Cryptoquant

The buy-and-sell ratio of assets takers measures the balance of buy-and-sell volume in the futures market. Values above 1 indicate stronger purchases, while values below 1 indicate heavier seller activity.

As seen on ETH, there were sustained returns of value over a month. This could delay ETH rallies to an additional $5,000, as it points to a bearishness among traders.

$5,000 Breakout Hinge-On Demand Revival

At the time of writing, the leading Altcoin traded for $4,542 and holds $4,211 above the support floor. As bearish feelings get reinforced and sell continues, the coin can retest this support line.

If it cannot be held it could decay deep to $3,626.

Ethereum price analysis. Source: TradingView

However, a revival of demand for ETH could undermine this bearish view. In that example, the price of the coin could attempt to infringe resistance at $4,957. If successful, new prices above $5,000 could peak.

Post Ethereum’s $5,000 dream, delayed by long-term holder exits and bearish futures bets, first appeared in Beincrypto.