The biggest buyers of Ethereum continue to add to their ETH stacks even though their purchase amounts are decreasing. While on-chain flows and DAT demand will still absorb more supply than the market is producing, a new RSI breakout suggests momentum could soon spill over into prices.

Bitcoin’s ETH monthly total plummets, dollar-denominated purchases slow down

Bitmine continues to grow Although the amount of Ethereum held is decreasing, the amount of its purchases is showing a clear downward trend. The latest chart shared by Maartung shows steady hourly inflows into the Treasury, while the broader market downturn reduces the impact on the dollar. As prices have declined since mid-November, each tranche of accumulated ETH has had a lower monthly total.

Inflow to Bitmine Ethereum Treasury. sauce: CryptoQuant/X

The decline is clear when comparing recent numbers. In July, around $2.6 billion worth of Ethereum was added to Bitmine. Then, August was the strongest month of the period, reaching nearly $4.3 billion. However, the momentum reversed in September to $3.4 billion, followed by $2.3 billion in October. By November, Bitmine’s monthly value had fallen to just $892 million, despite consistent purchases.

These numbers show that Bitmine’s accumulation strategy has not changed, but the market conditions have changed. As the ETH price fell, the valuation became smaller for the same inflow. Therefore, the company’s on-chain balance growth is now contrasted with a sharp decline in monthly dollar totals, demonstrating how pricing pressures have reshaped the company’s financial expansion scale.

ETH DAT purchases outpace new supply even as monthly totals fall

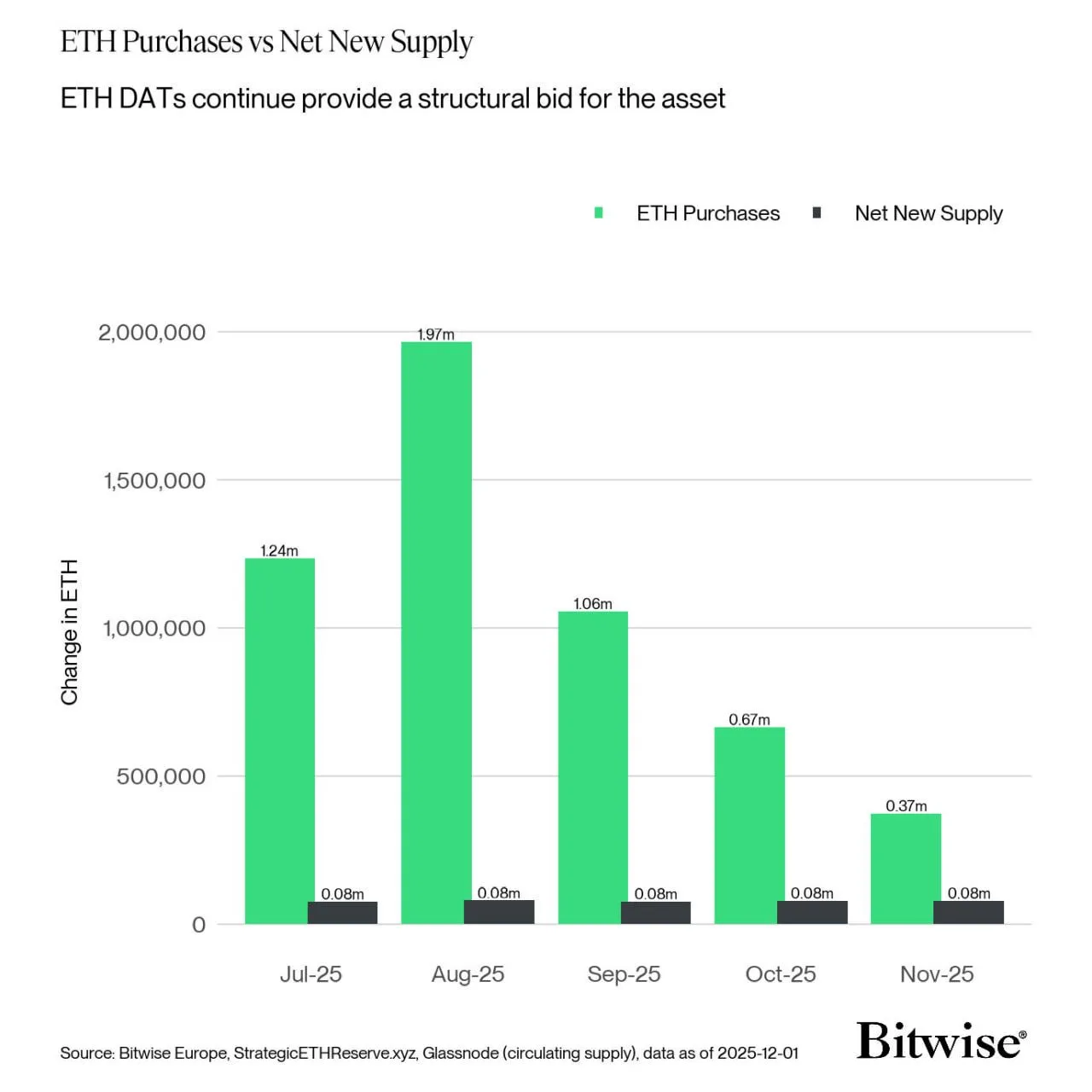

moreover, ETH demand While revenue from the DAT structure remains strong, the latest figures show a steady decline in monthly purchase volumes. A chart shared by Max Shannon highlights that DAT continues to provide a structural bid to Ethereum, but the magnitude of that support has weakened since its summer peak.

ETH purchases and net new supply. sauce: bit unit / X

In July, DAT absorbed approximately 1.24 million ETH, with net new supply reaching nearly 80,000 ETH. August reached a high point with approximately 1.97 million ETH purchases, which again far exceeded the modest monthly issuance amount. After that, buying slowed down. Approximately 1.06 million ETH was recorded in September, followed by 670,000 ETH in October. Although net new supply remained at around 80,000 ETH per month, purchases had fallen to around 370,000 ETH by November.

This pattern shows that demand for DAT remains significantly higher than new supply for Ethereum. However, the gradual decline in monthly inflows highlights how the pace of accumulation has slowed since late summer, narrowing the cushion between buyer demand and the amount of issuance in circulation.

Analyst warns of Ethereum RSI breakout as price approaches support

Meanwhile, trader Merlijn’s Ethereum chart shows that momentum indicators are turning to the upside even though the price is trading within a tight triangle. In the two-day ETH/USD view, the candlestick has gathered just above the horizontal support, with the downtrend line capping the recent highs and forming a compression zone.

Ethereum RSI breakout signal. sauce: Trader Merlin

At the same time, the Relative Strength Index has already broken through the downside resistance level, suggesting that buying pressure may be returning before the price. “Momentum leads and price follows,” Marlin wrote, noting that the next upside level if the breakout extends is $3,400. “The move is underway,” he added, urging market watchers to watch closely as Ethereum approaches the top of the current pattern.