Early Ethereum investors have likely completed a complete exit from Ethereum. Ethereum The position after on-chain data indicates the transfer of holdings to a centralized exchange. The sale is estimated to have resulted in a gain of approximately $274 million.

This will look like this Ethereum The stock continues to be under selling pressure from US institutional investors. Still, some market analysts are optimistic about the prospects for the second-largest cryptocurrency.

Ethereum OG Whale closes with 344% profit

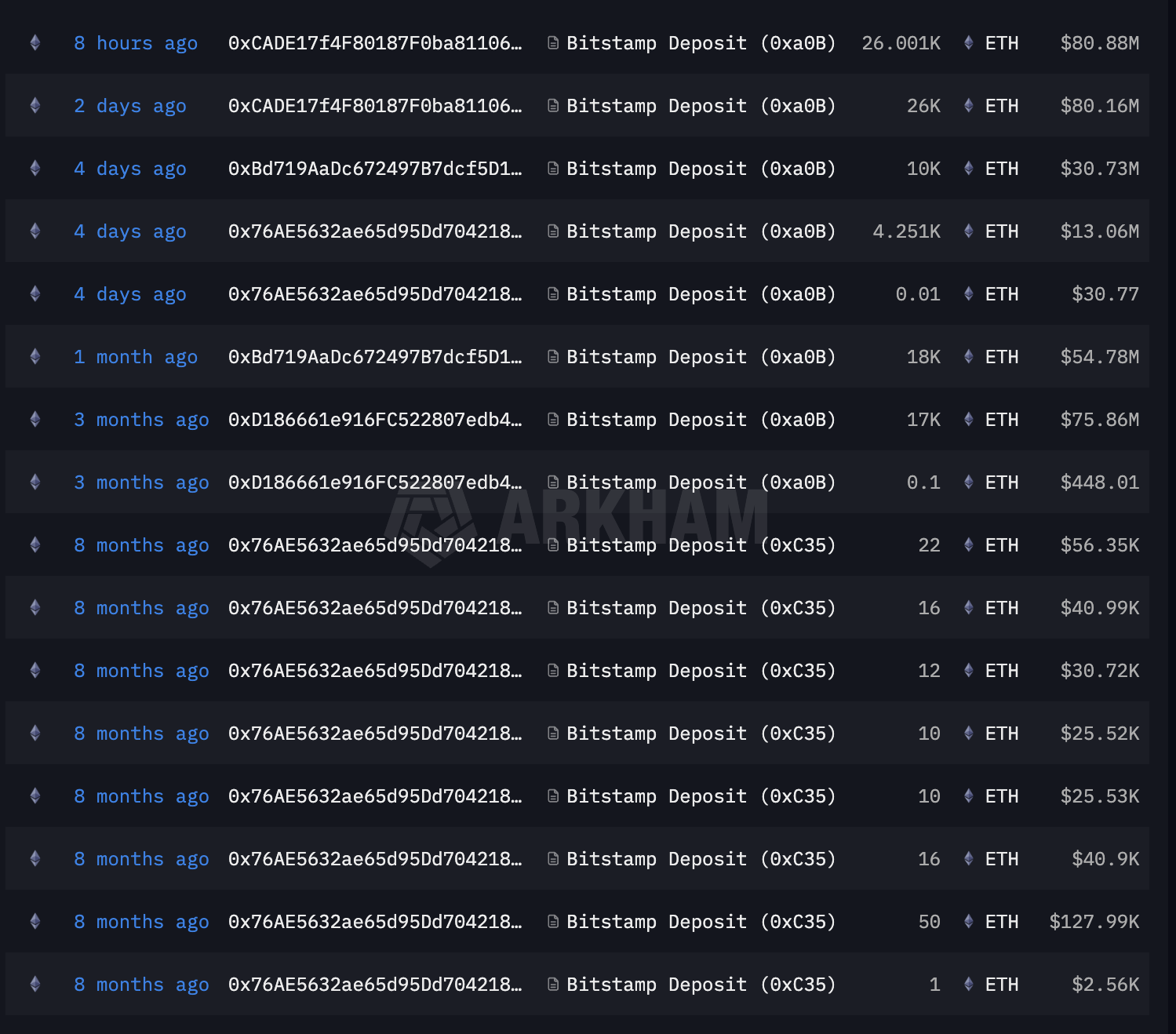

Blockchain analytics firm Lookonchain reported that investors accumulated $154,076. Ethereum The average price is $517. Transfers to my wallet started late last week. Ethereum to Bitstamp, a centralized cryptocurrency exchange.

“In the past two days, he has deposited an additional $40,251.” Ethereum ($124 million) invested in Bitstamp, still holding $26,000 Ethereum ($80.15 million),” Lookonchain posted on January 10th.

A few hours ago, the investor moved the last $26,000. Ethereum Go to the exchange. According to Lookonchain, the investor made an estimated total profit of approximately $274 million, which represents a gain of approximately 344%.

These latest transfers follow a pattern of gradual deposits that started long ago. Investors initially sent a total of 137 messages, according to Arcam data. Ethereum I posted on Bitstamp about 8 months ago.

A subsequent transfer of 17,000 was made. Ethereum 3 months ago and 18,000 more Ethereum About a month ago, the company signaled a long-term, gradual exit strategy rather than a one-time sale.

Ethereum “OG” investor remittance. Source: Arkham

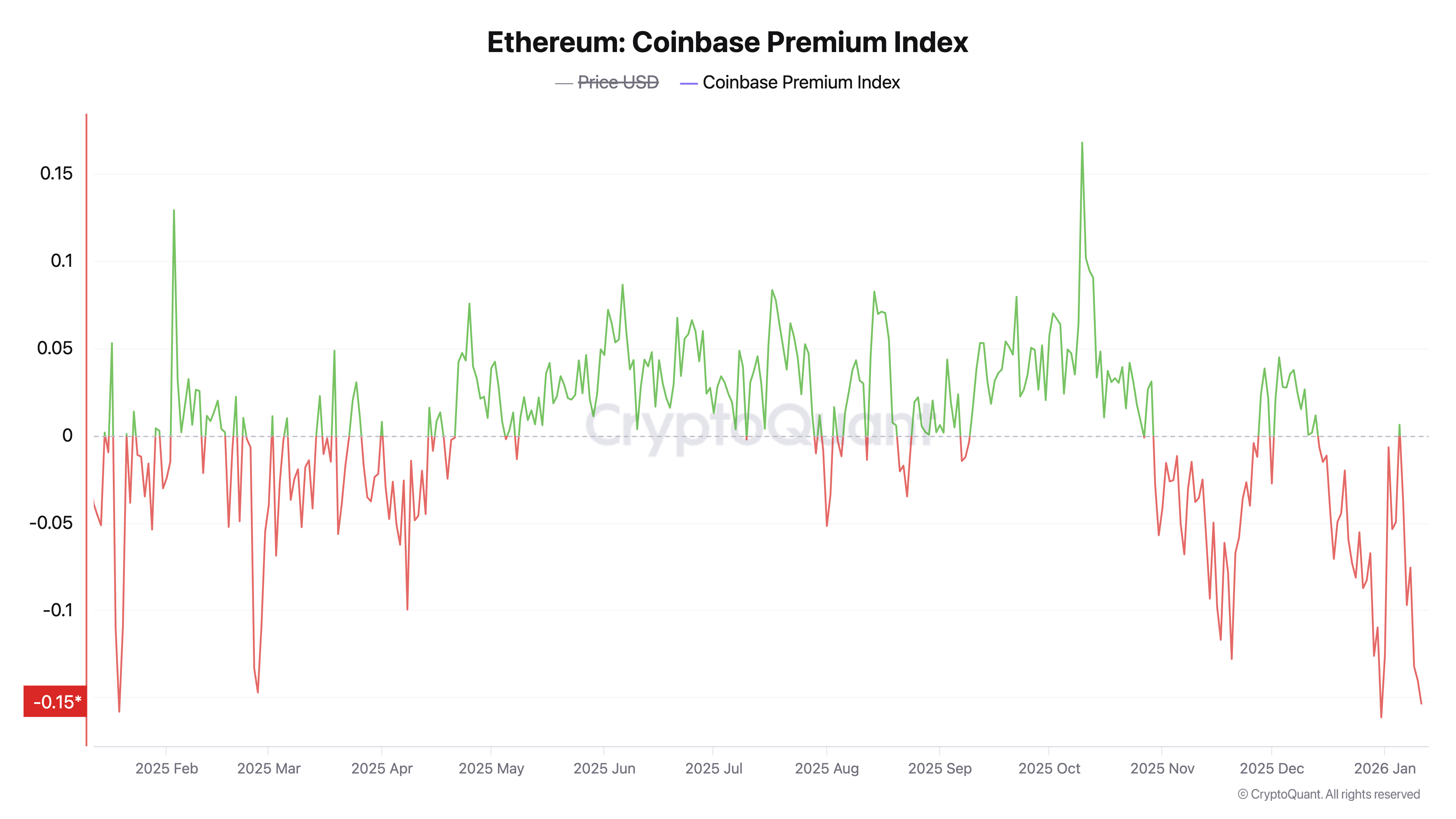

The timing of the whales’ exit also coincides with widespread signs of systematic alarm. Coinbase Premium Index Ethereum It remains deeply negative. The indicator tracks the price difference between Coinbase, which is often used as a measure of US institutional sentiment, and Binance, which reflects broader global retail activity.

Negative values indicate: Ethereum is trading at a discount on Coinbase compared to offshore platforms, suggesting increased selling pressure from US-based institutional investors. This trend will continue until 2026, indicating a continued risk-off attitude among professional investors.

ETH Coinbase Premium Index”>

ETH Coinbase Premium Index”>

Ethereum Coinbase Premium Index. Source: CryptoQuant

Is Ethereum “undervalued”?

Despite continued selling pressure, some analysts remain optimistic. Ethereumhas chosen to look beyond short-term volatility.

Quinten Francois suggested that when comparing Ethereum’s economic activity and price, Ethereum appears to be “significantly undervalued.”

$Ethereum Hugely underrated pic.twitter.com/IvfdosUQpk

— Quinten | 048.eth (@QuintenFrancois) January 11, 2026

Similarly, Milkroad added, an examination of the data reveals glaring discrepancies. According to this post, the amount of economic activity settled on Ethereum is Ethereumprices have lagged behind that expansion.

The analysis noted that large investors continue to prioritize Ethereum due to its uptime, liquidity, payment reliability, and regulatory clarity.

“As more activity moves on-chain, transaction volumes and fee generation will increase, placing more economic weight on Ethereum’s base layer. If usage remains high, Ethereum has historically struggled to remain flat for long periods of time. It will continue to improve as implementation progresses. Always zoom out,” Milkroad said.

From a technical perspective, analysts have identified key patterns that could support a price recovery.

$Ethereum Looks like he’s ready to move on.

The fallen wedge and channel were damaged.

The integration is complete and the goal is over $4,400.

Don’t overthink it. Trends have changed. pic.twitter.com/MCtD8Uxxg2

— CryptoKing (@CryptoKing4Ever) January 10, 2026

The push and pull between short-term selling and market confidence complicates the current Ethereum market. While growth in economic activity supports the strength of the ecosystem, early adopter withdrawals and negative Coinbase premiums are alarming. Whether or not Ethereum It remains to be seen whether prices will ultimately match these fundamentals.

The post Ethereum Whale gains $274 million in strategic exit amid market turmoil appeared first on BeInCrypto.