The major Altcoin Ethereum has been struggling over the past week, with bearish sentiment flowing nearly 10% of its value as bearish sentiment grasps the market.

On-chain data shows that top investors have reduced holdings as the coin battles inactive performance. This trend has led ETH to face headwinds that could go below the price’s significant level below the $4,000 price.

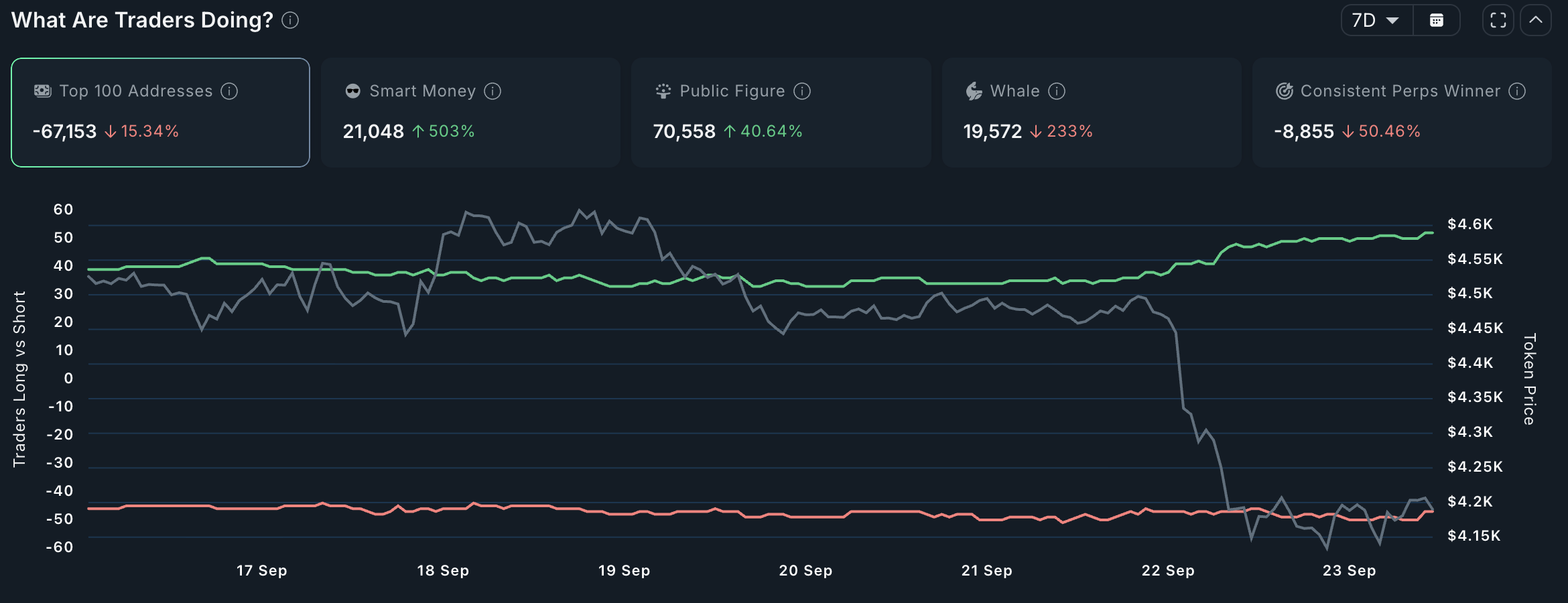

Top investors abandon ETH and increase the fear of short-term breakdowns

Data from Nansen shows that the ETH balance of the top 100 biggest wallets fell 10% last week.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

The top 100 deals with ETH HOLDINGS. Source: Nansen

According to the blockchain analytics platform, the metric tracks the token balance of the 100 largest crypto wallets. As these holders manage a significant share of the distribution supply of assets, changes in balance are usually a marker of emotional shifts between major players.

A 10% drop in ETH’s top wallet balance confirms that these holders have offloaded coins to the market last week. Such a move is a strong bearish signal, which puts downward pressure on the price of ETH.

Additionally, the on-chain data provider said that ETH whales have also declined, exacerbating the likelihood of DIP below $4,000.

Over the past week, whale wallets with over $1 million in coins have reduced ETH holdings by more than 200%. At the time of writing, this cohort of ETH investors holds 19,577 coins, which are currently at market prices of $662 million.

Such a decline in whale holdings usually ripples into broader market sentiment. Retailers closely track whale activity as a signal of trust. Therefore, as large investors begin to offload their assets, small holders may follow suit carefully.

This amplifies ETH sales pressure and allows for even lowering the short term.

Heavy-Sell-Off Test Market Resilience

ETH is currently trading at $4,196, and with an increase in sales from large investors, it encourages a deeper fear of loss. If sales pressure continues, ETH could fall below the $4,000 level and test support around $3,875.

Meanwhile, fresh demand entering the market to absorb this wave of supply could stabilize the price of the coin.

ETH price analysis. Source: TradingView

Such a shift could cause rebound and bring ETH back to $4,497.

The Post Ethereum Top Holder slashed the holdings, causing the fear of a $4,000 breakdown, and first appeared in Beincrypto.