Ethereum briefly fell for more than four hours on Monday morning before recovering the $3,100 price level. The recovery comes amid an uptick in activity from wallets for a decade and large-scale liquidations by prominent market figures.

Recent volatility has highlighted two contrasting market forces: the re-emergence of long-term holders and the reduction in exposure of influential players.

ETH price trend and market sentiment

Ether fell below $3,100 for the first time since November 4, 2025, and was trading at $3,066 as of 9:36 pm UTC on November 16, down 3.4% in 24 hours. The decline reflects the broader weakness in digital assets and the perception that ETH carries more risk than Bitcoin.

One trader at

ETH price for 90 days. Source: BeInCrypto

Despite the temporary drop, Ethereum showed remarkable resilience, rallying above $3,100 within hours. Market participants are closely monitoring ETF flows for any signs of continued selling or reversal, as ETH could be oriented around this important support.

According to Coinalyze data, ETH’s long-short ratio is above 3.0, indicating strong trader engagement. Recent highs indicate a period of increased activity, and rising open interest reflects increased participation and the potential for continued bullishness. Nevertheless, a sharp rise in the ratio also signals the risk of short-term volatility.

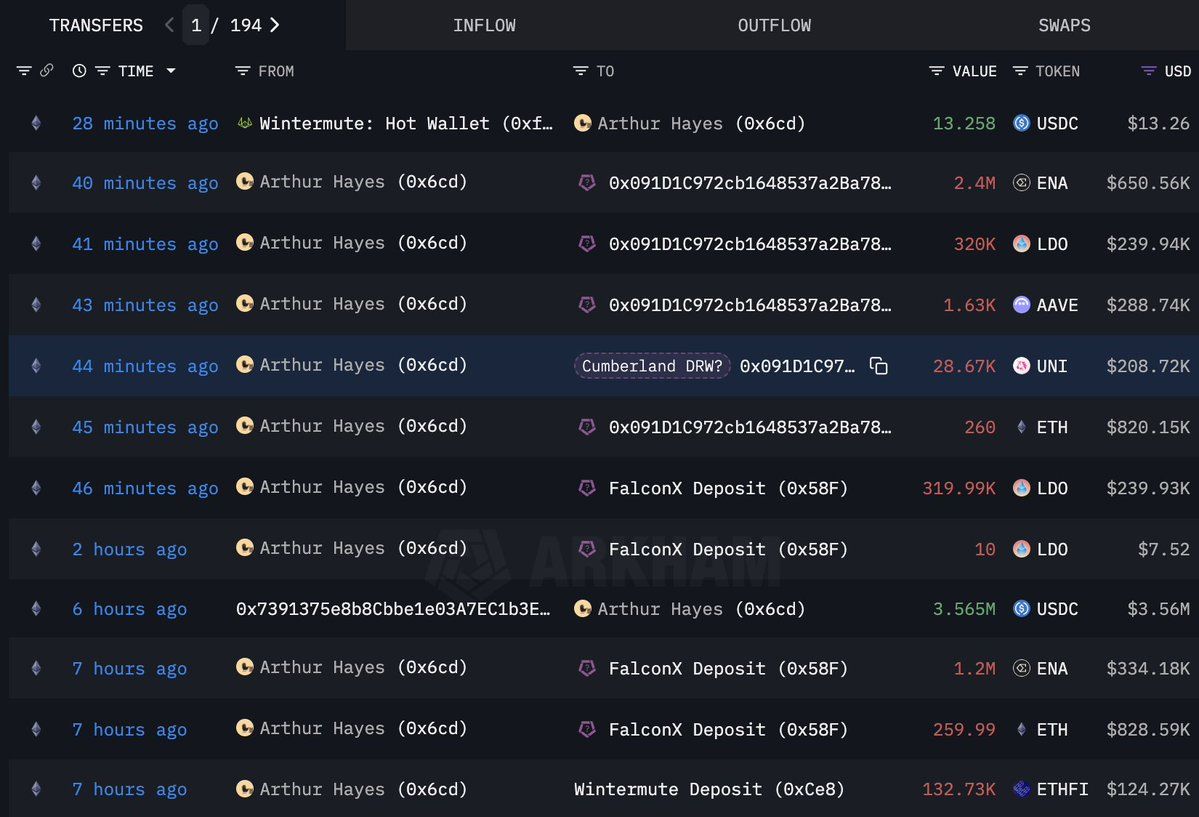

Arthur Hayes liquidates Cryptocurrency Holdings

BitMEX co-founder Arthur Hayes has launched a series of large-scale cryptocurrency sales totaling approximately $4.1 million. On-chain analytics platform Lookonchain reported that Hayes sold 520 ETH (worth $1.66 million), 2.62 million ENA (worth $733,000), and 132,730 ETHFI (worth $124,000) on Sunday.

Arthur Hayes’ On-Chain Transaction Activity – Lookonchain

Hours later, Hayes expanded on the liquidation. According to another Lookonchain post, he also sold 260 ETH worth $820,000, 2.4 million ENA worth $651,000, 640,000 LDO worth $480,000, 1,630 AAVE worth $289,000, and 28,670 UNI worth $209,000. These assets were sent to institutional desks such as Flowdesk, FalconX, and Cumberland, which typically handle high volume liquidations.

Arthur Hayes Continuing Asset Sales – Lookonchain

These sell-offs occurred as Ethereum fell to $3,100 and Bitcoin fell to $94,000. Hayes’ actions may reflect a defensive rebalancing or profit-taking approach amid uncertainty, which could increase selling pressure on ETH and related assets.

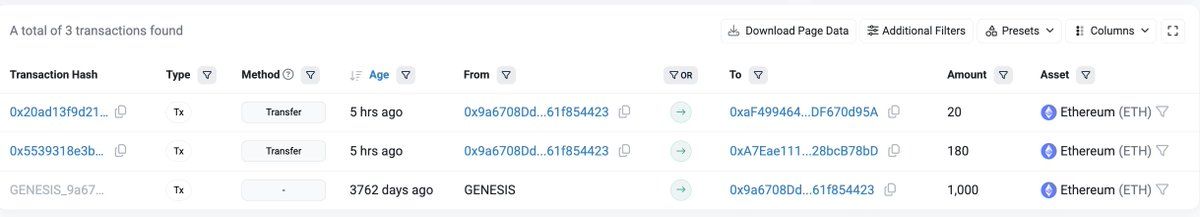

Dormant Ethereum wallet is back for the first time in 10 years

In a rare move, a dormant Ethereum ICO wallet has transferred 200 ETH worth $626,000 after more than a decade, according to Lookonchain. This wallet received 1,000 ETH for a $310 investment during Ethereum’s early days, but at current prices that’s a 10,097x return.

Ethereum ICO Wallet Wakes Up After 10 Years – Lookonchain

Activities like this are important because they demonstrate early adopters’ continued belief in Ethereum’s long-term value and potential. These moves could also increase market supply. Wallets associated with Ethereum’s early and pre-mining stages are rare and closely tracked by the cryptocurrency community as signs of whale activity and shifts in sentiment.

The reactivation of the 10-year-old wallet shows the maturation of the Ethereum ecosystem. Early investors who have weathered several bear markets and volatile cycles are now moving assets, perhaps for profit taking, diversification, or new investment strategies.

Experts disagree on the future of Ethereum

Prominent analysts are divided on the future of Ethereum. BitMine Chairman Tom Lee compared Ethereum to Bitcoin’s previous supercycle and conveyed strong bullish sentiment. In a recent statement, Lee pointed out that Bitcoin has experienced six declines of more than 50% and three declines of more than 75% in the past eight and a half years, but has risen 100 times by 2025.

Mr Lee emphasized that to profit from the supercycle, we need to overcome volatility and uncertainty. He argued that Ethereum is currently on a similar trajectory and urged investors to weather the turbulence in preparation for the potential for exponential gains.

$1,800 seems like the perfect spot to buy Ethereum $ETH! pic.twitter.com/sDZiga5XQy

— Ali (@ali_charts) November 16, 2025

Analyst Ali Martinez, on the other hand, took a cautious view, suggesting that ETH could fall to $1,800. His outlook reflects concerns about ETF outflows, risks associated with Bitcoin, and broader market challenges. The disagreement among experts highlights continued uncertainty about Ethereum’s near-term movement.

The tension between long-term optimism and short-term caution reflects the current sentiment towards Ethereum. While institutional investors are showing hesitation, on-chain actions and active trading by early participants suggest a complex environment. The coming weeks may decide whether ETH can hold onto the support above $3,100 or test lower levels with further decline.