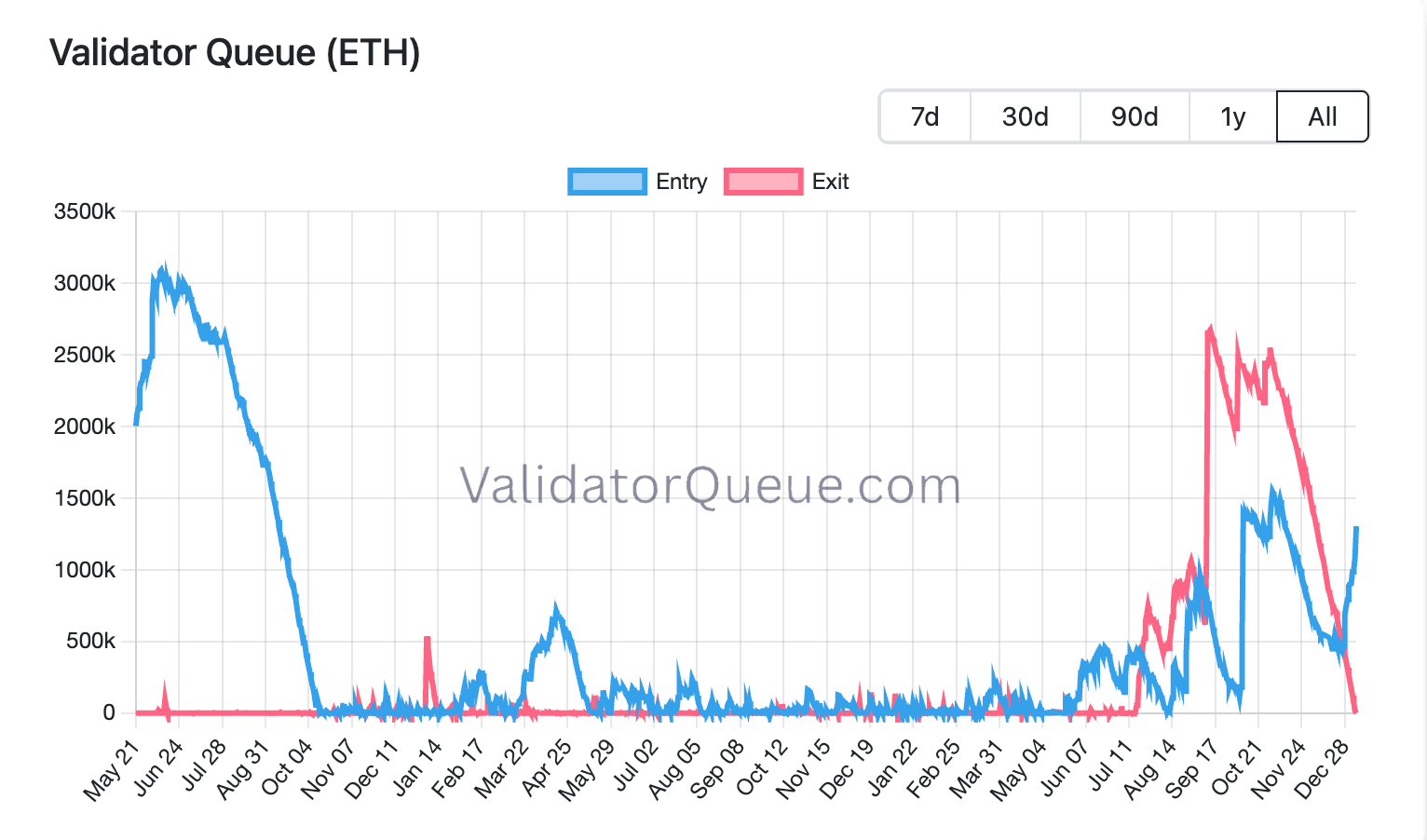

Ethereum’s staking queue is now empty, allowing the network to absorb new validators and exit in near real-time.

This means that the rush to lock up ETH has faded for now, and staking has settled into a steady state rather than a scarcity transaction.

Queue is simply the time spent starting or stopping staking on the Ethereum network and acts as a sentiment gauge and liquidity gauge.

In a sense, the lack of queues is a feature rather than a bug, as it proves that Ethereum can handle staking flows without locking up liquidity for weeks.

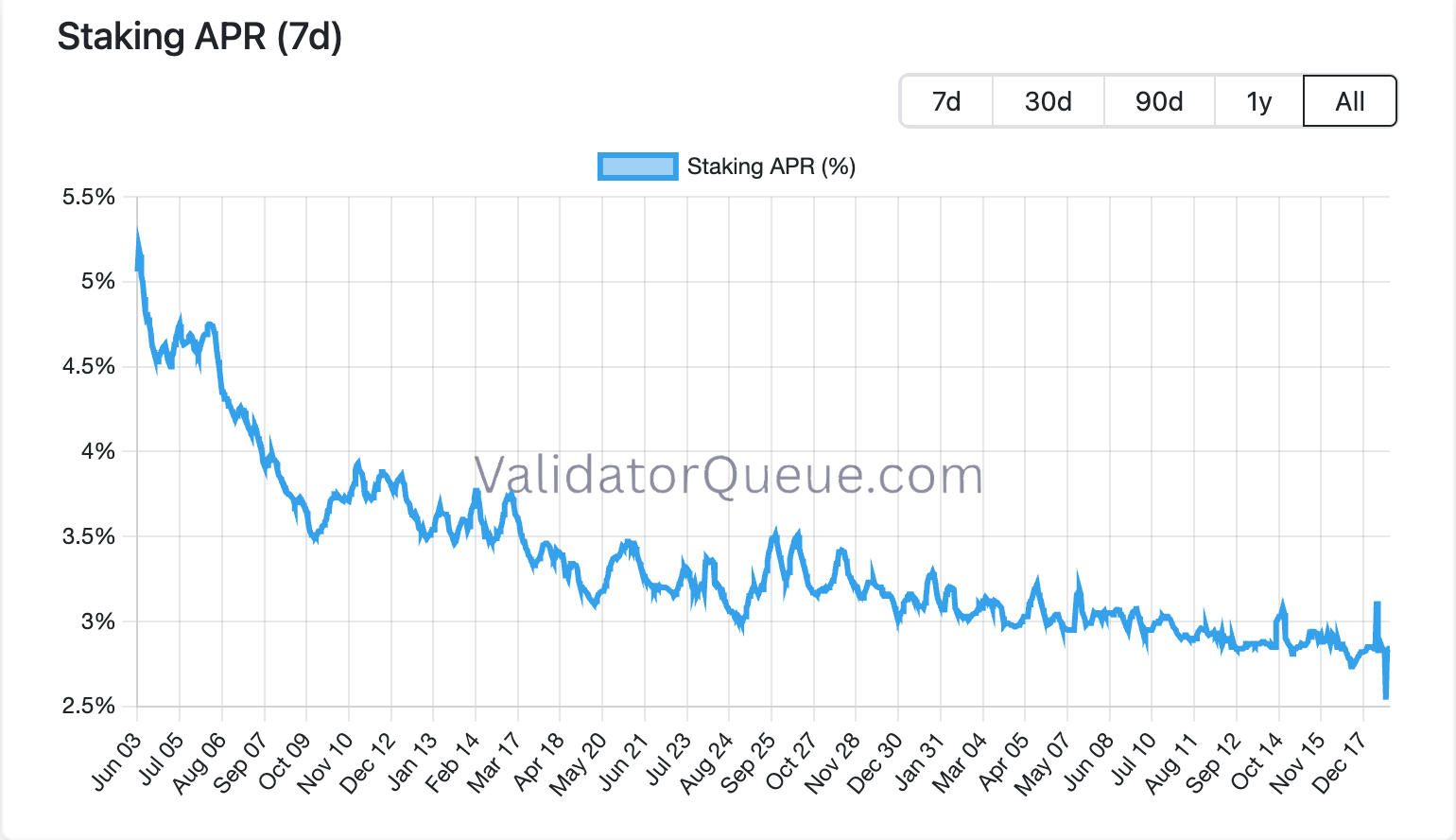

At the same time, staking rewards have been compressed towards 3% as total staked ETH has grown faster than issuance and fee income, limiting the incentive for new spikes in either direction and leaving queues near zero, even though overall staking participants are still increasing.

The decline in yields may reflect congestion, but it also reflects a rise in the “confidence premium.” This means more ETH is choosing to stay in staking rather than on exchange order books.

What this means, simply put, is that “bet pressure” is no longer an everyday occurrence.

If the queue is long, the ETH supply is effectively locked up faster than the network can onboard validators, which can create a sense of scarcity.

When the cue is near zero, the system approaches neutrality. Being able to stake or unstake without having to wait weeks makes staking feel more like a fluid allocation than a one-way street.

This changes the psychology surrounding Ether trading.

Staking still reduces immediate selling pressure, but it is not the same as coins being stuck. With withdrawals working smoothly, ETH behaves less like a forced lockup asset and more like a high-yield position that can be resized as sentiment changes.

Overall, Ethereum’s staking supply is around 30%, significantly lower than the 50% projected by Galaxy Digital at the end of 2025. Galaxy’s hopes that the supply shock from staking would keep ETH above $5,500 and that Layer 2 would overtake Layer 1 in economic activity did not materialize.

ETH’s all-time high may be some time away

According to DeFi Llama, Ethereum’s DeFi TVL remains at around $74 billion, well below its 2021 peak of around $106 billion, even though daily active addresses have nearly doubled over the same period.

While the network still accounts for nearly 58% of all DeFi TVL, its share masks a more fragmented reality.

Incremental growth is increasingly being captured by ecosystems such as Solana, Base, and Bitcoin-native DeFi, allowing activity to expand across Ethereum’s orbit without translating into the same concentration of value and demand for ETH itself.

This fragmentation is important because Ethereum’s strongest bull thesis used to be simple. More usage means more prices, more combustion, and more structural pressure on supply.

The TVL peak of 2021 was also the era of leverage. Today’s lower TVL doesn’t necessarily mean less usage, just less lather.

However, in the current regime, while a significant portion of user activity is likely to occur on Layer 2 networks, where fees are lower and the experience is smoother, the value capture that occurs back to ETH may not be as clear to identify the market at this time.

“One way to frame it is that Ethereum is losing clarity of direction,” DNTV Research founder Bradley Park shared in a note to CoinDesk. “If ETH is treated primarily as a trust asset to be staked rather than actively used, the burn mechanism will be weakened, meaning less ETH will be burned and issuance will continue, increasing sell-side pressure over time.”

“Over the past 30 days, Base has generated significantly more fees than Ethereum itself. This contrast raises a more difficult question for Ethereum: whether its current trajectory is adequately converting usage into ETH value,” Park added.

The gap between activity and value capture is manifested in prediction markets.

At Polymarket, despite the increase in active addresses and DeFi TVL’s still dominant share, traders see only an 11% chance of ETH reaching all-time highs by March 2026.

This pricing suggests that the market sees fragmentation and unlimited staking supply as limiting factors, and usage alone is no longer enough to challenge all-time highs.

However, that situation could change quickly if US policy evolves to allow higher-yielding ETH products, which would result in the resumption of “staking premium” trading.