A new Ethereum staking report shows major technology upgrades coming in 2025 and a surge in institutional adoption. $ETH Prices are lagging and are poised for structural changes in staking and market dynamics in 2026.

The Ethereum Paradox of 2025: Network Growth and Flattening $ETH price

Ethereum’s 2025 was defined by sharp contrasts. The network has delivered major protocol upgrades and attracted record institutional participation, according to the Ethereum Staking Insights and Protocol Analysis Report by Everstake. $ETH Prices remained almost stagnant. This disconnect highlights how Ethereum’s role is evolving faster than the market values it.

Two major upgrades shaped the year. Pectra introduces EIP-7251 and increases maximum active validator balance from 32 $ETH up to 2,048 $ETHwhile Fusaka activated PeerDAS (EIP-7594), significant title=”Learn about blockchain layers 0, 1, 2, and 3″ target=”_blank”>Layer 2 BLOB throughput increased by up to 8x. These changes improve scalability and validator efficiency, strengthening Ethereum’s position as a global payments layer.

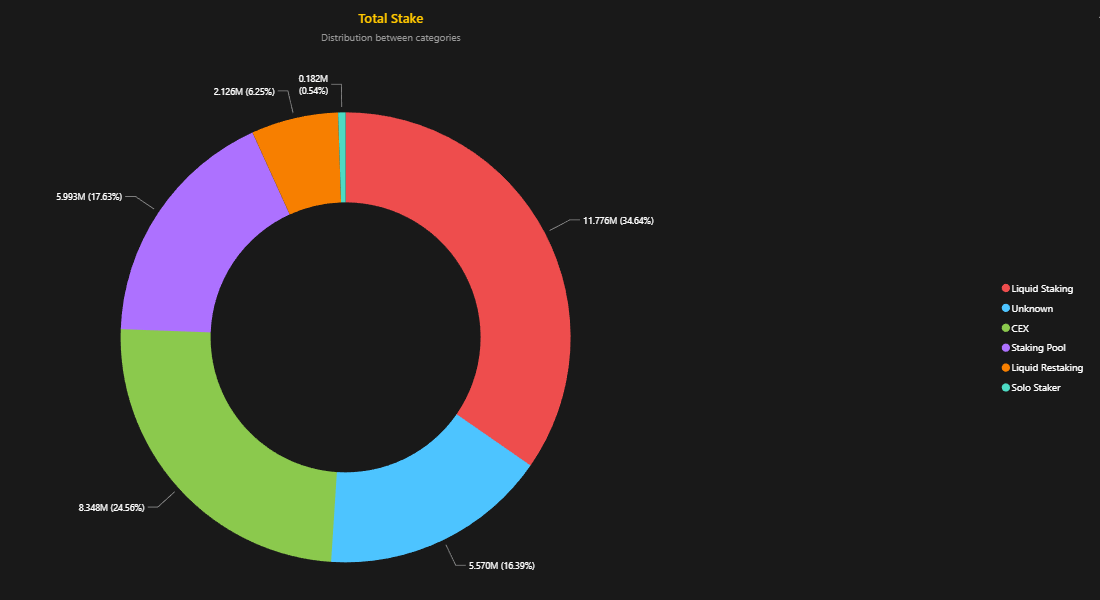

Integrated validators increased from approximately 2% to over 11% of total staked $ETH This reflects a shift toward operational efficiency, especially among large organization operators. By the end of the year, the total stake amounted to approximately 36.1 million $ETHrepresenting 29.3% of the total supply, with a net growth rate of over 1.8 million $ETH.

Source: Everstake

Demand from institutional investors also surged. Digital Asset Treasury (DAT) has accumulated an estimated $6.5-7 million $ETH By December, it would represent about 5.5% of the total supply. Many of these companies hold shares in companies in order to generate profits, effectively $ETH The supply from the liquidity market has decreased, contributing to increasing supply constraints.

Bohdan Oprisiko, co-founder and COO of Everstake, commented:

In 2025, as infrastructure improves and prices fall; $ETH Increasingly, it functions as working capital that secures networks and generates revenue. By 2026, we expect healthcare providers to move beyond passive exposure to provide treatment. $ETH As a high-yield asset where staking is a baseline requirement rather than an optional add-on.

read more: Ethereum daily transaction number hits record high, fees remain flat

On the usage side, Ethereum’s Layer 2 ecosystem exceeded 300 transactions per second, while Layer 1 activity still increased by about 30% year over year, reaching 1.5-1.6 million transactions per day. Daily active addresses increased to approximately 450,000 to 500,000. This was primarily driven by ETF-related wallets and smart accounts rather than retail transfers.

Looking ahead to 2026, the report suggests that Ethereum staking is becoming more formalized and aligned with traditional financial standards. While this could attract additional institutional capital, it also raises new questions regarding decentralization, client diversity, and systemic risk tolerance as Ethereum continues to transform.

Frequently asked questions🔗

- What will determine Ethereum’s performance in 2025?

Despite being flat, Ethereum saw massive network upgrades and increased institutional investment. $ETH price. - Which upgrades were most important?

Pectra and Fusaka have improved validator efficiency and layer 2 scalability across the network. - How strong was institutional adoption?

Institutional investors bet up to $7 million $ETHtightening supply and reshaping market dynamics. - What does this mean for 2026?

Ethereum staking is more institutional and structured, causing deeper market changes.