Ethereum staking plays an important role in forming ETH price support. Freely circulating ETH will be sold more quickly, creating a gap between staked ETH and the unrealized value of circulating ETH.

Ethereum staking holders currently have a different unrealized value profile compared to freely circulating ETH traders.

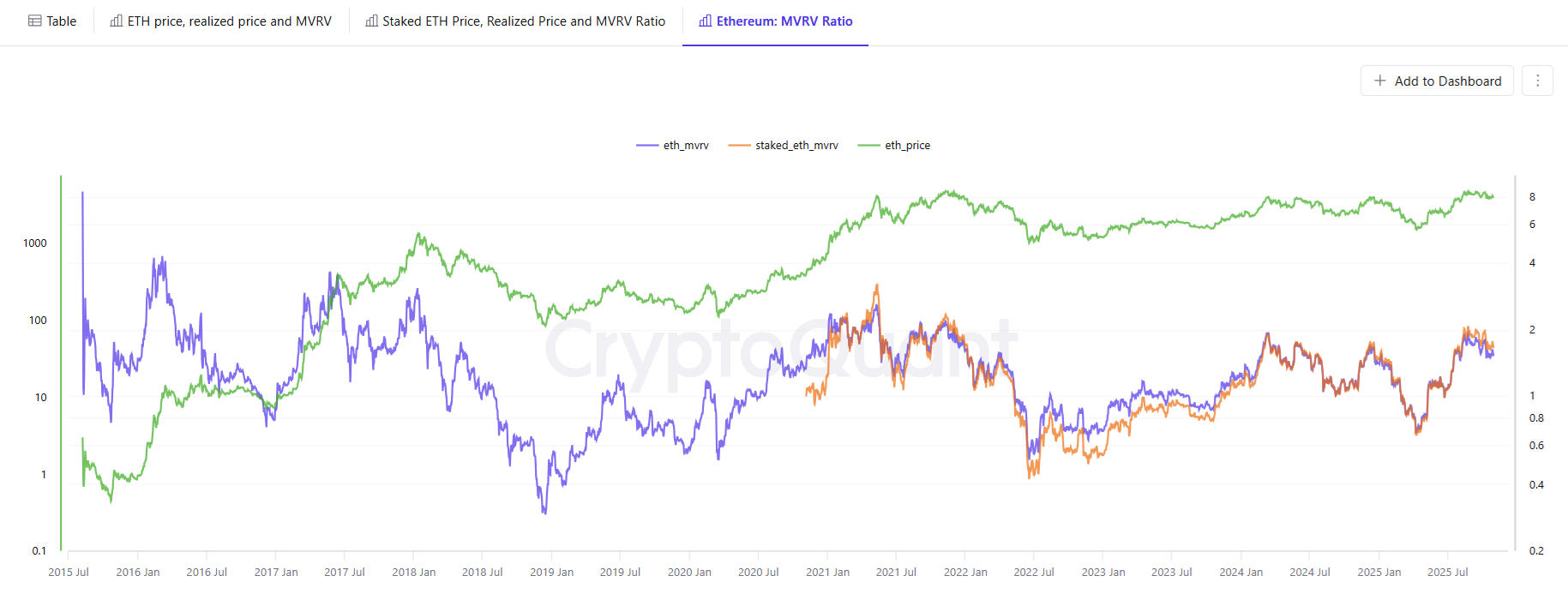

The market value versus realized value (MVRV) of staked ETH and freely circulating ETH has started to diverge in the past few months. This discrepancy suggests that staking ETH holders are saddled with greater unrealized value, with an MVRV ratio of 1.7. For free ETH traders, the ratio is 1.5.

Staked ETH has higher unrealized gains, indicating more long-term trust from stakers and longer holding periods. |Source: Cryptocurrency

Stakers lock up their tokens for a longer period of time, resulting in 20% higher unrealized gains. Holding ETH on the Beacon Chain shows strong belief in ETH.

Preventing panic selling by stakeholders

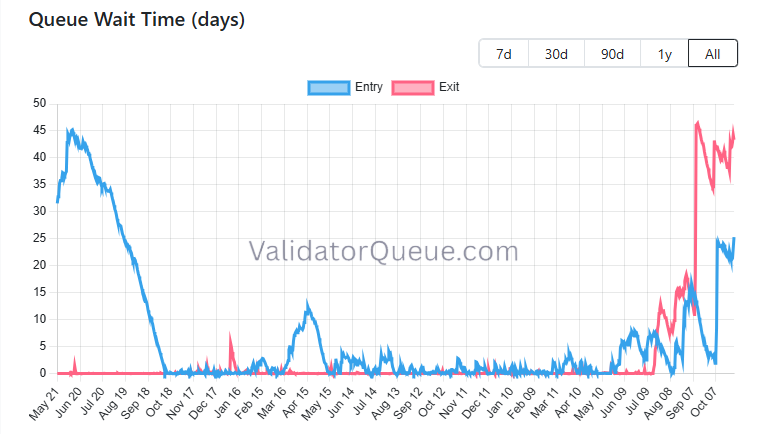

Unlike some ETH whales who can shift their coins quickly, ETH stakers cannot panic sell in the short term. Ethereum unstaking queue waiting time has been extended to 45 days, with approximately 2.49 million ETH waiting to be unstaked.

Ethereum Validator Queue Increases Latency Again to Over 40 Days | Source: Validator Queue

Part of the unstaking is not for sale, but for consolidating smaller stakes into larger stakes of up to 2,048 ETH. The Ethereum chain still has 1.1 million validators with multiple stakes.

In total, more than 36 million have been staked and approximately 121 million are in circulation. Some of the ETH in freely accessible wallets is unused or held for long periods of time, while some whales sell quickly during downturns.

Placing ETH into circulation will reveal price discovery for the token and will not result in significant unrealized gains without profit taking. Meanwhile, some coins are locked in even at all-time highs, so the staked supply acts as an anchor for the price. While staking is typically associated with whale activity, Samsung recently added staking as a native feature to its Galaxy devices, taking advantage of up to 200 million retail users.

Staked ETH is expected to grow as ETFs and financial companies also deposit coins on Beacon Chain. One of the biggest stakes may be with Grayscale halting sales and instead holding ETH as backing for exchange-traded products.

ETH ends October in the red

ETH traded at $3,855.99, near last month’s low. In October, ETH peaked above $4,700 before the largest liquidation in history.

As of October 31st, ETH had posted a 7% net loss for the month, making it the third worst October in history. ETH also fell by more than 3% in net value in October 2024.

ETH has expanded its daily usage while maintaining reasonable gas prices. The use of DeFi is increasing and value is being locked into liquid staking and lending. Currently, $2.2 billion of ETH is locked in loans, with liquidation positions growing at $1,891 per ETH. DeFi clearing maintains a more conservative price level compared to derivatives trading, and also represents a lower bound on the price range for ETH in the event of a deeper correction.