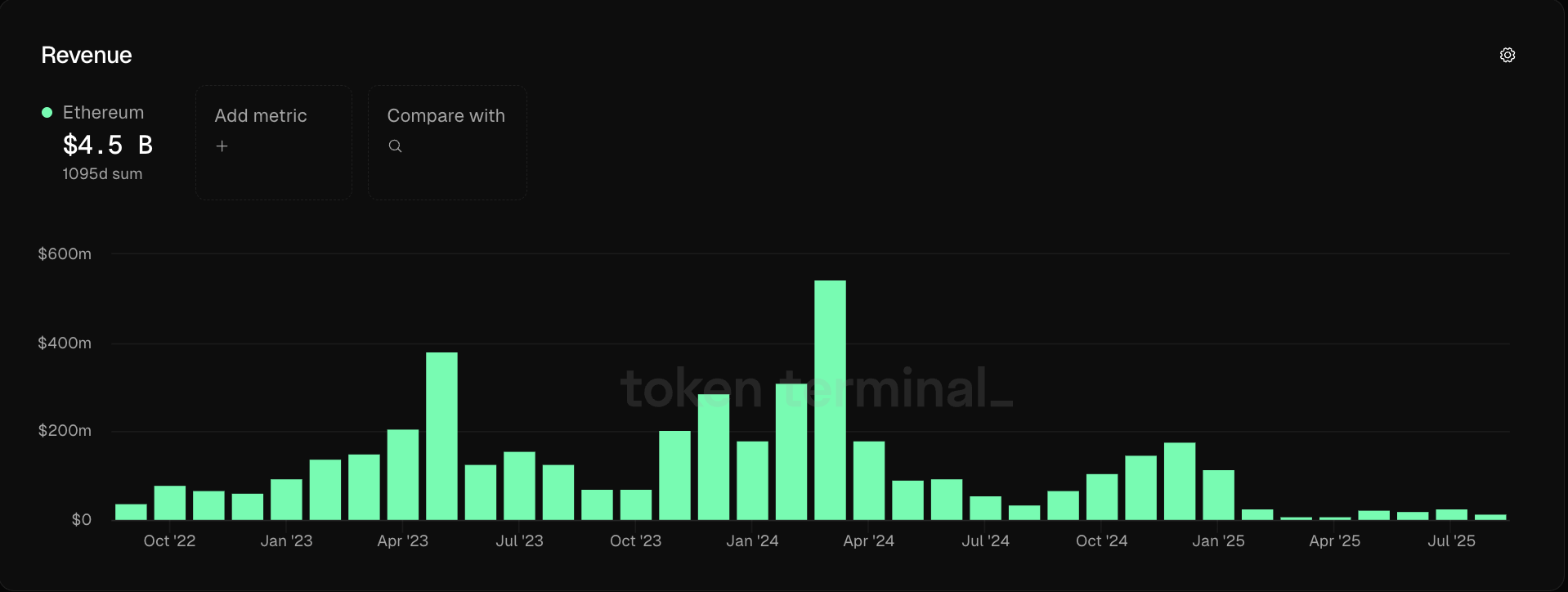

Ethereum revenue, the percentage of network fees incurred by ether (ETH) holders as a result of Token Burns, fell by about 44% in August, even among the highest ever ETH prices.

According to Token Terminal, revenue in August exceeded $14.1 million, up from $25.6 million in July. The decline has risen 240% since April, with ETH reaching an all-time high of $4,957 on August 24th.

Network prices also fell about 20% per month, falling from around $49.6 million in July to around $39.7 million in August.

Ethereum monthly revenue figures. sauce: Token terminal

Monthly Ethereum Network prices fell several digits in March 2024, following the Dencun upgrade. This significantly reduced the transaction fees for Layer 2 Scaling Networks to post transactions using Ethereum as the base layer.

The reduced fees and revenues of the network sparked debate over the viability of Ethereum. Critics say the Layer-1 smart contract platform claims that an unsustainable foundation and supporters are the backbone of the financial system of the future.

ETH prices reached an all-time high in August 2025. source: coinmarketcap

Related: Ether ETF is a straight week post of a weekly spill in a small priced dip

Ethereum Court institutional interests in 2025

The Ethereum Network has raised ETH prices to an all-time high as the community promoted blockchain platforms to Wall Street companies and ETH public finance companies.

Etherealize, an advocacy and public relations company selling Ethereum Network to public companies, announced it had completed a $40 million capital raise in September.

Matt Hougan, chief investment officer (CIO) of investment firm Bitwise, told Cointelegraph that institutions and traditional financial investors are attracted to the Ether yield capabilities.

https://www.youtube.com/watch?v=20zfedqdkl8

“If you receive a billion dollars of ETH, put it in your company and suddenly you bet on it, you’re making a profit. And investors are used to being a company that really generates revenue,” says Hougan.

These companies have earned the yield to lock ETKEN to protect their networks and provide verification services to the Layer-1 Blockchain Smart Contract Platform.

magazine: How Ethereum Finance Companies Can Cause “Defi Summer 2.0”