Ethereum price remains under pressure after the recent selloff that slowed the recovery momentum. $ETH The stock traded at $2,087, regaining the $2,000 level, but has not been able to build a sustained upside.

The challenge facing Ethereum lies not only in the level of resistance, but also indecision among the keyholder population.

Ethereum whale sells…then buys again

Whales and long-term holders represent the two most influential groups in the crypto market. In the case of Ethereum, both groups are sending mixed signals. This lack of adjustment contributes to long-term sideways price movements.

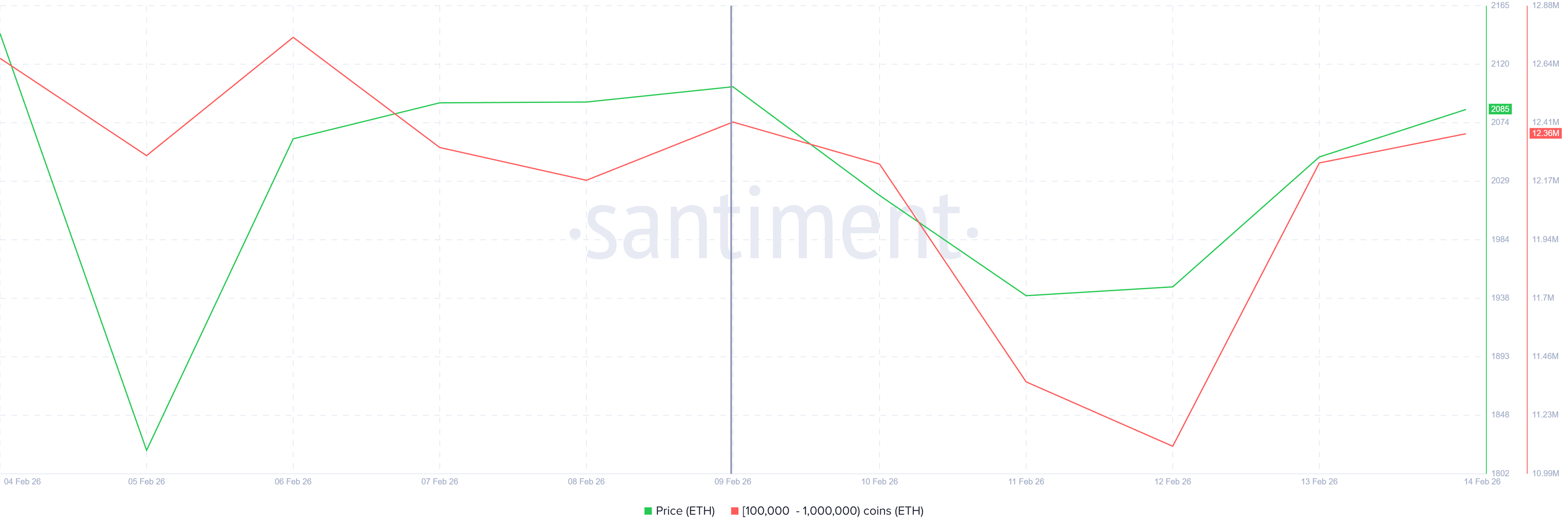

Addresses holding between 100,000 and 1 million $ETH Approximately 1.3 million units sold $ETH The sale is valued at approximately $2.7 billion. However, the same cohort purchased 1.25 million units $ETH within the next 48 hours.

Ethereum Whale Holdings. Source: Santiment

This rapid reversal resulted in approximately $2.6 billion in buying during the same week. Such large-scale back-and-forth activity creates unbiased fluidity. As a result, Ethereum price remains within a range rather than trending decisively upward or downward.

Ethereum LTH has accumulated…but is now on sale

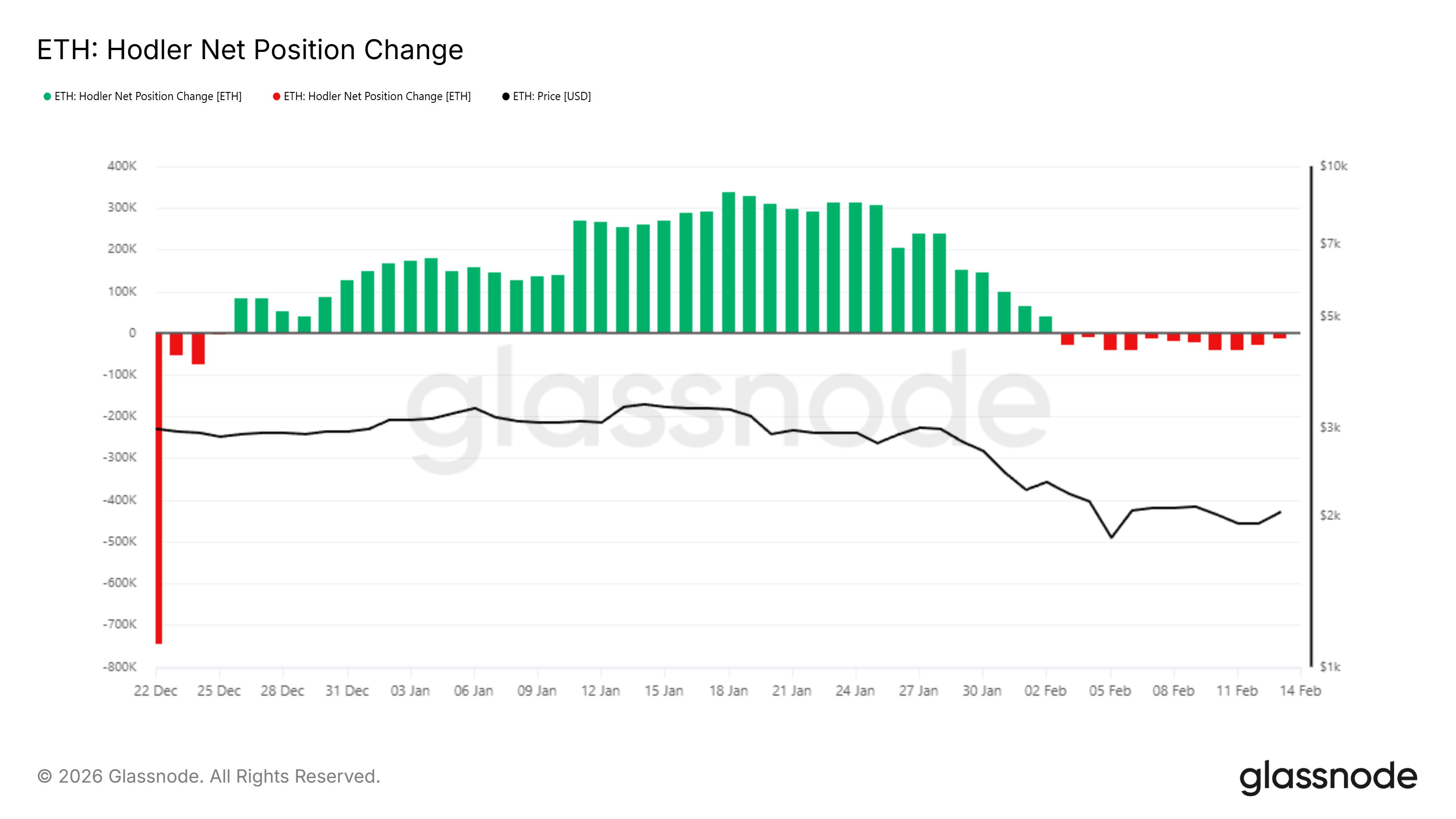

HODLer’s net position change metric reinforces this indecision. This indicator tracks the movement of long-term holders’ balances. The number of long-term holders has steadily increased since late December 2025. $ETH.

At the beginning of February, that trend changed. Long-term holders have reduced purchasing activity and started making modest distributions. Although the selling pressure is less aggressive, this indicates increased uncertainty among investors, which is typically associated with strong conviction.

Ethereum HODLer net position change. Source: Glassnode

Mixed whale activity, combined with cautious long-term holders, limits bullish momentum. Without sustained accumulation from these cohorts, Ethereum price will face difficulty breaking through key resistance levels.

$ETH The price is stuck at around $2,000.

Ethereum was trading at $2,087, successfully regaining the $2,000 threshold. The next major resistance level is located at $2,241. A move to that level requires a clear bullish bias from the dominant holder group.

Given the current lack of definitive accumulation, consolidation remains the most likely scenario. Ethereum may continue to hover around $2,000 while defending the support level at $1,902. Sideways momentum is likely to continue until directional certainty emerges.

Ethereum price analysis. Source: TradingView

If whales and long-term holders shift to accumulation again, Ethereum could rise above $2,241. A sustained rally could extend towards $2,395 and potentially test $2,500. If the price clears $2,500, the bearish theory will be invalidated and a stronger recovery trend will be confirmed.