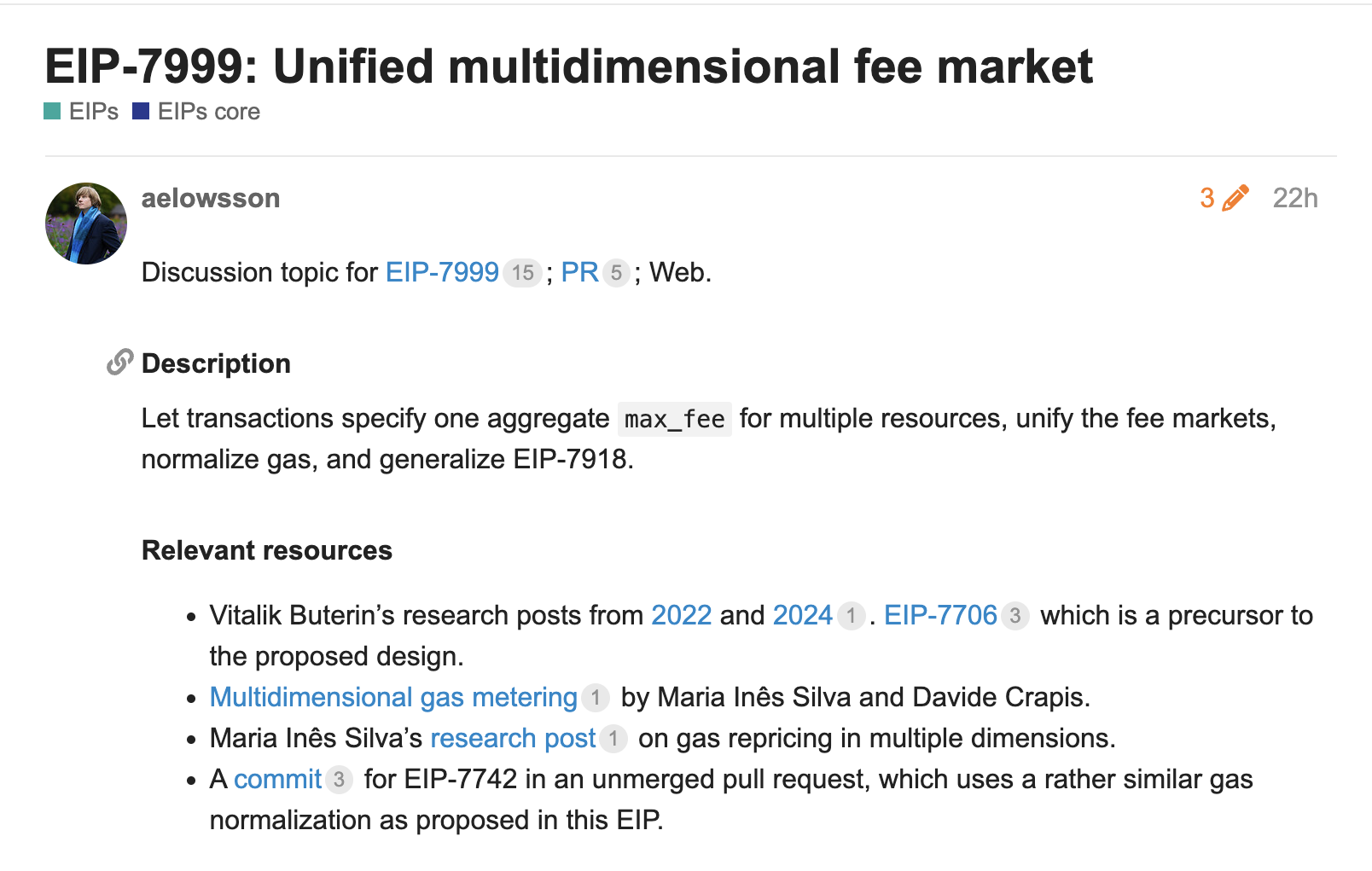

Ethereum co-founder Vitalik Buterin and developer Anders Elowsson have introduced EIP-7999, a proposal to streamline Ethereum’s transaction fee structure.

The proposal, released Tuesday, aims to establish a unified multidimensional charge market, allowing users to specify a single, tally maximum charge for multiple resources.

This proposal, when adopted, eliminates the need to estimate and manage multiple fee components when submitting a transaction, and allows users to specify one comprehensive maximum fee, making payments for the transaction simpler and more predictable.

The proposal is described as “how to simplify fee management by allowing users to specify a single maximum fee across multiple transactional resources and allowing them to improve capital efficiency and user experience.”

It is under community reviews and discussion prior to potential implementation.

Source: Ethereum Magicians

Long-standing issues with Ethereum gas pricing

Ethereum’s gas prices have been a sustained challenge since the rapid growth of the network in 2017, when a surge in decentralized applications (DAPP) and initial coin provision (ICO) caused traffic congestion and surge in transaction costs.

Things got worse between the summer of 2021 and the NFT boom. This was often the case that the average gas fee was often over $50 per transaction.

In response, Ethereum implemented the EIP-1559 upgrade in August 2021, introducing base rate burning, and aims to stabilize the rate. It helped with a slower fee surge, but periods of high congestion remained unstable and sometimes banned gas costs.

To make the burden even easier, layer 2 scaling solutions such as Optimism and Kimkai became popular, processing transactions and reducing fees. However, Ethereum’s mainnet fees remain a concern, prompting continued development efforts to come with the Dencun upgrade in March 2024.

Dencun’s impact: Gas prices drop as competitors acquire the ground

The Dencun upgrade, implemented on March 13, 2024, introduced nine Ethereum Improvement Proposals (EIPs), particularly to improve the scalability and transaction costs of Layer 2 solutions.

Within a year, average gas prices for common transactions fell from 95% to around $86 to $0.39, according to EtherScan data. Ethereum’s native token price has fallen by more than 50%, reflecting the challenges of the broader market.

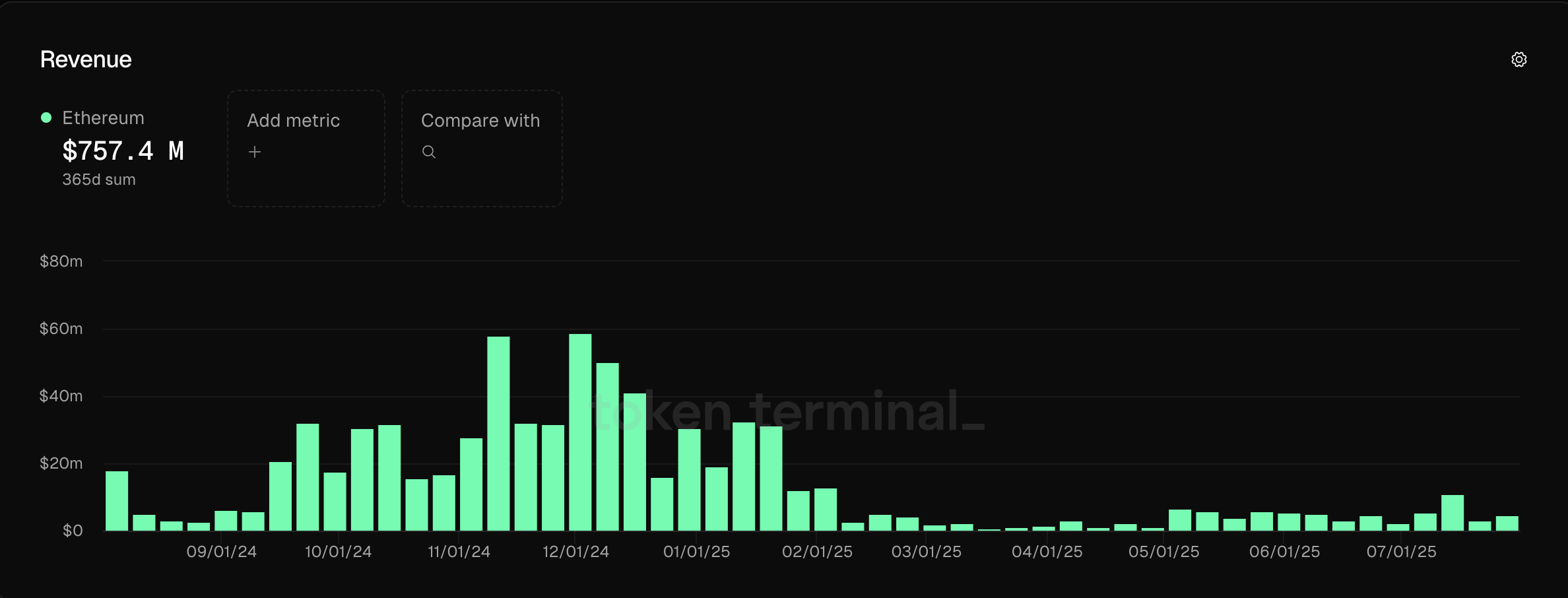

Ethereum remains the top blockchain due to transaction fee revenue in 2024, up $2.48 billion in 2023. However, fee revenues were volatile as competitors acquired their positions.

In the same year, Tron’s fees more than doubled to $2.15 billion, driven primarily by Stablecoin Transactions, Solana’s fees went from 2838% to $750 million amid a surge in network activity.

Over the past 365 days, Ethereum fees generated revenues at $757.4 million at the time of this writing, according to Token Terminal data.

Ethereum’s total network revenues are 365 days. sauce: Token terminal