Ethereum prices are trying to recover, but they cannot break past the $4,500 barrier. Despite surpassing key support levels, ETH continues to struggle with this resistance.

This ceiling could block Altcoin King’s newest run until the wider market situation changes crucially.

Ethereum investors sell

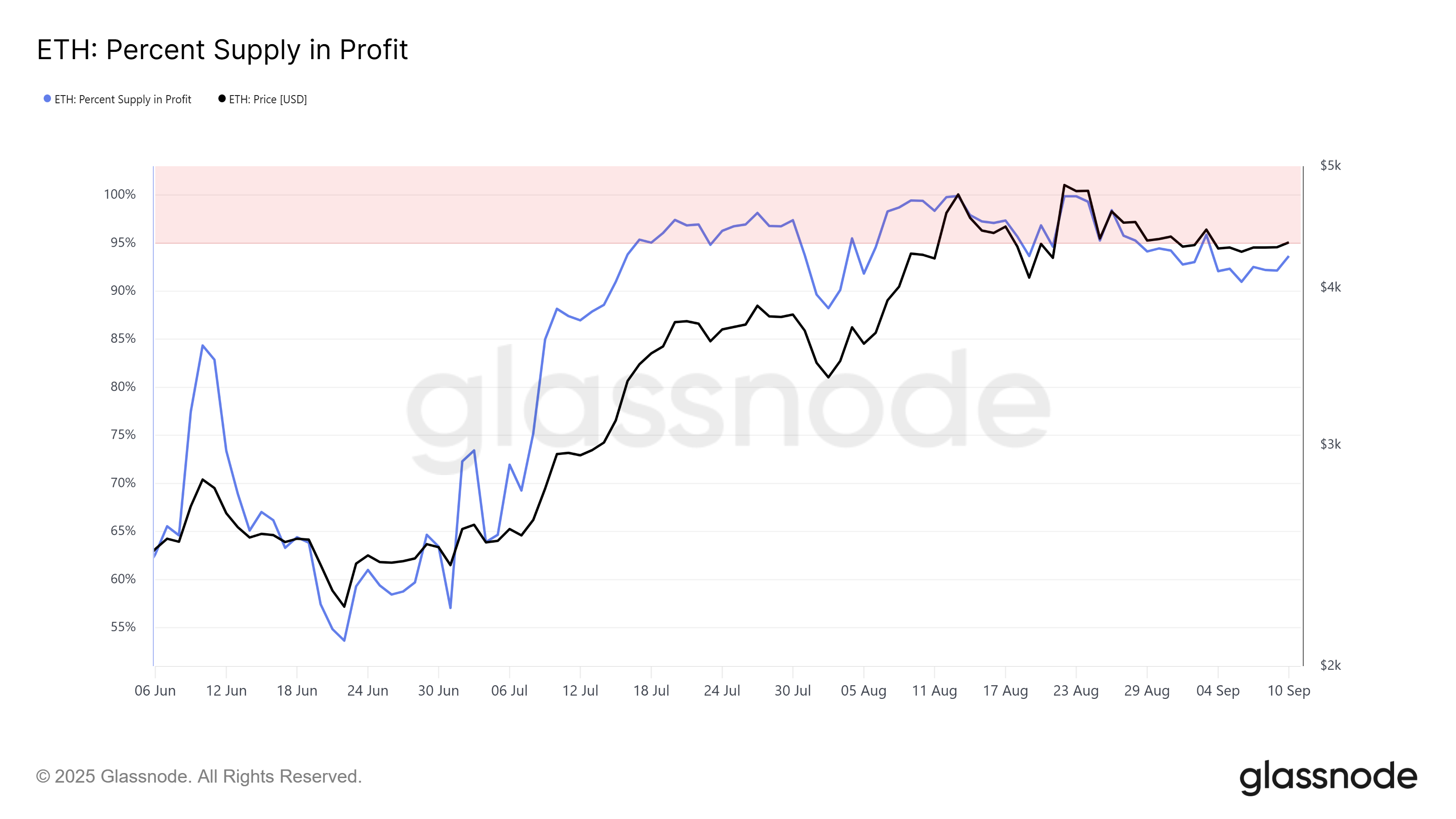

Ethereum’s profit supply is approaching a critical 95% threshold, which is historically relevant to the top of the market. When the supply of profits crosses this line, many investors tend to book profits, causing sharp revisions. This behavior reflects careful attention as the ETH approaches resistance.

The $4,500 mark has been a major obstacle for Ethereum over the past two weeks. Each attempt to break through failed, reinforcing investor skepticism. Making profits at these levels will prevent ETH from rising sales pressures and increasing momentum in the short term.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Ethereum supply in profits. Source: GlassNode

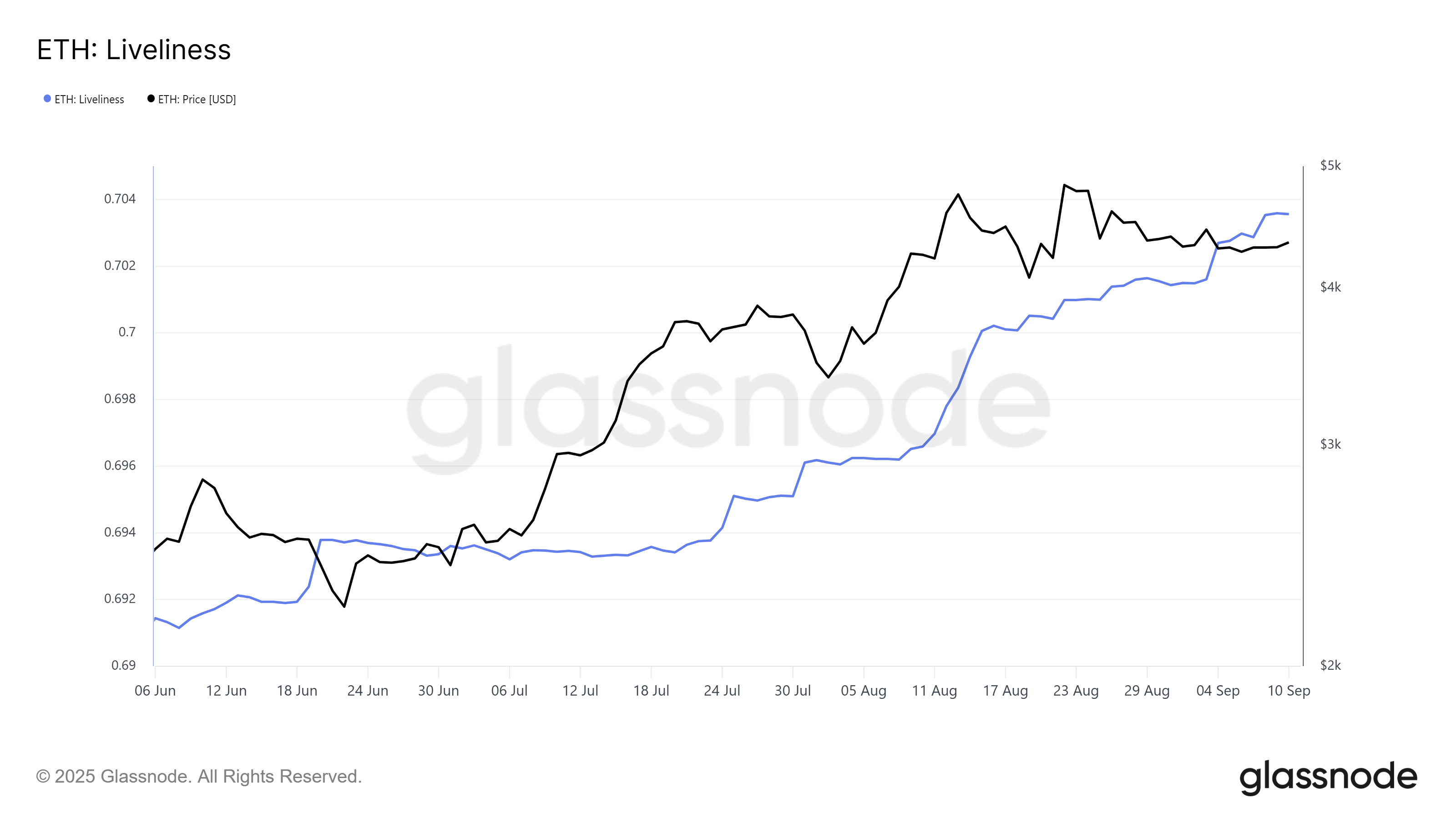

Lively indicators are also paying attention. The rise in this indicator suggests that long-term holders are selling ETH rather than accumulating. This shift usually appears when the owner fears potential losses or expects them to be rising. Their actions put pressure on market stability.

The sideways price movements accompanied this uptick in vibrancy, reflecting the uncertainty of macro momentum. While the broader terms continue to support cryptography, Ethereum-specific sales trends may outweigh positive sentiments. If this continues, the ETH may struggle to maintain upward traction, putting additional resistance at a higher level.

The vibrancy of Ethereum. Source: GlassNode

ETH Prices are waiting for a breakout

The price of Ethereum is currently at $4,433 and is trading above the $4,331 support. However, a $4,500 sustained resistance remains a formidable challenge. Supporting this barrier is key to Ethereum establishing bullish momentum.

Given current conditions, ETH could be in the range of $4,222 to $4,500. The integration within this zone reflects the reluctance of investors on the rise in profitability and long-term holder exits.

ETH price analysis. Source: TradingView

Still, if broader market sentiment improves and influxes are strengthened, Ethereum could ultimately infringe $4,500. Ensuring this level as support signals reversal strength and sets a stage of movement towards $4,749, invalidating the current bearish paper.

Ethereum Price’s New High ride could be blocked by the market top that first appeared on Beincrypto.