of Ethereum ($Ethereum) Markets are currently experiencing a period of stabilization as geopolitical headlines from the World Economic Forum in Davos continue to drive investor sentiment. After a week of high-stakes rhetoric, the second-largest cryptocurrency by market capitalization has found firm footing following a significant easing in trade tensions.

Ethereum price analysis: Ethereum Coins hold important levels

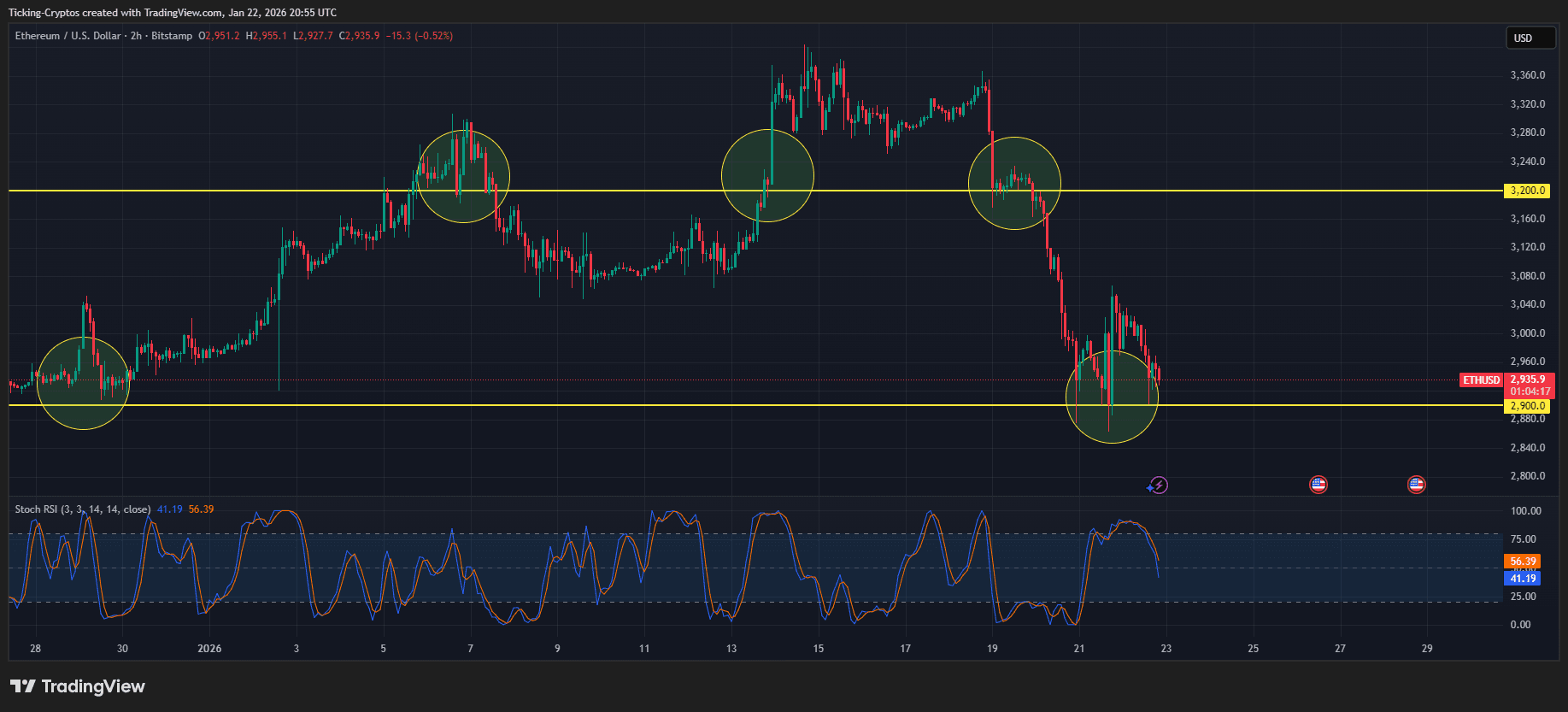

According to the latest information Ethereum price listEthereum is currently testing a significant horizontal support zone around it. $2,900. As shown in the attached technical analysis, the price has repeatedly reacted to this level over the past month.

Ethereum/USD 2H – TradingView

- support: The $2,900 zone remains a key floor for bulls. A daily close below this could open the door to a deeper correction towards $2,750.

- resistance: A yellow horizontal line appears upwards. $3,200 It acts as a strong ceiling. Ethereum It briefly broke above this level in the middle of the month, but was hit by strong selling pressure.

- Momentum: The stochastic RSI indicator is currently trending towards oversold territory (below 20), suggesting that the immediate downside impulse may have reached exhaustion.

Traders who want to take advantage of these price movements should compare the best crypto exchanges with the lowest fees and highest liquidity during volatile periods.

Ethereum Coin macro driver: “Davos Pivot”

The recovery in digital assets was spurred by President Donald Trump’s latest comments at Davos. After initially threatening to impose 10% tariffs on European countries that opposed his Greenland ambitions, President Trump announced a “framework for future agreements” with NATO Secretary-General Mark Rutte.

This shift from “force” to “diplomacy” led to a widespread backlash in risk assets. meanwhile Bitcoin Although it regained the $90,000 level, Ethereum managed to stabilize above the psychological $2,900 mark. Despite the reassuring rally, Reuters experts warned that a “volatility premium” persists in the market as specific trading details remain unclear.

Security comes first in volatile markets

While the latest crypto news suggests a easing of tensions, the sudden policy shift highlights the importance of self-custody. Macroeconomic shocks can lead to exchange rate suspensions and liquidity strains. To protect your holdings, consider moving your assets to a top-rated hardware wallet.

Market notes: During this consolidation phase, whale activity remains high. According to the data, large holders have amassed assets worth about $360 million. Ethereum This is because the price has fallen towards the current support level.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies is highly volatile and involves significant risks.