Ethereum price has gradually risen in recent sessions, indicating a slow but steady recovery. ETH has struggled to garner sustained investor support, limiting its upward momentum.

This lack of belief has made it increasingly difficult for the altcoin king to reach the long-anticipated $4,000 level, despite improving broader market conditions.

Ethereum whales continue to decline

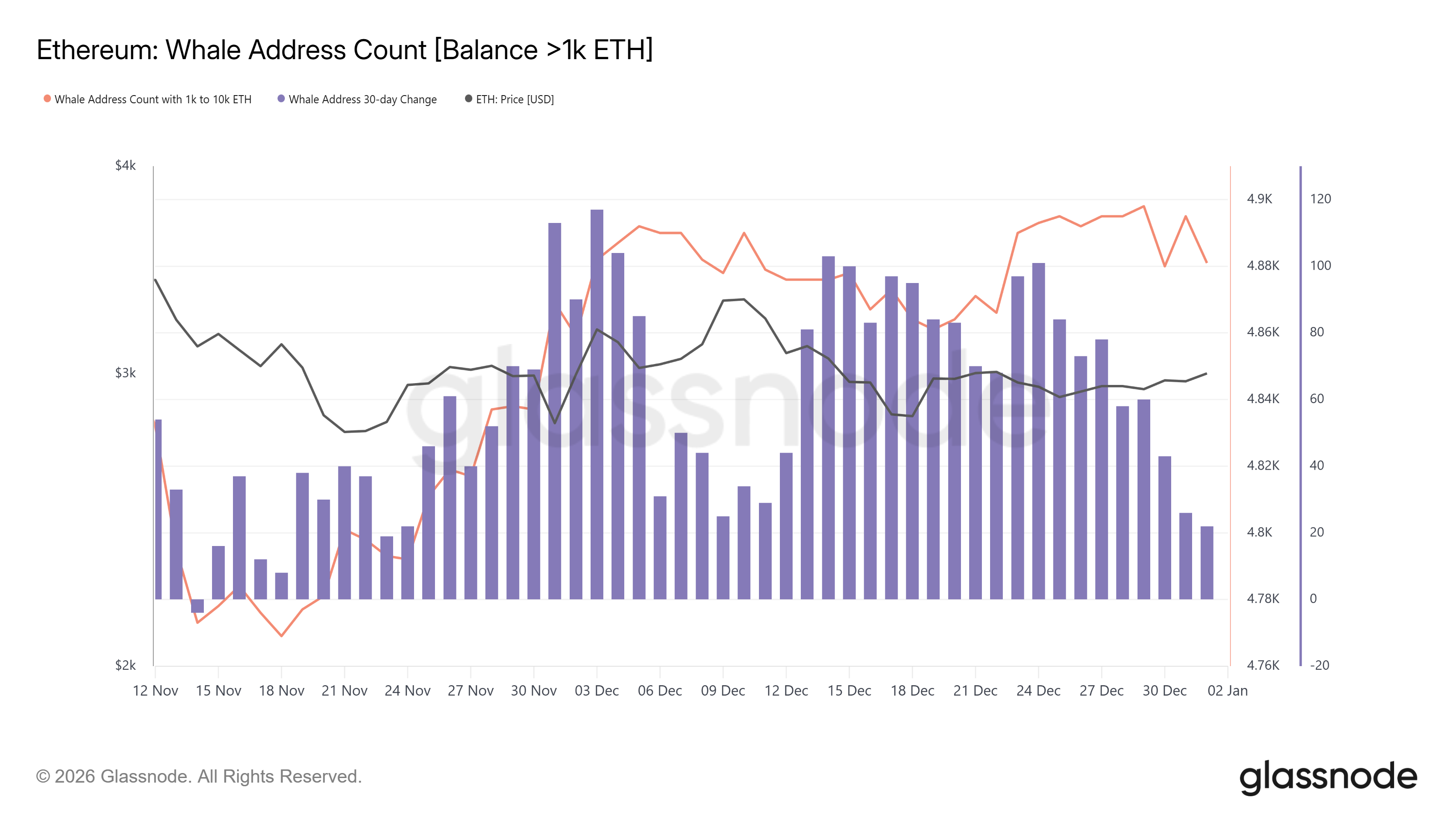

Whale activity reflects growing vigilance among large Ethereum holders. Data tracking whale addresses shows decreasing changes over 30 days, indicating declining participation from this influential cohort. A decline in whales maintaining or expanding positions often indicates weakening confidence in short-term price increases.

The decline suggests whales may be reassessing their impact amid limited growth prospects. Large holdings are typically accumulated during the high conviction stage. Their current pullback signals a bearish short-to-medium-term outlook and puts pressure on Ethereum’s ability to sustain strong gains without new demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Number of whale addresses on Ethereum. Source: Glassnode

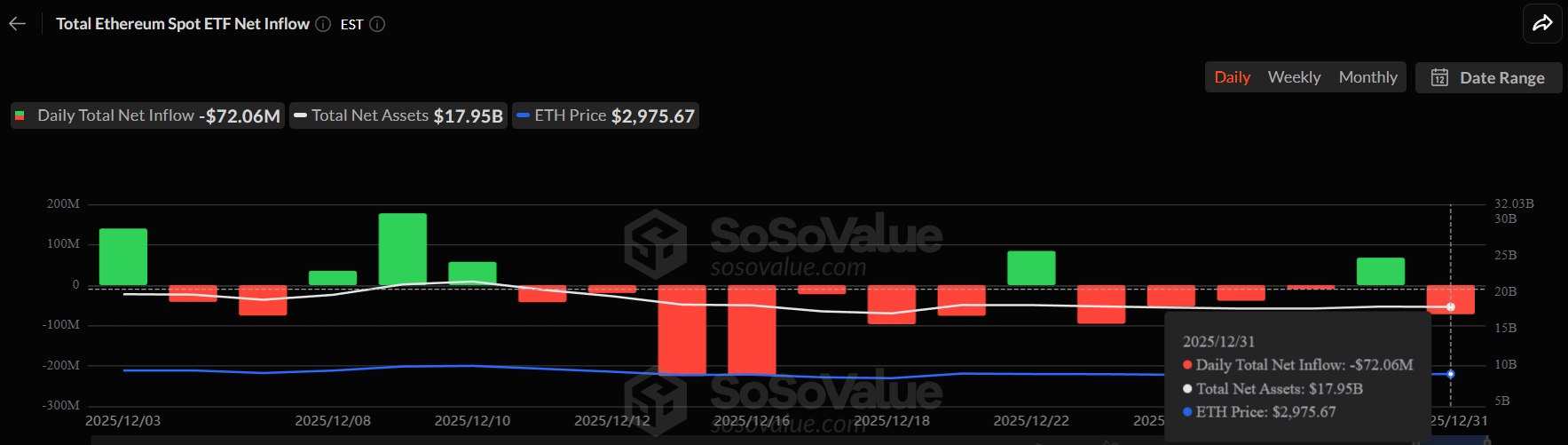

Macro indicators also highlight headwinds to Ethereum’s price recovery. The ETH Spot ETF ended 2025 on a bearish note, with total net outflows of $72 million. This performance reflects cautious institutional sentiment during a period of broader market uncertainty.

Even into the new year, participation remains low. In the past month, the ETH Spot ETF recorded inflows just five times. This partial withdrawal from institutional investors limits liquidity support and reduces the likelihood that the rally will be sustained without a clear macro catalyst.

Ethereum ETF Flow. Source: SoSoValue

ETH price is facing a supply crisis

Ethereum price is showing early signs of strength in 2026. ETH recently reclaimed the $3,000 level, breaking above this resistance for the first time in 10 days. While the move represents a psychological milestone, it remains only the first step toward the broader $4,000 goal.

The next major hurdle lies at 32% above current levels, with ETH trading around $3,014. Price movement is still constrained within a descending wedge pattern. A confirmed breakout would require a decisive move above $3,131, which could shift momentum and attract new buyers.

ETH price analysis. Source: TradingView

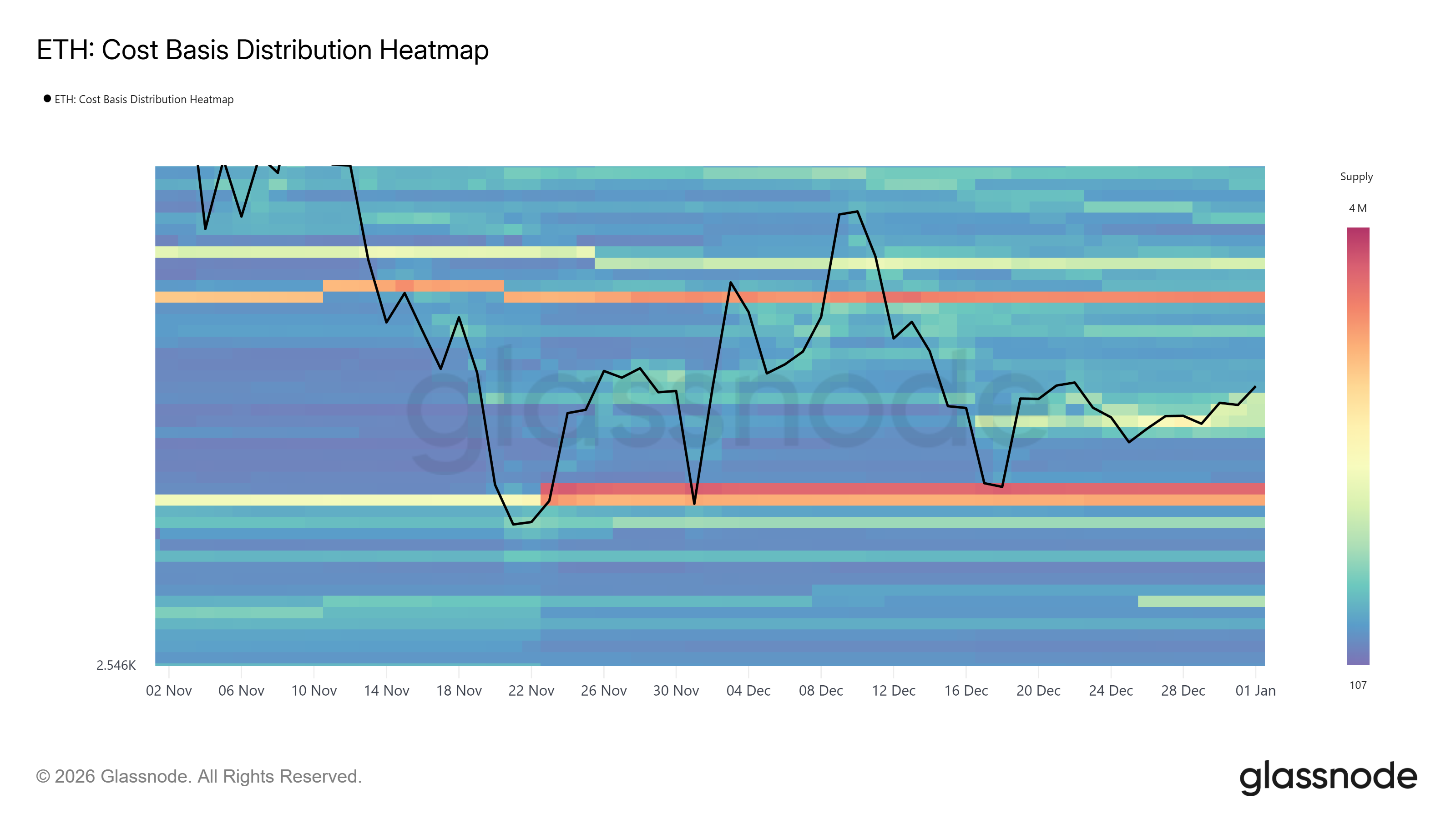

It’s hard to reach that level because there’s a lot of overhead supply. The cost-based distribution heatmap shows approximately 2.83 million ETH accumulated between $3,151 and $3,172. This zone acts as a resistance because when the price approaches this zone, many holders may sell to breakeven.

Barring strong demand, Ethereum is likely to consolidate below $3,131. This range-bound movement is likely to continue as sellers absorb the pullback and buyers remain hesitant. Such consolidation reflects the market waiting for confirmation rather than actively committing to higher valuations.

Ethereum CBD heatmap. Source: Glassnode

Whether the bearish thesis is invalidated depends on new whale and macro support. Significant inflows into Ethereum via the spot and ETF markets would signal a return to confidence. If institutional investor participation continues, ETH could regain momentum by breaching $3,131 and extending its rally toward $3,287.

The post Ethereum price crossed $3,000, but why $4,000 is a challenge appeared first on BeInCrypto.