Ethereum has been steadily climbing since the beginning of the month and gains strength as the market gains. At the time of writing, ETH is trading for nearly $4,477 and is shy about the $4,500 resistance.

Despite failing to break this barrier, investors’ sentiment suggests that Altcoin King may be preparing for a run up to $5,000.

Ethereum investors are bullish

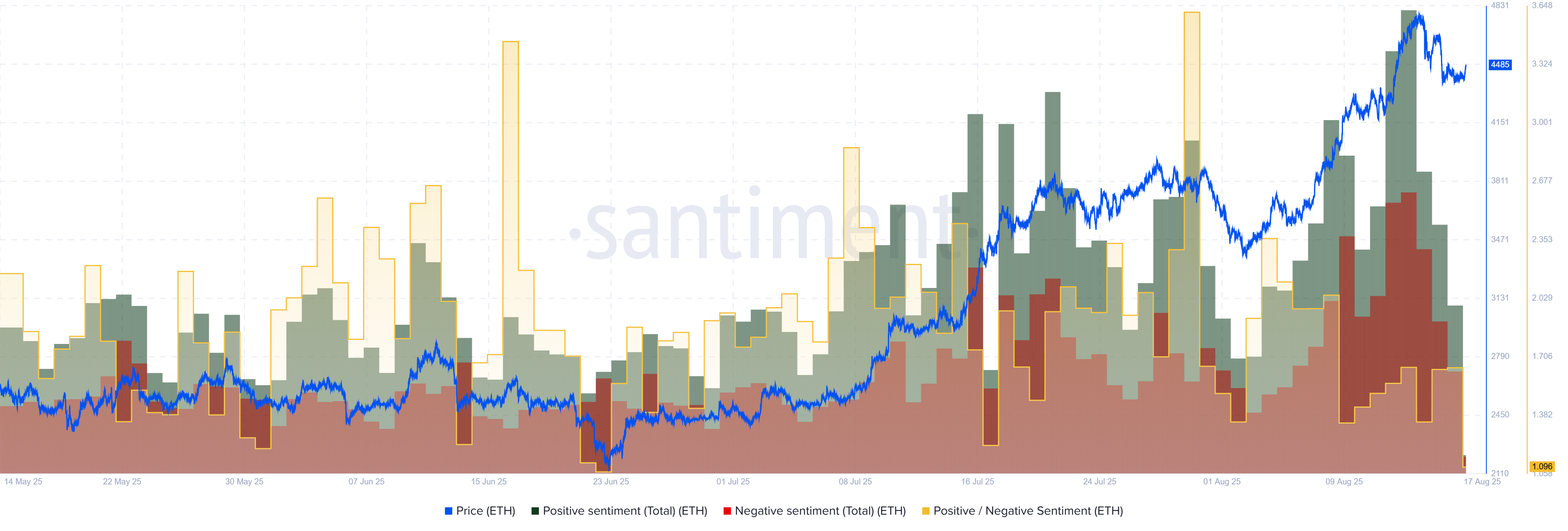

Ethereum’s emotional index is currently below 2.00, at a level that has historically shown an increase in fear, uncertainty and doubt among retail investors. When traders are leaning heavily towards FUD, prices often move in the opposite direction, catching skeptics off guard. This pattern has repeatedly been proven to be an inverse indicator.

For context, Ethereum faced extreme greed from traders on June 16, 2025, and on July 30, 2025. Both instances caused price corrections. In contrast, today’s environment of mistrust and attention has come while ETH continues to set higher prices, suggesting that emotionally driven skepticism can ironically burn rallies.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Ethereum investors sentiment. Source: Santiment

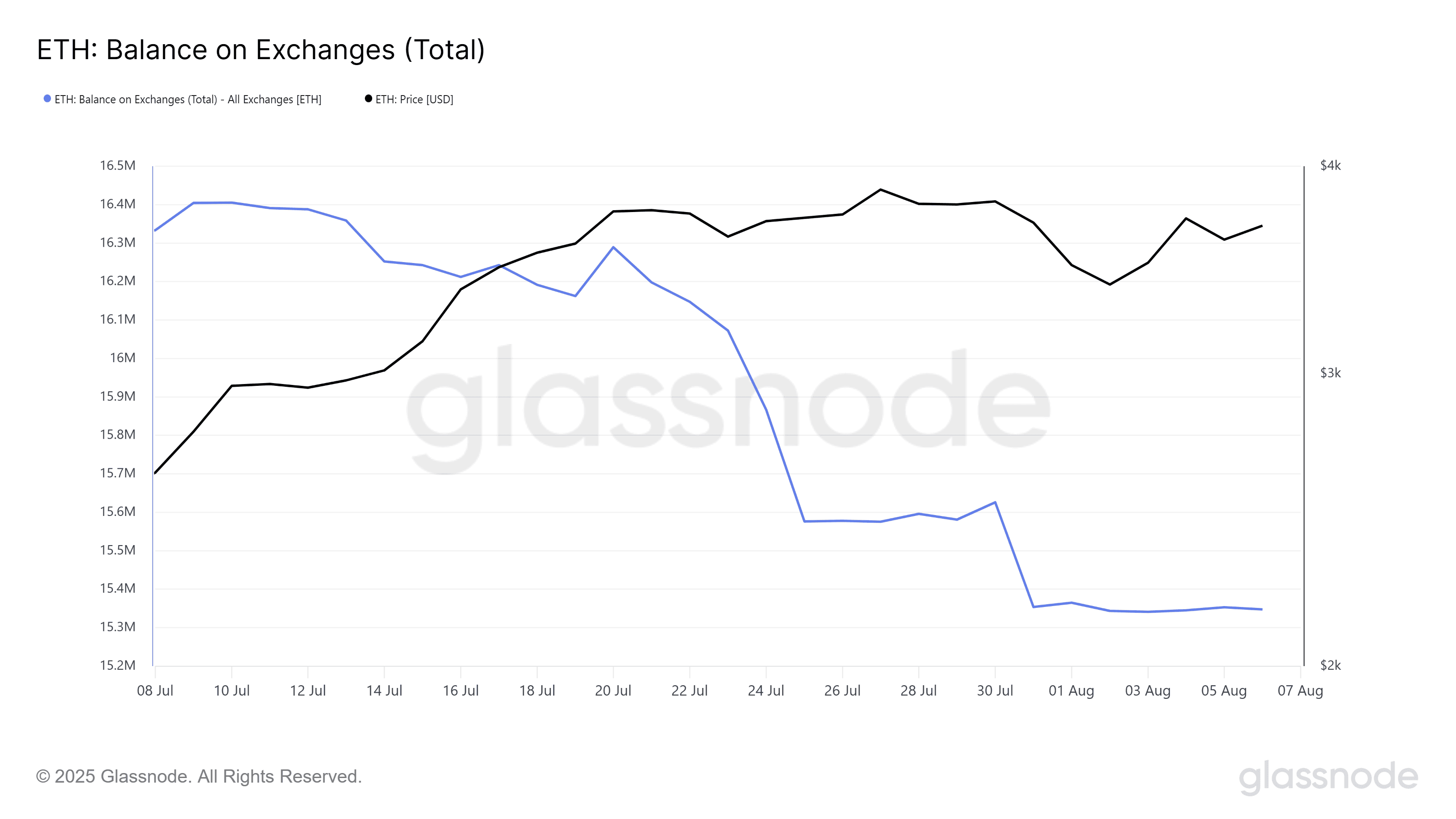

On-chain data highlights key trends that support the outlook for Ethereum macros. Exchange balances fell to a nine-year low of ETH of 1,488 million, indicating that investors are moving their holdings into long-term storage.

Accumulation strengthens confidence, while still modest. Approximately 470,000 ETH, worth $211 million, have been purchased over the past week. The pace is not offensive, but a steady inflow is below investor convictions. Tightening supply and retention of demand could potentially sustain Ethereum’s bullish momentum, especially if broader market sentiment changes its favor.

Ethereum exchange balance. Source: GlassNode

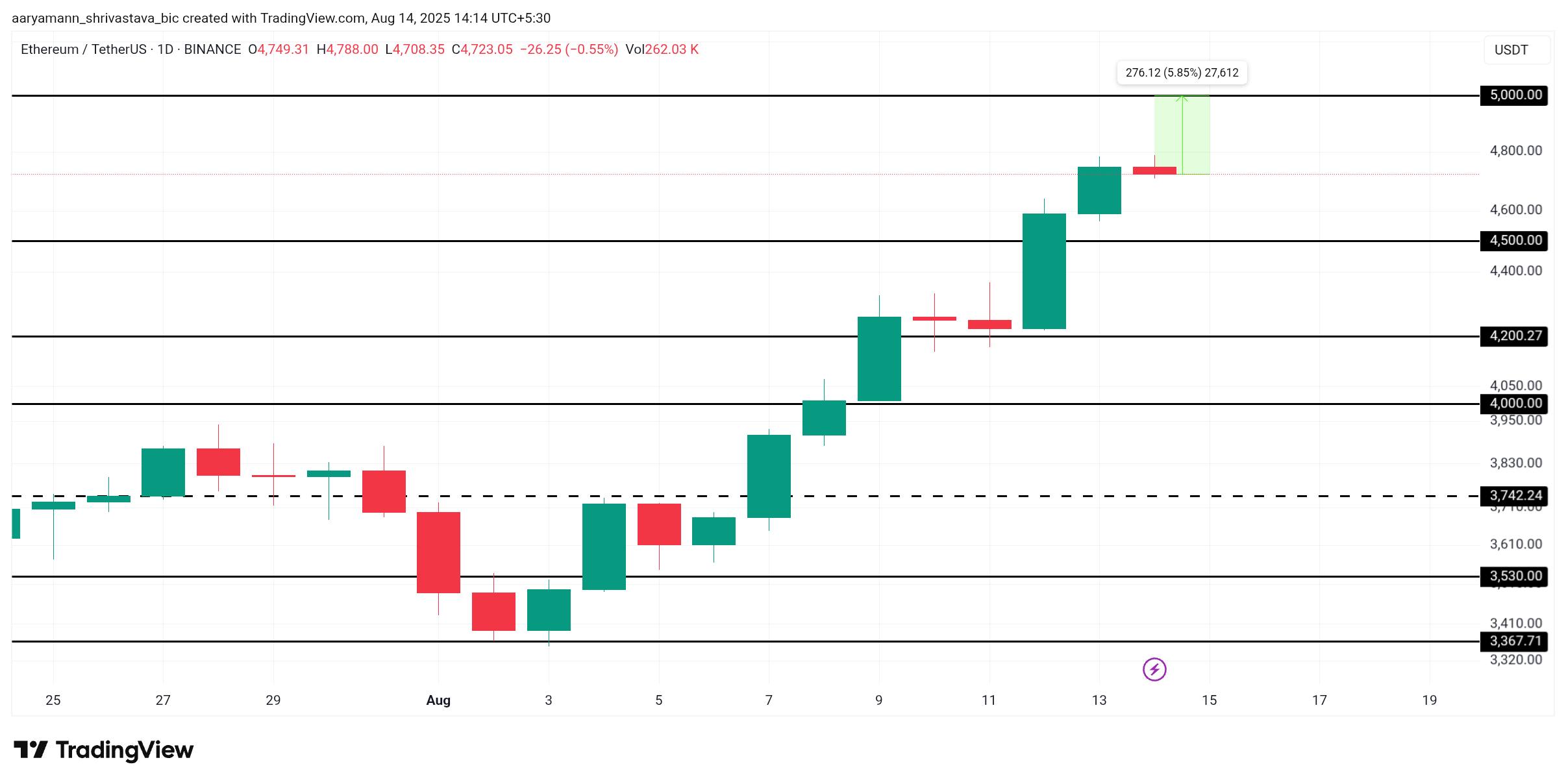

ETH Prices Need to Regain Support

The ETH priced at $4,477 and is located just below the $4,500 resistance. A broader indicator, including reduced exchange balances and reverse emotional signals, suggests a favorable environment for breakouts. These terms collectively support Ethereum bullish cases in the near future.

If Ethereum is able to regain $4,500 in support, the uptrend can accelerate. The move will help cryptocurrency push the next resistance at $4,749, paving the way for a $5,000 test.

ETH price analysis. Source: TradingView

However, if investor sentiment suddenly changes, the risk remains. If the owner decides to secure a profit, the ETH can slide to $4,200 or $4,000. Such decline weakens bullish papers and opens the door to consolidation rather than continuation of the current uptrend.

Ethereum Price is aiming for $5,000 as its exchange balance fell to its lowest level in nine years.