Ethereum’s price has fallen sharply in recent trading, shaking investor confidence across the market. $ETH It has lost significant value in a short period of time, intensifying fear-based reactions.

Many investors have now changed their stance and are increasing selling pressure on the altcoin king. Such actions could extend the decline, but they could also create conditions for a healthier long-term recovery.

Ethereum holders go back to not buying

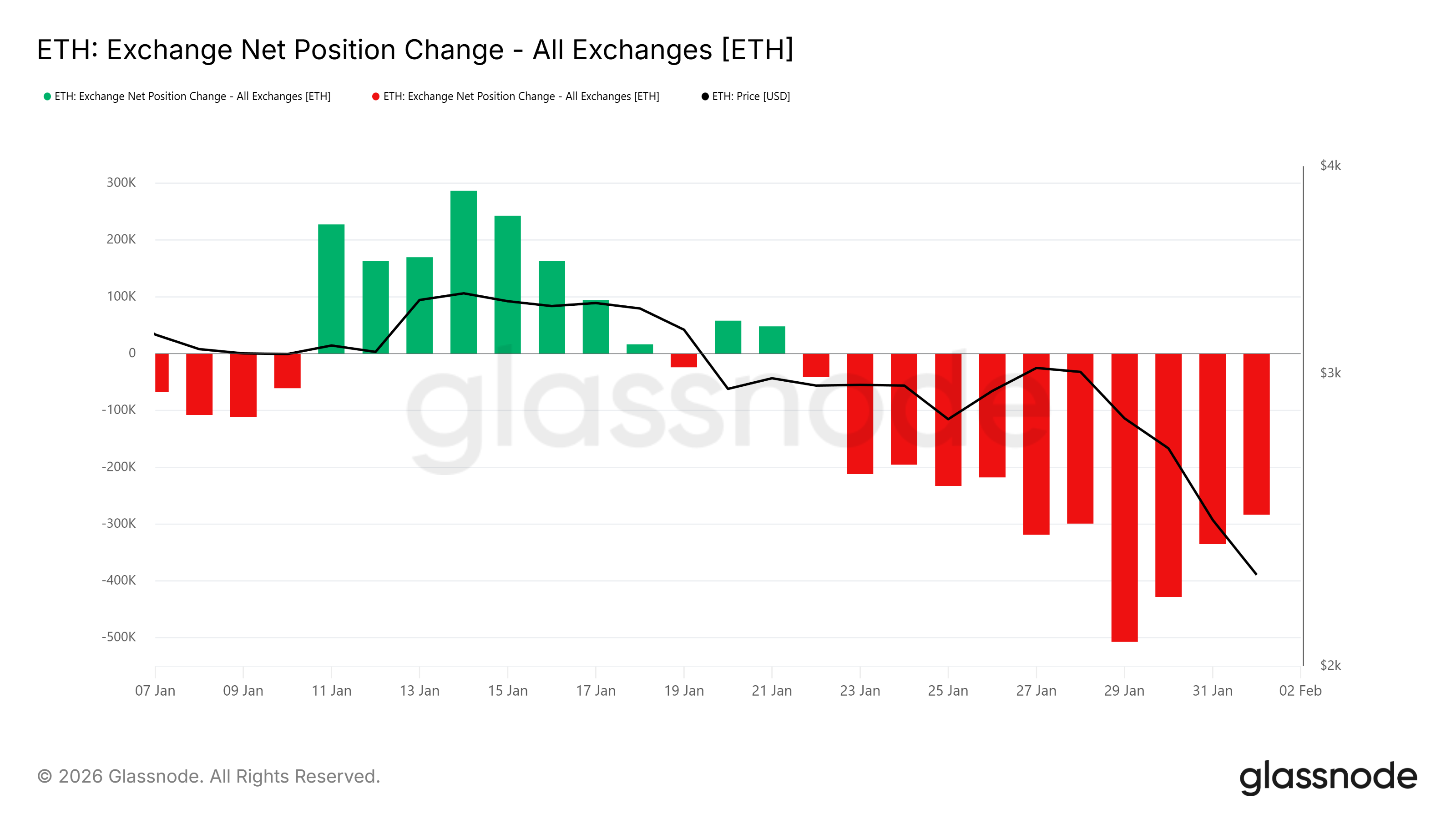

Recent on-chain data highlights a notable shift in market sentiment. Changes in the exchange’s net position indicate that the buying momentum built over the past two weeks is fading. The red bar tracking net inflows has been steadily shrinking. This decline indicates that active accumulation is slowing down.

Once buying pressure subsides, selling momentum often continues. Investors who entered earlier may begin to close out their positions to limit their losses. This transition usually affects price fluctuations. In the case of Ethereum, a drop in demand increases the likelihood of further declines before stabilization returns.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Changes in net positions on the Ethereum exchange. Source: Glassnode

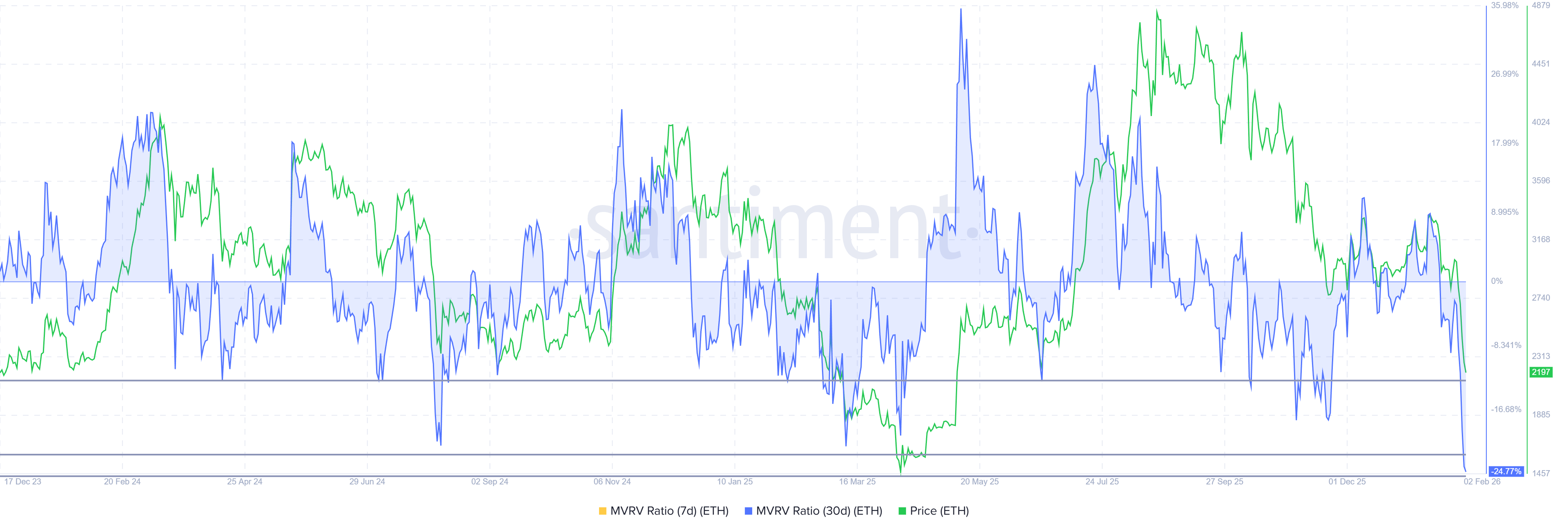

Despite short-term weakness, macro indicators point to a more constructive outlook. Ethereum’s market value to realized value ratio has entered the opportunity zone. This range of -12% to -24% historically indicates periods of sell-off.

In the previous cycle, $ETH Immediately after MVRV entered this zone, a price reversal followed. Saturation of losses prevents further selling to avoid investors perceiving deeper drawdowns. Accumulation often resumes during these phases. Ethereum could benefit from similar dynamics as a peak in selling pressure.

Ethereum MVRV ratio. Source: Santiment

$ETH Price likely to fall to $2,000

Ethereum is trading around $2,211 at the time of writing, just above the $2,205 support level. The asset remains under pressure, having fallen 27% over the past five days. Current momentum suggests further downside risks remain high.

$ETH The stock is 9.2% away from falling below $2,000. Given the weakening buying momentum and heightened caution, it seems likely that the price will move towards this level. Although bearish in the short term, such a decline could attract value-conscious investors. Low prices often encourage accumulation among long-term participants.

$ETH price analysis. “>

$ETH price analysis. “>

$ETH Price analysis. Source: TradingView

The rebound scenario depends on new demand near major supports. Ethereum could recover to current levels if investors take advantage of the discount. This move would mark the beginning of a reversal-driven recovery. However, there are risks if bearish momentum continues. Unstable and may be sent $ETH We will delay any sustained rebound below $1,796.

The article “Ethereum price is 10% away from dropping below $2,000, but there are signs of hope” appeared first on BeInCrypto.