Ethereum (ETH) has seen a continuous setback recently with weaker price performance and almost bullish momentum, but is now attracting renewed interest from major institutions. This Ethereum News was founded to push the bears in the market.

Retail investors have moved to faster, more affordable alternatives like Solana ($sol) and bases, but larger institutions are confident in Ethereum. This trend shows that Ethereum remains a key player in managing key real-world assets (RWAS).

The role of Ethereum in institutional investments

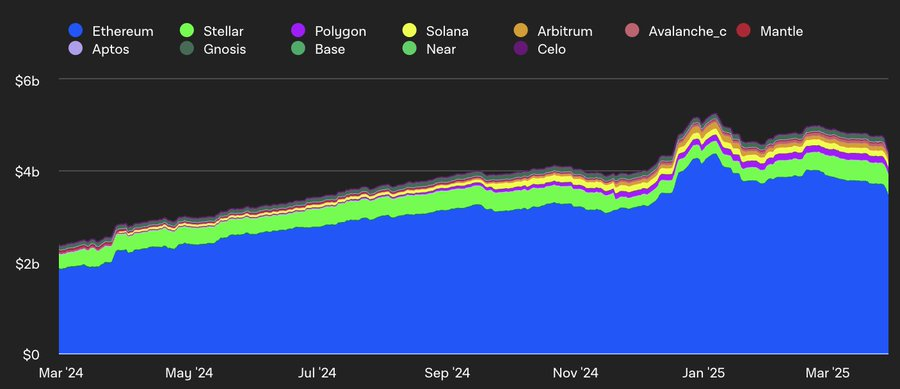

The importance of Ethereum in the financial world is clear. Currently, over 53% of all real-world assets are held on the Ethereum blockchain. Considering Layer 2 solutions, this percentage increases to 75%.

Renowned financial institutions such as Franklin Templeton and BlackRock have launched Ethereum-based funds, and BlackRock has worked with regulators to speed up the tokenization of assets.

Source: x

The appeal of Ethereum to these agencies lies in its reliability, security and strong infrastructure. These entities prioritize clear regulations, liquidity, robust systems and quality that Ethereum offers.

While not the most affordable or fastest blockchain for individual investors, Ethereum offers unparalleled security and trust in large-scale financial operations, making it a platform of choice for institutional players.

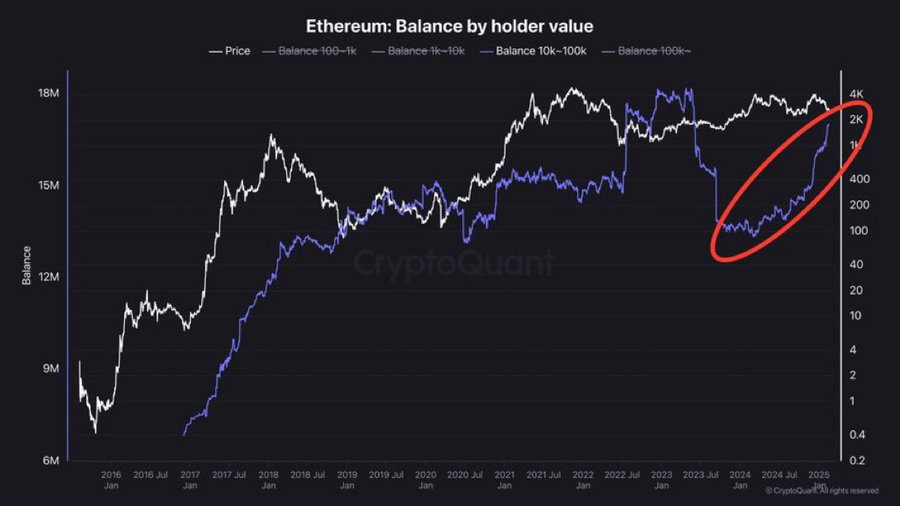

News: Whale accumulation shows the growing value of Ethereum

Ethereum has come back to value and builds confidence as whales buy it. According to market analyst Crypto_Goos, Ethereum is currently undervalued, and large owners are taking advantage of the opportunity.

As trading activity increases, Ethereum prices are constantly rising. Whales buying ETH at an increasing rate explain that they expect blockchain to increase in value.

Source: x

Whales tend to understand market trends and generally ahead of the major trends. Given that their current accumulation could be a signal that Ethereum prices are set to rise in light of demand from both institutional and retail investors.

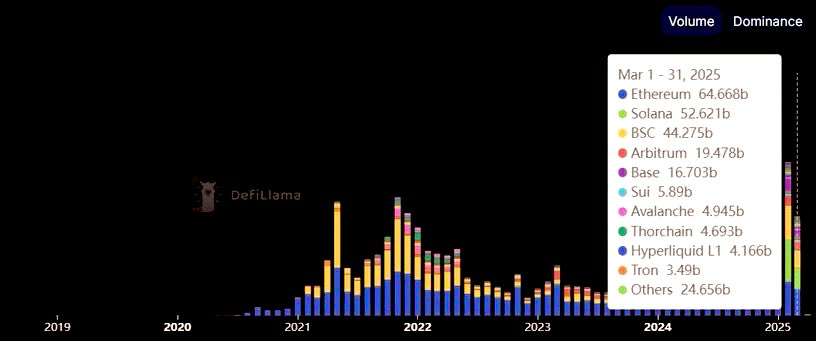

Ethereum News: Ethereum surpasses Solana in Dex Trading

Ethereum has regained its position as a leader in distributed exchange (DEX) trading, surpassing Solana for the first time since September 2024.

The increased demand for Defi Solutions further strengthens Ethereum’s control in the market.

Source: x

The growth of DEX trading is also the result of continued development of Ethereum layer 2 solutions.

Owning these improvements should allow you to sell Ethereum at lower transaction costs and speed up transactions, allowing you to maintain the appeal of your institutional users while making Ethereum more suitable for retail investors.

In other words, Ethereum is poised to become a leader in the decentralized financial sector with greater scale and liquidity.

Ethereum Technical Analysis

Currently, the RSI (14) is at 41.98 just below the neutral 50 level, and I have Ethereum sold, but it’s above the 30 level so it’s not an extreme level. These measurements could cause Ethereum to surge, but the larger Ethereum News story seems low for now.

One day Ethereum trading chart. Source Trading View

The CVD indicator is positive at 38.68K, meaning that the purchase pressure is higher than the sales pressure. This indicates an increase in current demand and can support price growth if the trend continues.

However, the MACD line is below the signal line. This suggests that a more downside is expected unless there is a bearish short-term momentum and a bullish crossover.

.