Ethereum has been experiencing a challenging month, with its price approaching a 17-month low at $1,802 at the time of writing. Despite this continued downtrend, it has sent ETH into the bare market, but key investors remain optimistic.

As Ethereum approaches these critical levels, many market participants believe that price rebounds may be on the horizon.

Ethereum investors are taking advantage of low prices

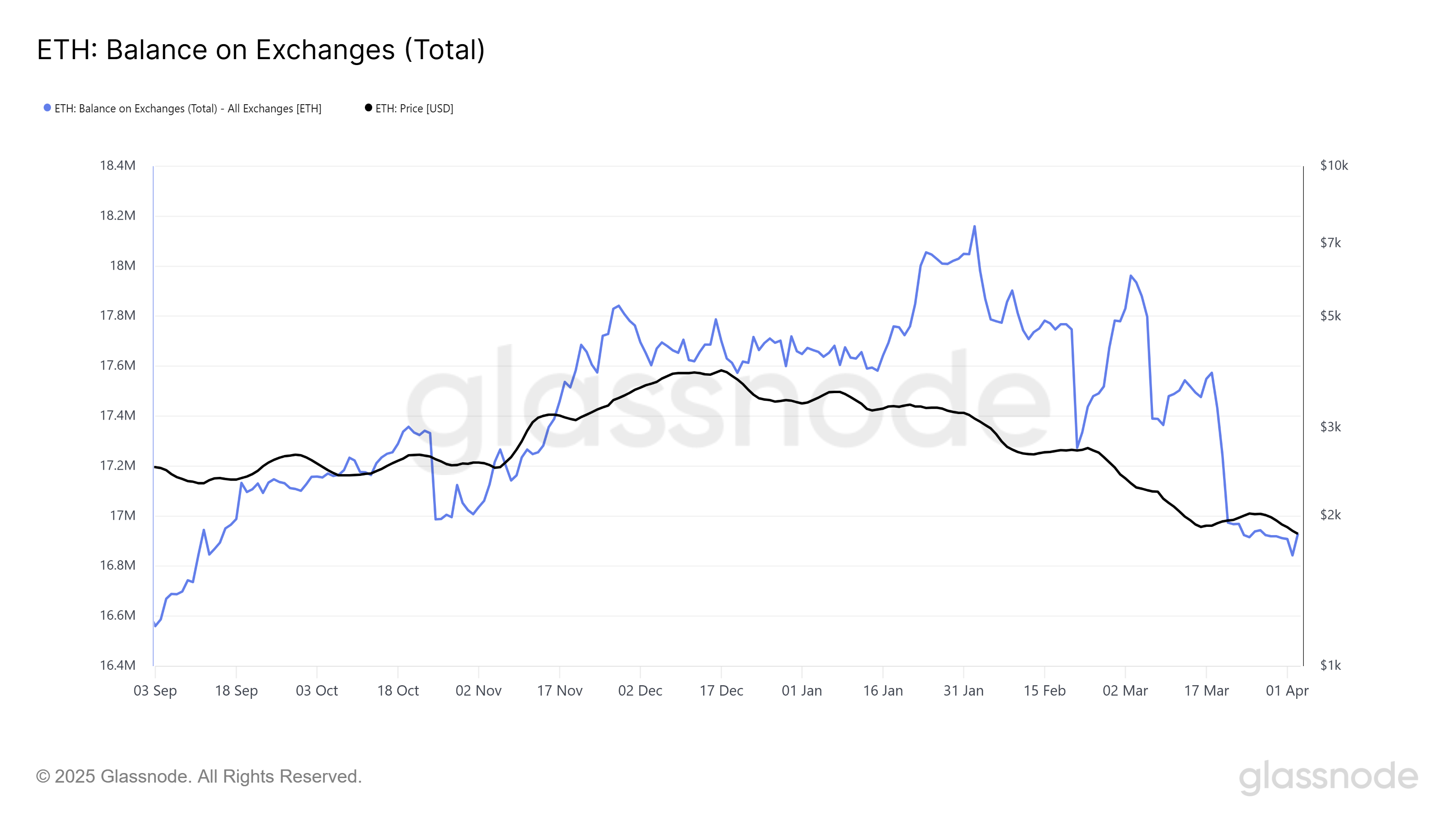

Ethereum’s exchange supply has fallen to a six-month low, indicating investors are increasingly holding assets from the market. This decline in exchange supply is often seen as a sign of bullishness as it suggests that long-term holders (LTHs) accumulate more ETH at these low price levels and predict future price increases.

These investors are unwilling to sell and show strong belief in the long-term value of Ethereum. A decrease in exchange balance also indicates less short-term trading activity. This suggests that many investors are waiting for the price to rebound before they move.

Supply of Ethereum on the exchange. Source: GlassNode

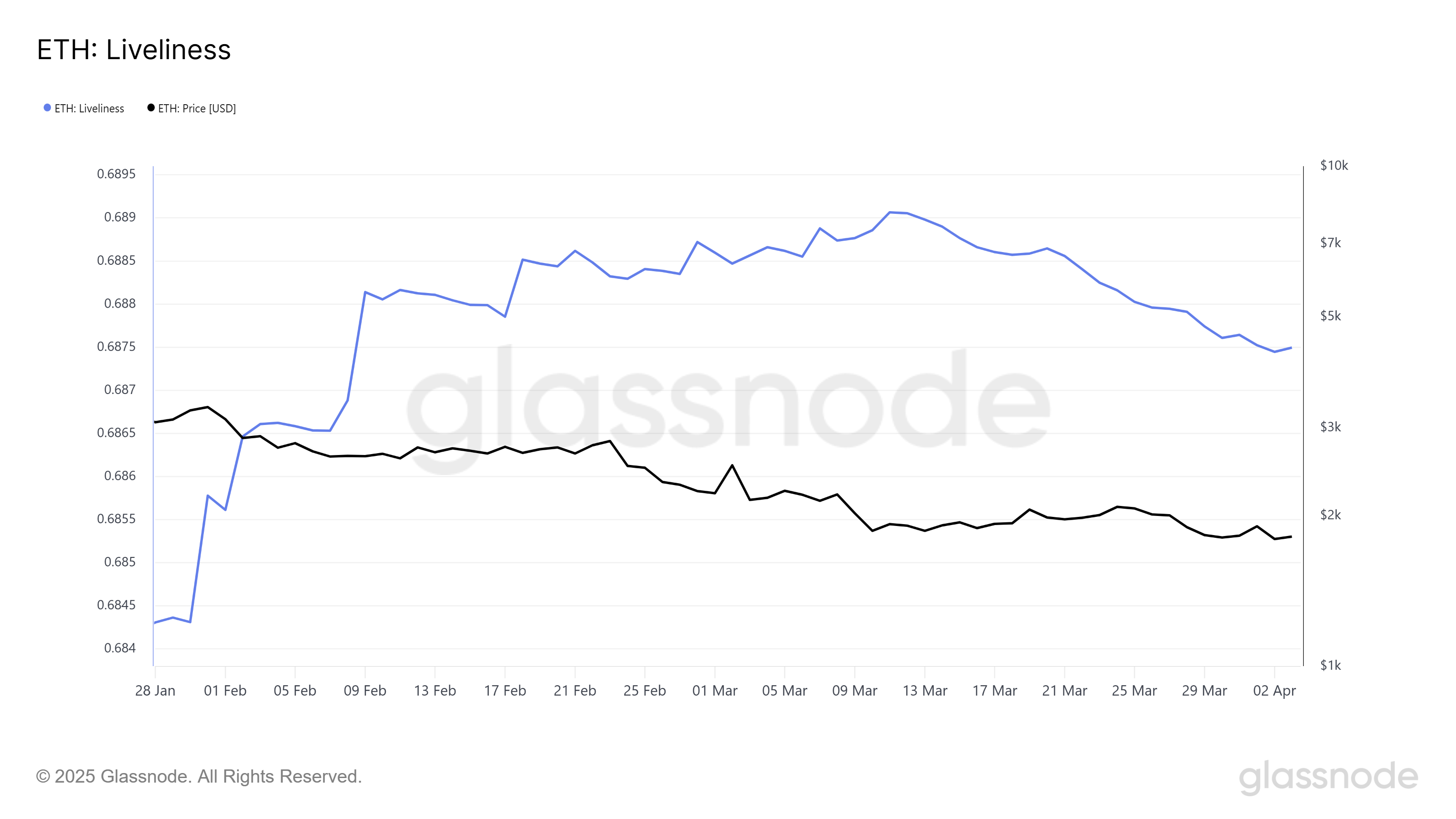

Over the past month, Ethereum’s vibrancy indicators have declined, indicating a weakening of sales pressure. Vitality measures long-term holder activity, while decline indicates accumulation rather than selling to the public.

The decline reflects growing sentiment among long-term Ethereum investors, who hope to increase their holdings and recover future prices. The decline in vibrancy suggests that many people are confident in the foundations of Ethereum and are less concerned about short-term fluctuations.

This accumulation stage suggests that market sentiment in Ethereum may be changing. LTHS trust, which has a major impact on asset prices, can lead to strong upward momentum as market conditions improve.

The vibrancy of Ethereum. Source: GlassNode

ETH prices require nudges

Ethereum is currently trading at $1,802 just below the $1,862 resistance level. Prices have been stuck under this barrier for six weeks and continue the downtrend, which defines many of the recent price measures. However, if Ethereum exceeds $1,862, it could indicate the end of the downtrend and the start of a price recovery.

Given current market sentiment and accumulation by key owners, Ethereum could continue to gain upward momentum. If Ethereum successfully infiltrated the $1,862 resistance, it could move towards the $2,000 mark, recouping some of the losses from past weeks.

Ethereum price analysis. Source: TradingView

Meanwhile, if bearish sentiment intensifies, Ethereum prices could drop even further to a 17-month low of $1,745. Failure to secure support at this level can lead to even greater losses. This could extend the recent downward trend and expose many investors to a long-term bear market.