Ethereum has failed to regain momentum after falling 15.8% earlier this month. The king of altcoins continues to struggle with weak recovery signals and is trading sideways as investors cautiously adjust their positions.

Although selling pressure has eased, Ethereum’s price recovery remains limited due to market-wide headwinds.

Ethereum investor selling recedes

Data from the exchange’s Net Position Change Indicator shows that Ethereum outflows have been gradually decreasing over the past few days. This trend suggests investors are slowing down their selling activity, which could favor potential stability in prices.

A consistent decline in currency outflows typically reflects a cooling in bearish sentiment among traders. However, the current stage represents a pause rather than a reversal. The decline in sales volumes has not yet led to significant accumulation, which is an important condition for a sustained recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Changes in net positions on the Ethereum exchange. Source: Glassnode

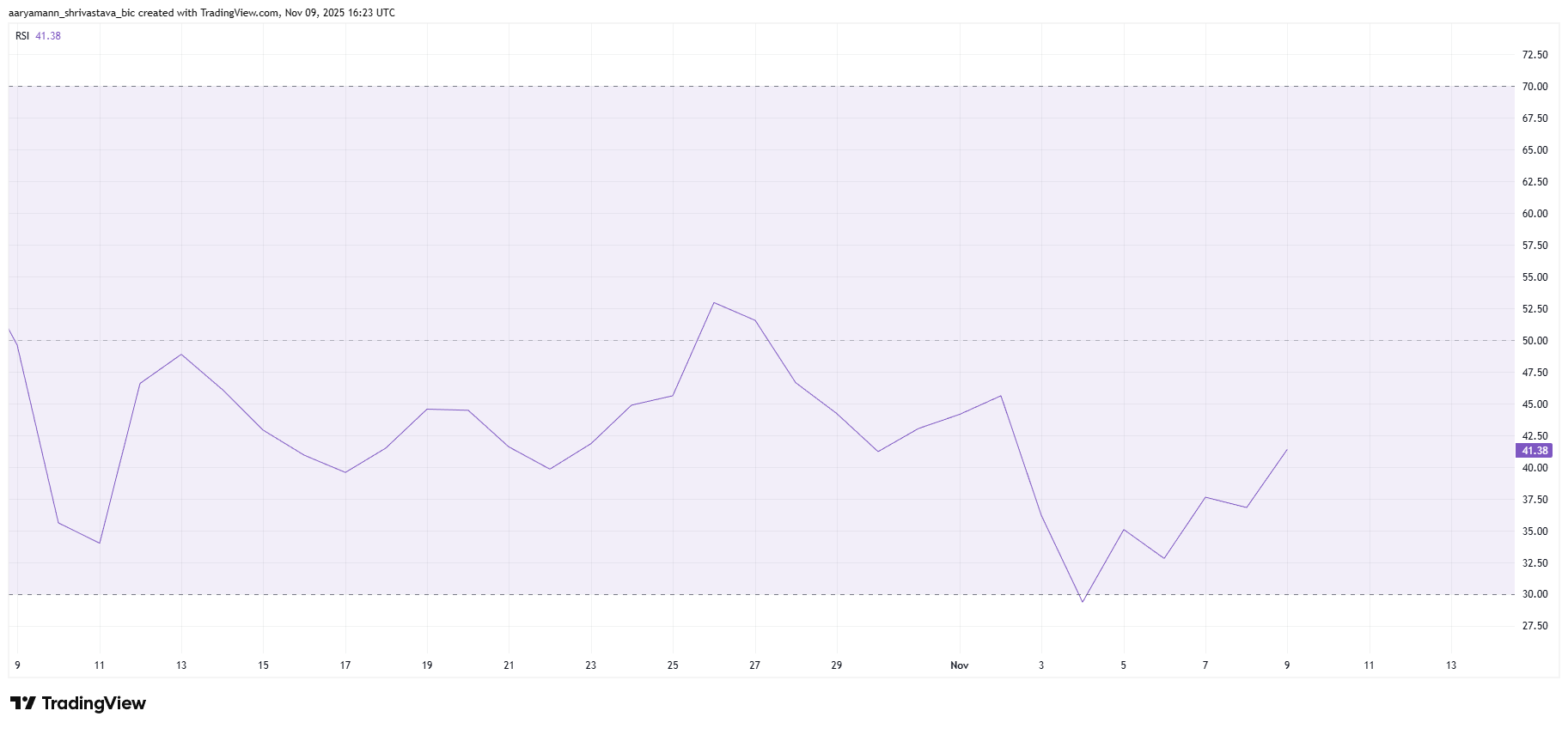

The Relative Strength Index (RSI) provides a cautious indication of Ethereum’s momentum. The indicator remains below the neutral 50 mark, indicating sustained bearish pressure despite a slight rebound from oversold conditions. This suggests that sellers still have the upper hand and the path to ETH recovery remains uncertain.

For Ethereum to regain bullish momentum, the RSI needs to rise above 50 and sustain higher values. Such developments signal renewed investor confidence and increased purchasing activity, which could fuel a price recovery.

ETH RSI. Source: TradingView

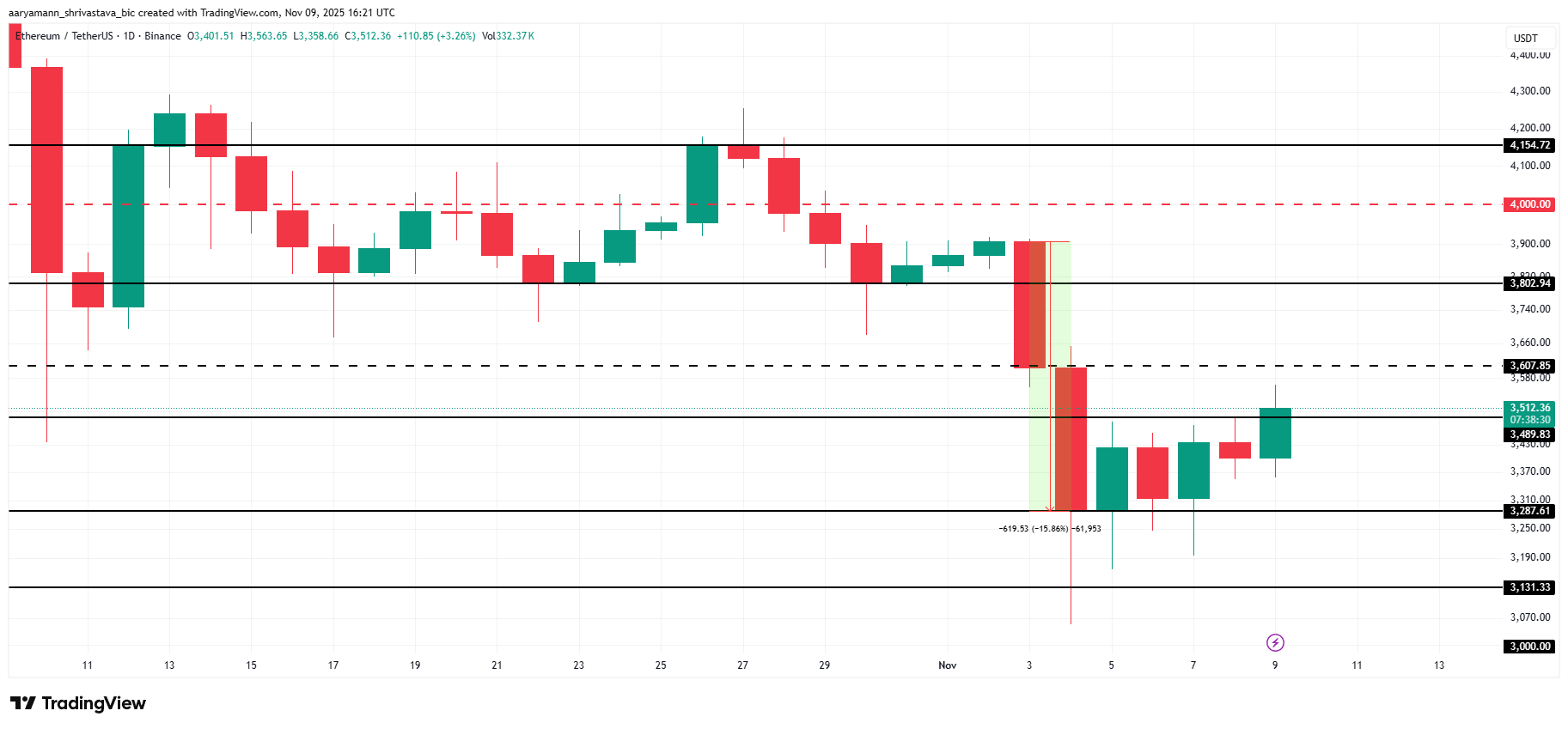

ETH price may eventually consolidate

Ethereum is trading at $3,512 and remains just above the $3,489 support level after recent volatility. Despite the slight improvement, the king of altcoins remains below a key resistance level and is struggling to fully recover from this month’s 15.8% drop.

To confirm a trend change, ETH price needs to break through the $3,607 resistance. Current indicators suggest continued consolidation within the $3,489 to $3,287 range as momentum remains neutral.

ETH price analysis. Source: TradingView

If market conditions improve next week, Ethereum could rebound and retest $3,607. A successful breakout could push the price towards $3,802. This would indicate new bullish strength and invalidate the current bearish outlook.

The post “Ethereum Investors Sell Reversely, but Price Still Faces Problem” was first published on BeInCrypto.