On Thursday, June 19, the Crypto market experienced low-volatility trading as investors projected FUD (fear, uncertainty, doubt) surrounding geopolitical tensions in the Middle East. Ethereum prices are above the $2,500 level, demonstrating the sentiment of this market with the formation of candles neutral to the daily chart. However, net-based high-end investors remained shaky at this integration and continue to show a positive accumulation trend.

Ethereum is ready to turn around in whale buying

Over the past week, Ethereum prices have plummeted from a few months high to current trading value of $2,880 to $2,534, marking a 12% decline. This bearish trend followed primarily a wider market decline amid escalating military action in the Middle East.

Despite the possibility of further downfall, on-chain data highlights the updated accumulation from ETH whales. According to blockchain tracker SpotonChain, the whales at major establishments have spent more than $220 million at USDC over the past week obtaining 85,465 ETH through OTC transactions with WinterMute and Coinbase.

ETH Whale Activities | SpotonChain

Earlier today, the whales purchased an additional 15,000 ETH at an average price of $2,477, at $37.16 million. Despite facing a floating loss of $4.97 million (-2.25%), investors still hold USDC of $112.94 million on Aave and bet entirely on 85,465 ETH on Lido, indicating long-term confidence in Ethereum’s growth.

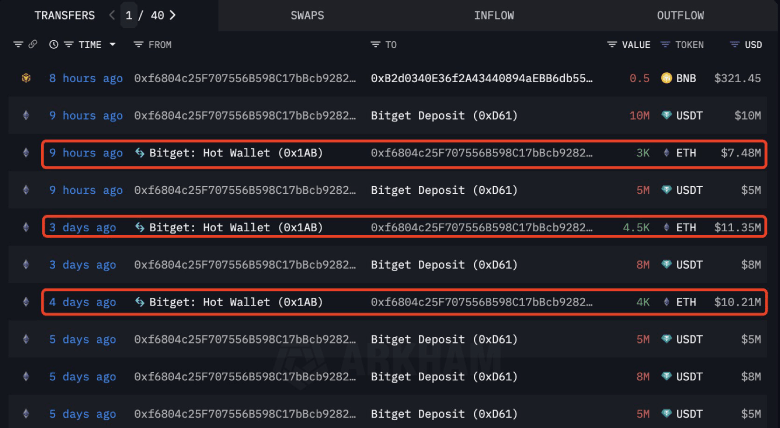

In parallel, another crypto whale “0xf680”, which works under a wallet address, purchased 3,000 ETH (worth about $7.48 million) nine hours before the report by Lookonchain.

Lookonchain

Historically, this trend of whales accumulation has coincided with the bottom of major markets emerging as a potential signal for bullish reversal.

An inverted head and shoulder pattern could push ETH up to a $3,000 breakout

Ethereum’s daily chart analysis shows that its prices range from $2,400 to $2,850, reflecting market uncertainty.

Despite the uncertainty, this integration revealed the formation of a well-known reversal pattern known as the inverse head and shoulder. The characteristics of the chart setup are characterized by three troughs. A start drop on the left shoulder and a major dip called the head followed by a new recovery with a temporary pullback as the right shoulder.

Currently, Ethereum prices show long tail rejection candles at a support level of $2,500, indicating unharmed dip emotion among market participants. If the pattern applies, the coin price can bounce back 13.5% and challenge the neckline, potentially violating and indicating a change in market direction, as indicated by the $2,870 addition.

ETH/USDT – 1D Chart

A post-breakout strategy could push assets up by an additional 35% and reach the $3,900 mark.

On the contrary, buyer returns integration could be extended to July if sellers continue to define overhead resistance at $2,860.

Also Read: Trump may take action to end Iran’s nuclear enrichment: JD Vance