Ethereum demonstrated evidence of new momentum this week as it reversed after slow network activity and price action. The second largest cryptocurrency has finally broken through key price ranges that had limited progress for over a week.

Active addresses increase by almost 10%

According to statistics from Cryptoquant analyst Carmelo Alemán, Ethereum’s network experienced a significant increase in user activity between April 20th and April 22nd.

Active addresses have increased from about 306,000 to over 336,000 over the last three days, up nearly 10%. According to Aleman, the network just gets “hot.”

Ethereum is getting hot!

“Ethereum’s active address jumps from 306,211 to 336,366, representing a 9.85% increase in just 48 hours” – @oro_crypto

Read the complete analysis

– cryptoquant.com (@cryptoquant_com) April 23, 2025

This crazy activity at the address usually indicates a change in the market mood and an increasing interest among investors. Market analysts often consider such increases as an early indicator of price movements when they are primarily consistent with price increases.

Prices run along with great resistance

The price of Ethereum ultimately surpassed this resistance area, continuing to defend the struggle of over $1,640, which was achieved since April. Over $1,780, the coin defeated the confinement left behind by the assertive green daily candle.

For the first time in recent history, buyers appear to be on the central stage of the market. Prices are currently read as above for both the 10-day and 20-day moving averages, indicating short-term intensity.

The relative strength index is just above the 50 line, showing bullish momentum without getting close to excess zones.

Technical indicators present mixed signals

Some indicators show great momentum, but they are all not perfectly aligned. Moving average convergence/divergence begins to synthesize early, predictive reversals of trends with slightly positive numbers.

At the same time, the stochastic RSI approaches the upper limit of its range.

According to price forecasts, Ethereum fell 6.50% on May 24, 2025 to $1,652. Technical analysis shows a bearish trend, with the Fear & Greed Index being 64, placing market sentiment in the “greed” zone.

Last month, Ethereum was green on a green day (12 out of 30 days), and Coincodex data showed that green days were 9.26% and 9.26%.

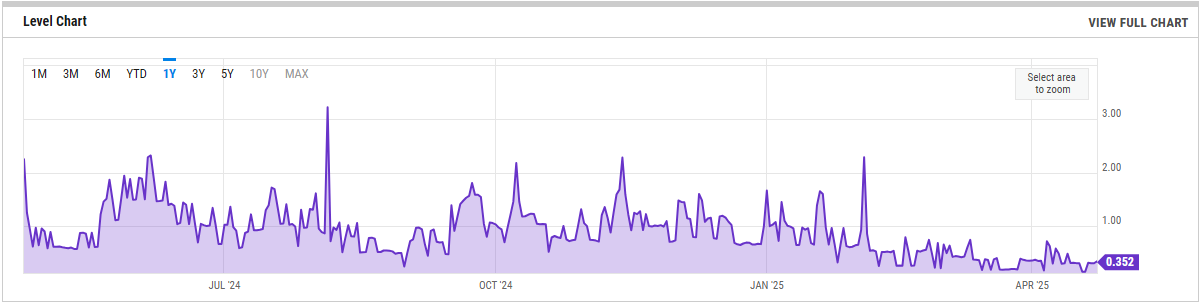

Despite price movements, network usage remains low

One of the confounding things about the current state of Ethereum is the difference between price action and the use of real-world networks. Based on YCHARTS data, transaction fees are unusually low at around $0.31 on average. Low prices indicate that, despite the inexpensive use of the network, on-chain demand is still lacking.

Despite this conflicting indication, the combination of increased active addresses and ETH retention positions above previous resistance levels enhanced the short-term picture.

As momentum continues, market strategists are keeping an eye on whether Ethereum can charge in the direction of a psychologically significant $2,000 price level.

Fandom featured images, TradingView charts