Ethereum price has fallen by nearly 11.5% in the past 24 hours. It has since recovered about 2.5% and is currently trading above $3,230. Still, the 24-hour ticker still shows a decline of nearly 6%.

However, the corrective move has etched a bullish reversal pattern on the chart, but the question is whether it will last while large holders continue to pull back.

Whale activity continues to show weakness despite reversal pattern

Ethereum has formed a bullish harami on the daily chart. This pattern occurs when there is a small green candle inside the body of the previous day’s large red candle. It often indicates that selling pressure is easing and buyers are trying to take back control.

A similar setup appeared on November 5th, but the rally failed as buying power quickly waned. This failure puts more emphasis on the current pattern and whether buyers can maintain the momentum this time around.

Bullish Pattern Identified: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

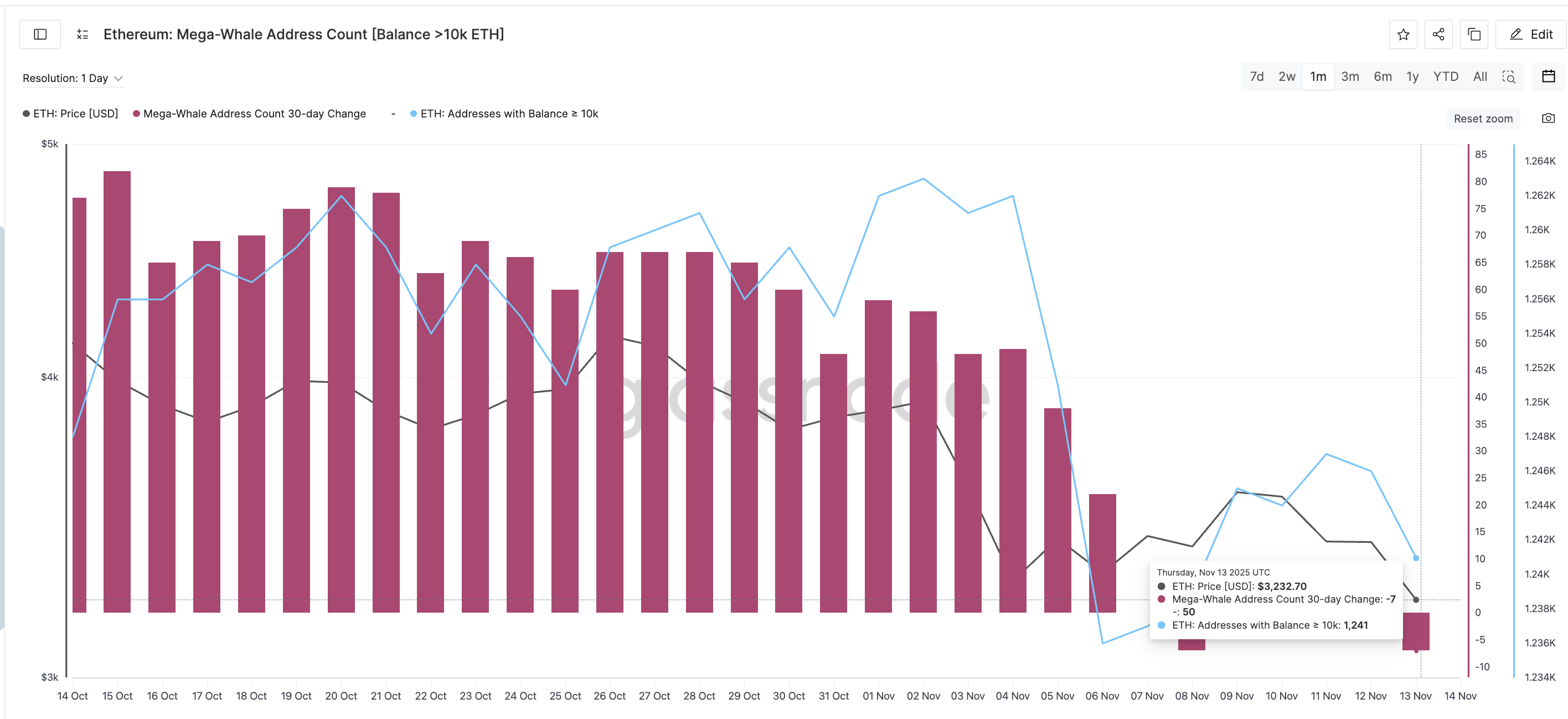

The pressure comes from the whales’ behavior. The number of mega whale addresses that track 30-day changes in wallets holding more than 10,000 ETH has decreased again. It has now returned to the same negative level as on November 8th.

The number of addresses holding 10,000 ETH has also decreased since November 2nd. There was a brief recovery between November 6 and 11, but the decline returned soon after. This decrease in holdings coincided with a bearish crossover in Ethereum, a risk we highlighted earlier.

Mega ETH whales are not convinced: Glassnode

Therefore, even though the bullish Harami is active, the whales are not yet supporting the move. Therefore, Ethereum’s price reversal setup remains weaker than seen on the chart.

Key levels now determine whether Ethereum price reversal expands or contracts

If the bullish pattern holds, Ethereum’s next test will be near $3,333, making this week’s rebound limited to short-term levels. We will discuss this level later when we discuss the Ethereum price chart.

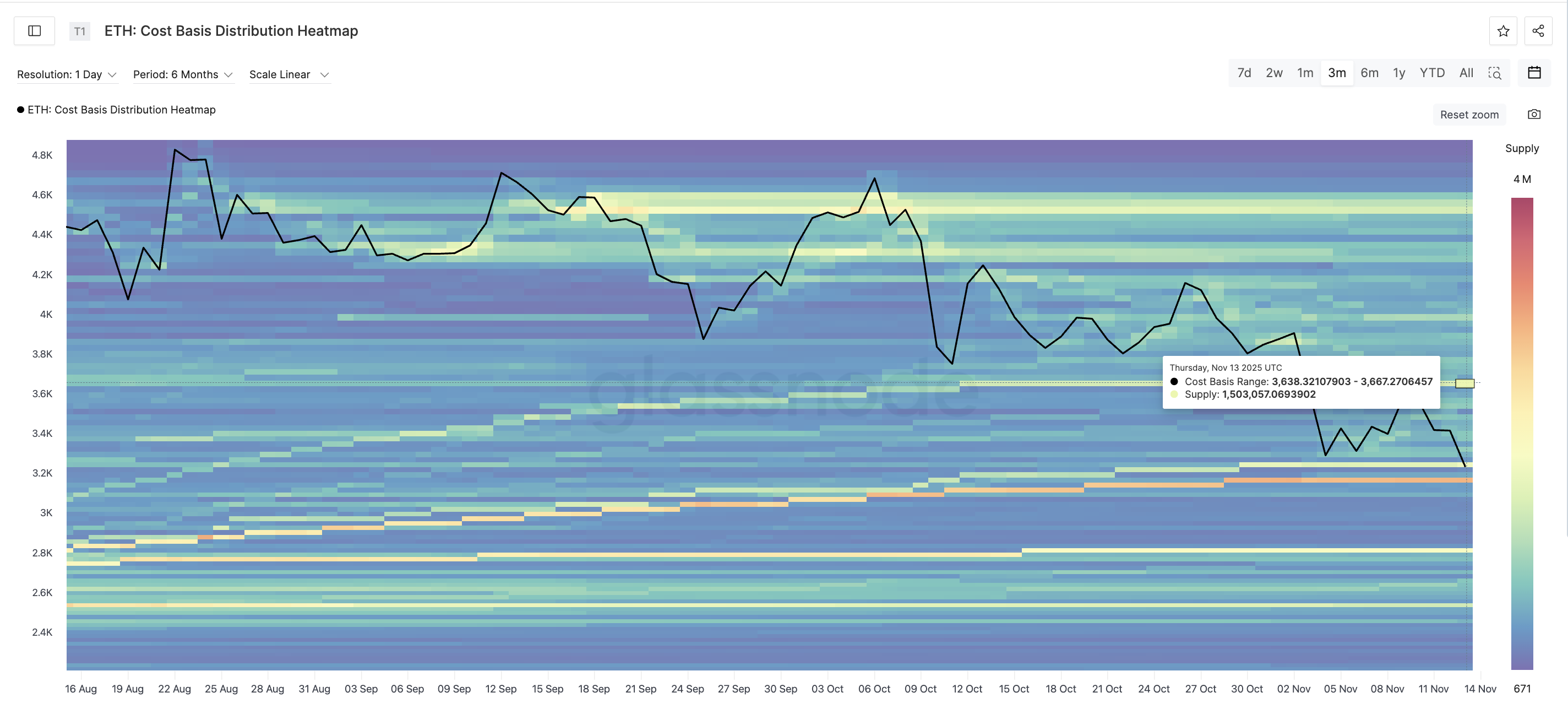

A stronger hurdle is $3,650, which requires a 12% upside from recent lows. Data from the Cost-Based Distribution Heatmap, a tool that maps where large amounts of ETH last traded, shows that $3,638 to $3,667 holds one of the largest supply zones.

Ethereum supply cluster: Glassnode

It contains over 1.5 million ETH, so liquidating it would demonstrate strong commitment from the buyer. This is why the $3,650 level becomes increasingly important.

A close above this band would confirm that the bullish Harami is working and could signal the start of a broader recovery. However, the pattern weakens quickly once Ethereum price loses support around $3,150.

Ethereum Price Analysis: TradingView

A sharp decline below $3,050 would invalidate the structure and allow sellers to push higher lows, repeating what happened after the Harami failure earlier this month.

The article Ethereum Flashes Reversal Setup – Now Just Needs a ‘Mega’ Confirmation appeared first on BeInCrypto.