After regaining a level of $3,600 in a sharp two-day recovery, today’s Ethereum price is held nearly $3,634.40. However, the rebound stagnated at nearly $3,720, with ETH encountering both a Bollinger Band Resistance and a 20 EMA Cap. With on-chain spill installation and daytime momentum softens, traders are checking if ETH can hold a support zone of between $3,590 and $3,624.

Ethereum price forecast table: August 6, 2025

What will be the price of Ethereum?

ETH Price Dynamics (Source: TradingView)

On the 4-hour chart, Ethereum Price Action shows clean bounces under $3,400, supported by a dynamic cluster of EMAs (100 EMA for $3,576, 200 EMA for $3,360). The bullish movement regained Bollinger’s midline, but lost steam at the upper band boundary.

ETH Price Dynamics (Source: TradingView)

The short-term trend has shifted positively, but Bollinger bands are beginning to approach current prices, indicating compression and indecisiveness. Meanwhile, SuperTrend is once again bullish, with support currently seen at $3,497, but the candles are still trading above this level.

ETH Price Dynamics (Source: TradingView)

However, the 30-minute RSI slips to 43.73, has signaling fading strength and hoveres at a VWAP baseline priced at nearly $3,634. The DMI indicator also shows a decrease in directional momentum, with ADX dropping to 19, and +DI returning under DI, reflecting early weaknesses after the rally.

Why are Ethereum prices falling today?

Today, the price of Ethereum is falling due to both technical rejection and intense profits. The $3,720-$3,735 band represents the previous distribution zone since late July, and today’s candles did not break past this resistance despite a strong bullish core.

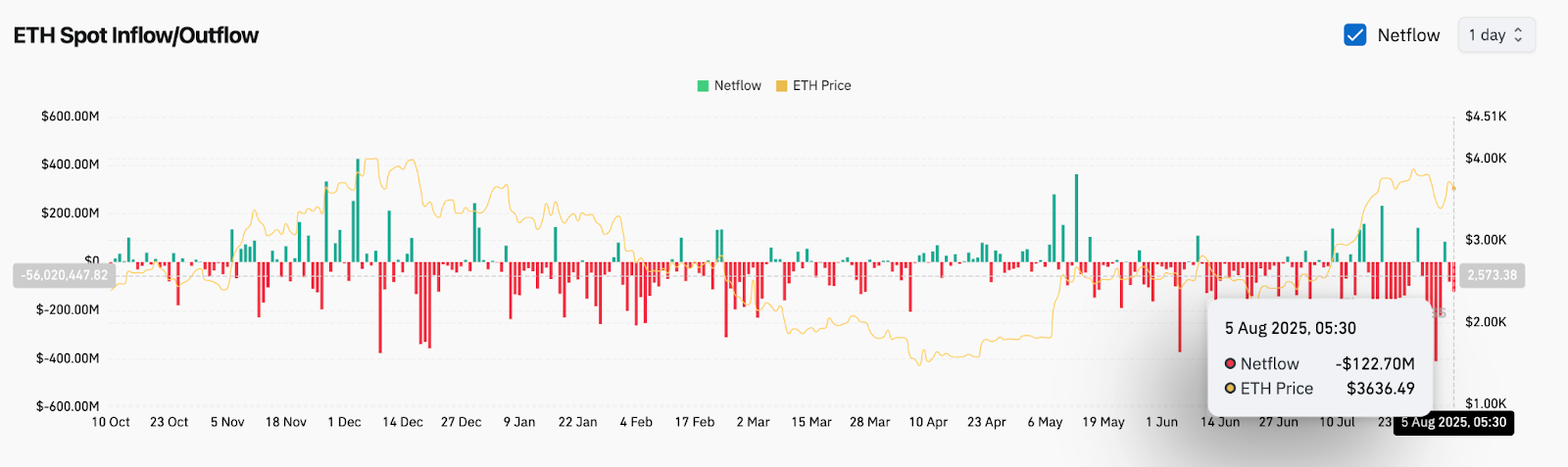

ETH Netflow data (source: Coinglass)

On the spot market side, Coinglass Netflow data has shown $122.7 million outflows in the last 24 hours, the highest in nearly three weeks. This spill in this spill signal an increase in exchange sales pressure, particularly after a 15% rally from a $3,200 base in July.

ETH Price Dynamics (Source: TradingView)

The monthly chart also reveals that ETH is struggling at $3,496.72 near the 0.236 Fibonacci Retracement. This is the zone that has caused multiple rejections since late 2021.

Important levels and chart structure to monitor

ETH Price Dynamics (Source: TradingView)

From a daily standpoint, Ethereum prices remain structurally bullish after surpassing the July falling wedge pattern. However, the rise in the support trendline connecting the May and July lows is located near $3,400.

In the 4-hour view, prices are currently pinned between major EMA levels. The 20 and 50 EMAs ($3,594 and $3,624) offer immediate support, with the 100 EMAs just below at $3,576. Below this, the next important support is $3,360 near the 200 EMA, which is closer to the previous breakout area.

The VWAP channel tightens at around $3,660 and $3,687. If ETH is unable to recover beyond $3,660 in the next few sessions, the seller may push towards a liquidity pocket of between $3,500 and $3,520.

ETH Price Forecast: Short-term Outlook (24 hours)

If Ethereum prices exceed the $3,590-$3,624 range, there remains another upward attempt range for $3,720. A clean break beyond that level, paired with a bullish RSI and MacD cross, was able to pave the way for $3,850 and then $4,000.

On the downside, if it falls below $3,576, it triggers a deeper test of the 200 EMA zone, close to $3,360. This will override the short-term bullish structure and risk ETH returning to trendline support of $3,200.

If negative Netflows cause impairment in momentum metrics, the next 24 hours will be extremely important. A breakout above $3,720 or a breakdown below $3,576 could define Ethereum’s next move.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.