After multiple weeks of rallying that raised Ethereum prices towards a $4,000 psychological barrier, the bear re-emerged and forced ETH under major short-term support. With lower spills and rising spills of momentum, Ethereum prices today stand at $3,630, wobbling near the lower limit of the main ascent channel.

What will be the price of Ethereum?

ETH Price Dynamics (Source: TradingView)

In the four-hour time frame, Ethereum price action is broken under the midline of the rising channel, and is currently testing the lower limit of nearly $3,625. The Supertrend has turned the bears upside down at $3,899, suggesting that momentum has moved to sellers for the first time since mid-July. The -DI line of the DMI indicator is spiked to 30.4, and the +DI drops to 11.0, confirming the dominant downward pressure.

ETH Price Dynamics (Source: TradingView)

Daily charts reveal a wider structural view. After breaking past nearly $3,940 on July 29, Ethereum returned to the $3,600 zone and responded sharply to the supply they encountered around the $3,900-$4,000 resistance band. Historical fluidity from the April 2024 range remains close to this level, adding more headwinds towards the headwinds.

Why are Ethereum prices falling today?

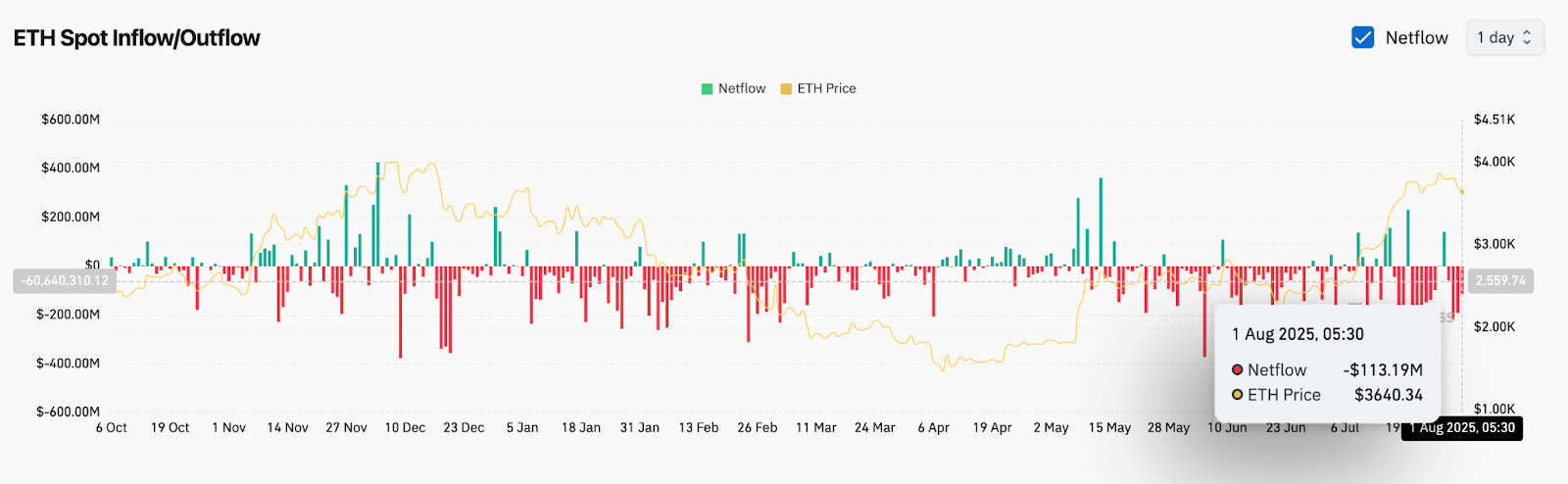

ETH Spot Inflow/Outflow (Source: Coinglass)

The current weakness of Ethereum prices stems from both technical fatigue and worsening inflow dynamics. On-chain data shows that on August 1, it recorded a net outflow of $113.19 million, suggesting that exchange withdrawals will rise and buyer profits will decline.

ETH Price Dynamics (Source: TradingView)

Short term metrics check the retreat. On the 30-minute chart, the RSI has dropped to 30.9, approaching overselling territory, while MACD is very negative with the expansion of histogram bar. This coincides with failed attempts to hold over $3,700 early in the session.

ETH Price Dynamics (Source: TradingView)

In the four-hour Bollinger band, ETH breaks under the median band at $3,784 and heads towards the lower band at $3,665. At the same time, EMA ribbons are beginning to compress, with prices currently below 20, 50, and 100 EMA, weakening the reliability of the trend.

Super Trend Flip and Weekly Supply Zone Weights are on the Bull

ETH Price Dynamics (Source: TradingView)

On the weekly charts, Ethereum prices encounter resistance near major Smart Money Concept (SMC) supply blocks between $3,900 and $4,500. This red zone was previously marked by the market structural shift in late 2021 and now serves as a macro ceiling.

Despite the recent bullish BOS in July, ETH is stagnant in this overhead zone. Parabolic SAR dots are beginning to narrow, and prices have not been able to establish new weekly highs after last week’s push. Unless buyers get back $3,900 immediately, the risk of a reversal increases as facility supply is absorbed.

ETH Price Forecast: Short-term Outlook (24 hours)

Looking ahead, if today’s Ethereum price loses its $3,600 handle, the Bears will target the next dynamic support zone at $3,594 (100 EMA in 4 hours), followed by $3,307 (200 EMA). This will show you a deeper breakout-based retest for June.

The advantage is that recovery above $3,700 may provide early relief. However, ETH should bring the supertrend level closer to $3,784 (Bollinger’s median band) and $3,899 to recover short-term bullish bias. Without this recall, Ethereum will remain exposed to further drawdowns.

Traders should also focus on the volume spikes and RSI divergence of 1H or 4H charts for local bottom formation cues. A flash towards $3,500 could induce profits for short-term buyers, but at current levels it remains a confirmation.

Ethereum price forecast table: August 2, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.