Today’s Ethereum price is around $4,280. It’s up 1.3% since the last session, but is still below the $4,355 resistance level. ETH hit a high of around $4,792 earlier this month, but has since fallen within the downward channel. Sellers protect supply bands ranging from $4,400 to $4,450. The Bulls need to show strength by regaining this area. Otherwise, you risk dropping to another $4,100.

Ethereum price forecast table: August 23, 2025

What will be the price of Ethereum?

ETH Price Dynamics (Source: TradingView)

ETH’s daily chart shows the series of powerful structures that have pushed prices to $4,700 from $2,000 in April. However, recent candles show character changes (Choch), with fluidity moving and weak formations of nearly $4,750. The nearest demand zone is between $3,500 and $3,600. This means that if the bearish trend continues, this is still the main area of support.

ETH Price Dynamics (Source: TradingView)

In the four-hour time frame, Fibonacci’s retracement level outlines the current struggle. The price is hovering at the 0.382 level ($4,343), but a 0.5 retracement ($4,428) and a 0.618 retracement ($4,511) form immediate resistance. The refusal here can be seen to ensure that the ETH remains locked within the correction cycle, but breakouts above 0.618 could resume the road to $4,636 and $4,792.

The DMI on the 4-hour chart shows that ADX holds -di above.

Why are Ethereum prices falling today?

ETH Price Dynamics (Source: TradingView)

On the 30-minute chart, the RSI was cooled to 46.0 after failing to maintain above 57.0. Meanwhile, VWAP has shown that ETH transactions are below $4,304, and signal prices are struggling to maintain session value levels. The 4-hour chart descending channel continues to compress prices, with resistance being nearly $4,380-4,400 and being rejected multiple times.

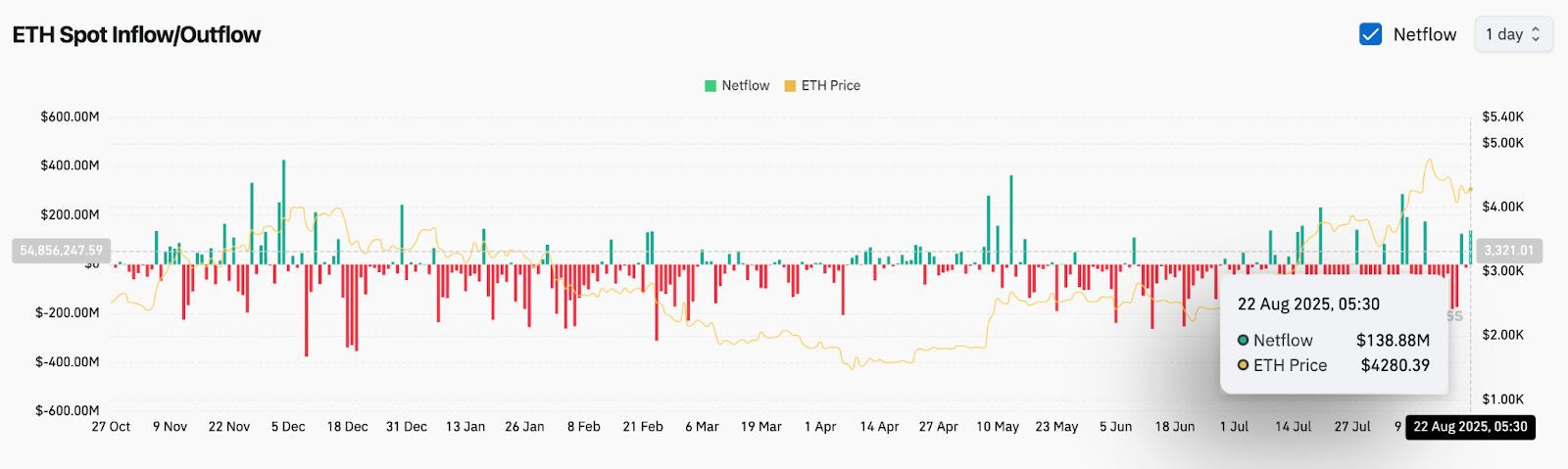

ETH On-Chain Activity (Source: Coinglass)

Exchange flow data also enhances short-term attention. The net spill has dominated the past month and supported summer rallies, but on August 22 it showed a remarkable net inflow of $138 million.

Bollinger Band, Emma, Channel Structure

ETH Price Dynamics (Source: TradingView)

The 4-hour Bollinger band is relatively wide, with ETH testing a midband that is close to $4,280. Below this level, the focus shifts to the lower band at $4,103. At the same time, EMA clusters draw complex pictures. ETH holds 20 EMA ($4,280), but below 50 EMA ($4,306) and 100 EMA ($4,412). The $3,956 200 EMA still supports a major upward trend, but the short-term signal has been revised.

ETH Price Dynamics (Source: TradingView)

The descending parallel channels highlight this dynamic. The price is fixed between $4,100 support and $4,400 resistance. Each rejection near the upper boundary leads to a sharp daytime decline, indicating that the Bulls have not yet regained their certainty.

ETH Price Forecast: Short-term Outlook (24 hours)

Over the next 24 hours, the Ethereum Price Action will be pivoting between $4,280 and $4,300. If ETH clears $4,400 on volume, a $4,511 (FIB 0.618) test and a $4,636 test could soon follow. On this, $4,792 is the next major target.

On the downside, it could potentially expose $4,135 first, with $4,066 and $3,955 as deeper downside levels as they failed to hold $4,280. Given the increased influx of exchanges and channel resistance, the short-term bias is leaning from neutral to barish unless the bull convincingly regains $4,400.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.