Ethereum has finally ended its four-week streak of ETF outflows. The week ending February 18th saw record inflows, showing the first signs of a return to institutional demand. At the same time, whale wallets are also starting to accumulate again. However, long-term holders continue to sell Ethereum every time the price jumps.

This creates a direct conflict that could determine whether Ethereum’s price recovery continues or stalls.

Whale accumulation begins and continuous ETF outflow ends

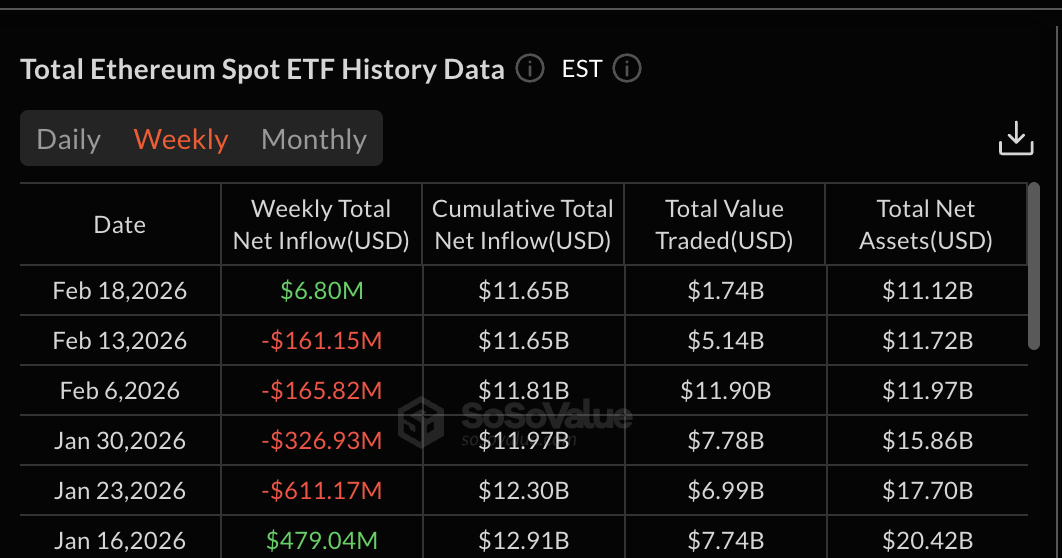

Ethereum has been under consistent selling pressure from institutional investors for four consecutive weeks. The Spot Ethereum ETF recorded net outflows for the weeks ending January 23rd, January 30th, February 6th, and February 13th. This sustained sell-off reflects weak institutional confidence and coincided with Ethereum’s broader price decline.

That trend has now changed. For the week ending February 18, there was a net inflow of $6.8 million. This change suggests that selling pressure from institutional investors has stopped, at least temporarily. When ETF flows turn positive after a long period of outflows, it often indicates an early stage of stabilization. However, inflow numbers remain weak and still cannot match the strength of outflows.

Ethereum ETF: SoSo Value

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

At the same time, the accumulation of whales has also returned. Data shows that wallets holding large amounts of Ethereum have increased their holdings from 113.5 million $ETH 113.63 million people on February 15th $ETH the current. This means an increase of 130,000 people $ETH. At current prices, this equates to an accumulation of approximately $253 million worth of Ethereum in just a few days.

Ethereum Whale: Santiment

Whale accumulation during downturns is important because large investors often take positions early, before a broad recovery begins. But this growing optimism is facing resistance from another group of investors.

Ethereum price shows bullish divergence, but long-term holders continue to sell

Ethereum’s 8-hour chart shows important momentum signals that historically precede price rallies.

From February 2nd to February 18th, Ethereum price formed another low. This means that the price has fallen below the previous support level. However, during the same period, the Relative Strength Index (RSI) formed even higher lows. The RSI measures the strength of buying and selling, and this pattern is called a bullish divergence.

This signal has already proven effective twice earlier this month. The first bullish divergence formed between February 2nd and February 11th. Since then, the price of Ethereum has increased by 11%. The second divergence appeared between February 2nd and February 15th. This resulted in an additional 6% recovery.

Spotting a bullish divergence: TradingView

both of these $ETH The rebound occurred while ETF outflows were still ongoing, indicating that buyers were already trying to regain control. Now, ETF inflows are returning and whales are accumulating. This increases the likelihood of another bounce attempt.

However, long-term holders are moving in the opposite direction. Hodler net position change measures whether long-term holders are accumulating or selling. A negative value means that long-term holders are diversifying their holdings.

On February 17th, long-term holders sold 34,841 shares. $ETH Rolling over 30 days. By February 18, that number had increased to 38,877. $ETH. This represents a sudden increase in selling pressure in just one day despite a bullish divergence signal.

Continued sales of holders: Glassnode

This indicates that long-term holders are taking advantage of price strength to exit their positions. Similar movements were seen at a rally in early February. Both past rallies failed to maintain upward momentum as selling by long-term holders limited the recovery.

This creates an obvious contradiction. While whale accumulation and ETF inflows support the recovery, selling by long-term holders limits upside room and signals clear risks. This conflict is now directly reflected in Ethereum’s price structure.

Triangular pattern reveals critical levels

Ethereum is currently trading within a symmetrical triangle pattern on the 8-hour chart. This pattern is formed when price moves between converging support and resistance lines.

A symmetrical triangle represents the balance between buyers and sellers. In the case of Ethereum, buyers include institutional investors coming back through whales and ETF inflows. Sellers also include long-term holders who are diversifying their positions.

This balance explains why Ethereum is still stuck in consolidation.

The first major resistance level is near $2,030. At this level, previous recovery attempts were stopped. A successful move above this level would indicate strengthening momentum and also confirm a breakout of the triangle. The next major resistance level is $2,100, which is also a bounce blocker. If we can break through this level, we may see a stronger recovery and pave the way to higher levels.

Ethereum Price Analysis: TradingView

However, downside risks still remain. The immediate recovery level is $1,960. If this level is not sustained, Ethereum could fall to $1,890. If selling pressure accelerates, the decline could extend further to $1,740.

Post-Ethereum ETF breaks 4-week outflow streak – Possibility $ETH Will prices finally recover? The post appeared first on BeInCrypto.