As November approaches, so too does the debate over the future of the world’s second-largest cryptocurrency. Experts remain divided on Ethereum’s trajectory, leaving the market with a crucial dilemma: Is shorting ETH a wise move or a risky bet?

Recent research and exchange-traded fund performance suggest caution. However, on-chain and derivatives data paint a different picture.

Why some analysts recommend short selling Ethereum

10x Research positions Ethereum as a better hedge than Bitcoin for short sellers in the current situation. Their analysis, shared amid ETH’s recent decline below $4,000, highlights major weaknesses that could amplify downside risk.

This bearish thesis focuses on Ethereum’s eroding “digital finance” narrative that once attracted institutional capital. This model, exemplified by BitMine’s strategy of accumulating ETH at cost and offloading it to retail at a premium price, fueled a self-reinforcing cycle throughout the summer. However, 10x Research claimed that the loop was broken.

“Market stories don’t die with the headlines. When new capital stops believing, market stories die in silence. The Ethereum machine shop story convinced many, but the bidding behind it wasn’t what it seemed. Even as retail turns a blind eye, institutional option positioning is quietly picking sides,” the post reads.

Additionally, spot ETFs have also experienced significant outflows. According to data from SoSoValue, the ETH ETF recorded outflows of $311.8 million and $243.9 million in the third and fourth weeks of October, respectively.

“The ETH ETF lost $184.2 million yesterday. BlackRock sold $118 million in Ethereum,” added analyst Ted Pillows.

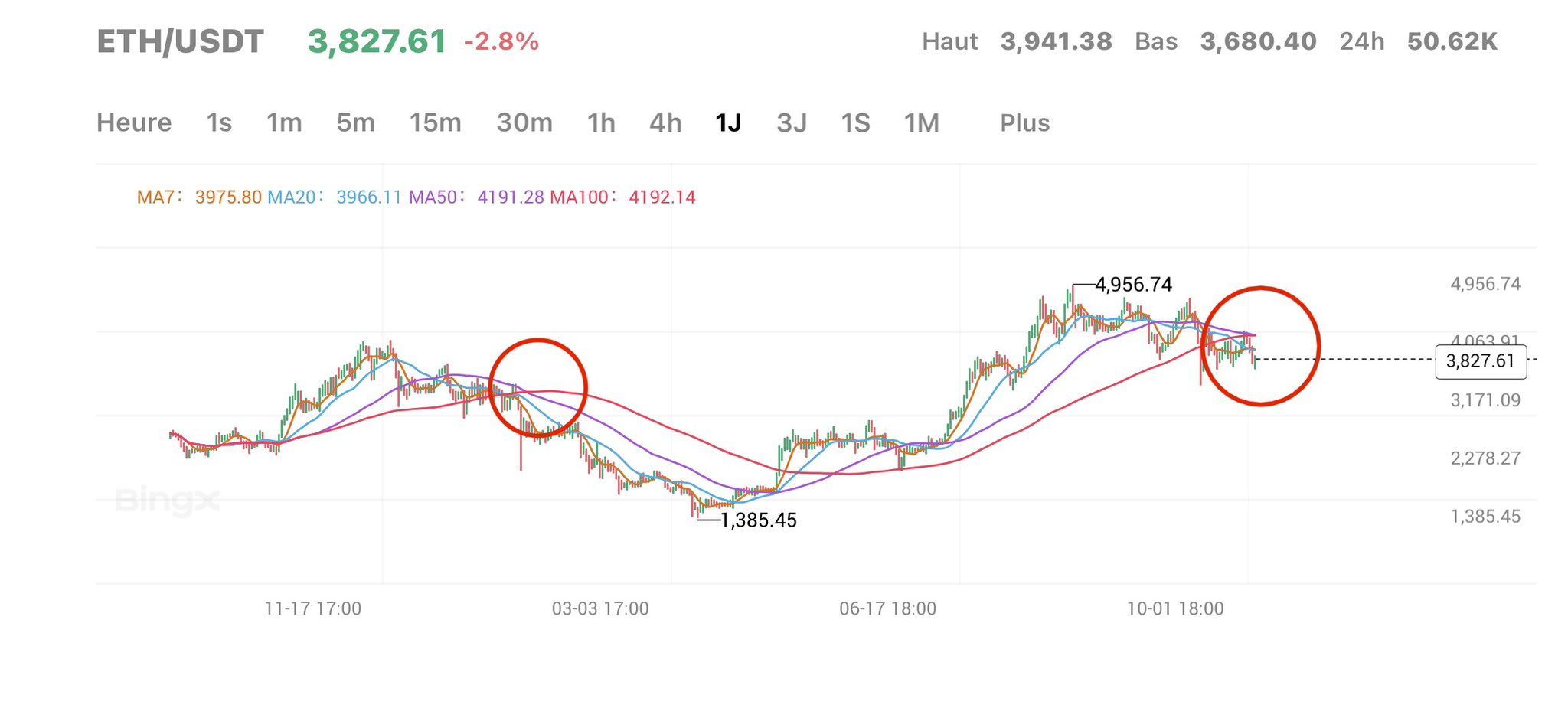

From a technical perspective, analysts pointed out that ETH is forming a bearish crossover. This is a technical analysis signal indicating a potential downtrend. He noted that the last time this pattern appeared, the price of Ethereum fell from about $3,800 to $1,400.

Ethereum price prediction. Source: X/Borg_Cryptos

Bearish sentiment matches bullish data: Will Ethereum bounce back in November?

However, not all signals are consistent with a bearish outlook. Some are suggesting that Ethereum could rebound in November.

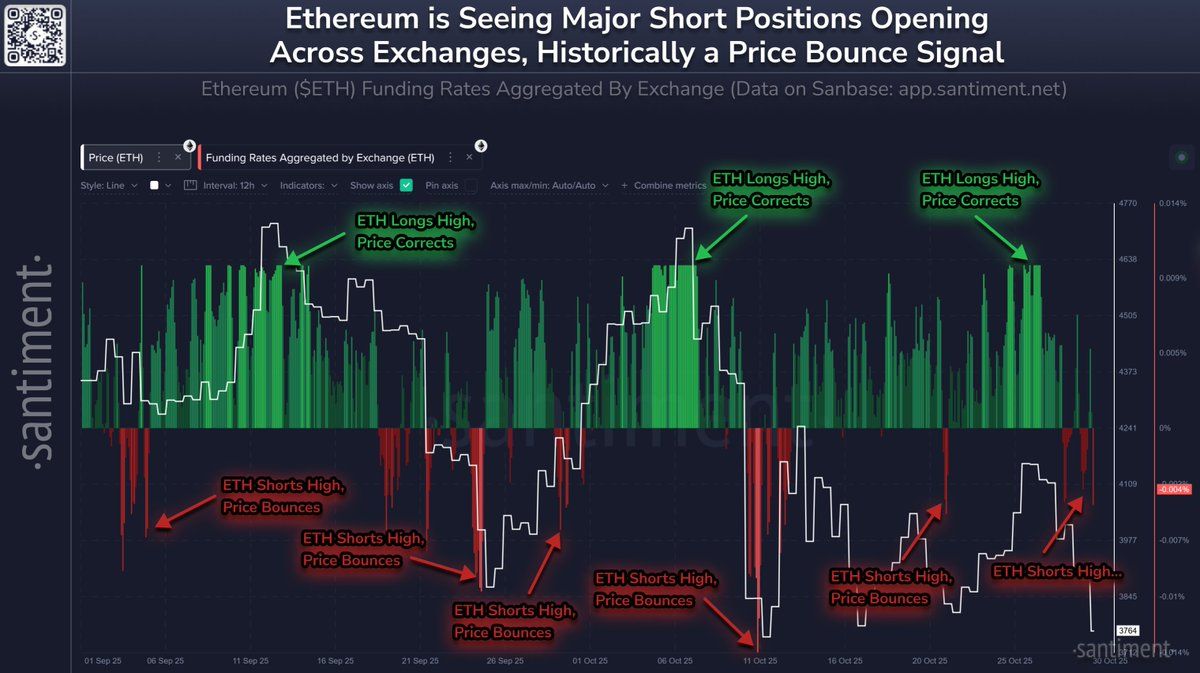

Santiment noted that once Ethereum fell to $3,700, traders began taking short positions again, a move that paradoxically preceded the price rally. The post highlighted that over the past two months, exchange funding rates have been a key indicator of where ETH will go next.

When funding rates turn positive, indicating that long positions are prevailing, excessive optimism often builds and prices correct. Conversely, if shorts are dominant and funding rates become negative, the possibility of a rebound increases.

“If the leading longs are dominant (greedy), the price will correct. If the leading shorts are dominant, a rebound is likely.” Santiment highlights.

ETH funding rate and price correlation. Source: X/Santiment

Another analyst noted that Ethereum’s “ecosystem daily activity index” has reached an all-time high, indicating strong involvement in the network.

This surge in on-chain activity provides a solid fundamental foundation for Ethereum and suggests that market strength is being driven by real user growth rather than speculation.

“This high level of participation has the potential to strongly support further price increases in the future,” CryptoOnchain said.

#Ethereum / $ETH is going to behave like gold and outperform them all

Don’t allow MM to dump you

Look at this graph and tell me something isn’t happening. pic.twitter.com/BVnZgA7p5K

— Mikybull 🐂Crypto (@MikybullCrypto) October 31, 2025

Therefore, the outlook for Ethereum heading into November remains delicately balanced. On the other hand, institutional dynamics, ETF outflows, and bearish technical patterns suggest caution. On the other hand, enhanced on-chain activity and derivatives data indicate the potential for increased user engagement and recovery.

Whether ETH extends its decline or rebounds may ultimately depend on which force proves to be stronger in the coming weeks.

The post Ethereum dips below $4,000—is this the beginning or a shakeout? appeared first on BeInCrypto.