Ether soaked more than 7% from its 2025 high as validators and investors were not betting on Wednesday.

Ethereum is a Proof-of-Stake network that requires Validators to wager assets and lock up funds to protect their network.

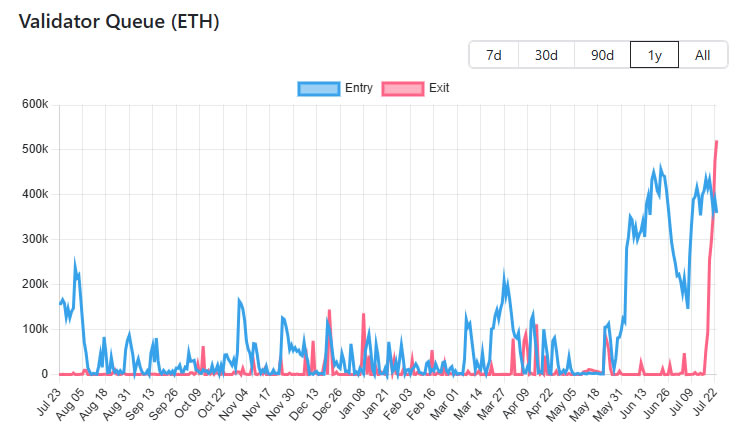

Validators who want to leave Ethereum’s staking system “and in the past few days, the numbers have absolutely surged,” reported Staking Protocol Everstake.

According to BalidatorQueue, 644,330 ETHs, worth around $2,340 million, are currently on vacation on 11 days of waiting, with around $2,340 million. In January 2024, when ETH prices fell 15% in January 2024, there was a similar spike in the exit queue.

Staking can mean that the validator is trying to free up assets for sale, but that’s not always the case.

Everstake said it was a “shift” rather than a sign of fear or collapse, adding that “shift” is likely to retreat to “rest, optimize, or rotate the operator rather than leave Ethereum.”

They added that investors and holders may also want to lock in profits. “It’s natural to assume that some stakers are preparing for sale, creating short-term selling pressure and could lead to price adjustments,” he added.

Ethereum Validator Exit cue surge. sauce: Validatorqueue

Acquiring or relocating profits?

Despite the obvious Exodus, the entry queue has 390,000 ETH, worth around $1.2 billion. In other words, the net unorganized amount is only about 255,000 ETH.

Furthermore, entry queues have increased significantly since early June. This is when Ether finance companies like Sharplink and Bitmine began to actively accumulate assets. Most corporate strategy companies say they will bet ETH for additional yields.

Additionally, the number of active validators is already below 1.1 million, with ETH already at 35.7 million, or nearly 30% of total supply, worth around $130 billion.

Ether prices will fall from the height of 2025

The assets have retreated by about 7% from their seven-month high of $3,844. This hit Monday, falling below $3,550 during late trading on Wednesday as traders locked in profits.

ETH prices were recovered to just $3,643 at the time of writing, up over 50% over the past month.

There has also been a great demand from US spot ether ETFs, which has seen more than $2.5 billion inflows over the past six days.

“We have seen a net inflow of $8 billion to Ethereum Mainnet over the last three months through the defi bridge and have seen a significant increase in Ethereum ETF inflow despite BTC ETFs seeing the outflow,” Henrik Anderson, chief investment officer at Apollo Capital, told Cointelegraph.

“This shows interest from Onchain natives and institutions,” he added.

Lido Liquid Staking Token Depegs

Tron founder Justin Sun recently removed roughly $600 million worth of ETH from the Aave Defi Lending platform, causing a sharp drop in liquidity in Steth (Steth), Lido’s Liquid Staking token and Aave.

What Redstone Staking Platform co-founder Marcin Kazmierczak has observed is that it may have been added to the exit queue as a panicked yield farmer attempted to convert Steth to ETH or sell it on the secondary market.