The crypto market is off to a bullish start to the week, with Bitcoin, Ether, and other major cryptocurrencies currently rising in value. Holiday periods are characterized by slow price movements due to low market volume.

However, that did not stop the bulls from regaining control and Bitcoin rose to the $90,000 level a few hours ago.

Ether collects $3,000 as Ethereum developers ramp up upgrades

Copy link to section

Ether, the native coin of the Ethereum blockchain, has the best performance among the top 10 cryptocurrencies by market capitalization. It has increased in value by 3% in the past 24 hours and is currently trading at $3,012 per coin.

The positive results come as bulls regain momentum and Bitcoin and other major cryptocurrencies also perform well.

Ethereum’s rise also comes as Ethereum developers intensify discussions of upgrading towards 2026. Ethereum developers have agreed that the Hegota upgrade will take place in the second half of 2026.

This upgrade comes after the Gramsterdam upgrade in the first half of this year and will focus on Verkle Trees.

Verkle Trees are a new data structure designed to allow Ethereum nodes to store and verify large amounts of data more efficiently.

When implemented with a Hegota upgrade, Verkle Trees can significantly reduce hardware requirements for node operators and improve decentralization by making it easier for more participants to run nodes.

The Gramsterdam upgrade, on the other hand, aims to address the fairness of MEVs on the network. Gramsterdam will address Proposer-Builder Separation (ePBS), officially tracked as EIP-7732.

With this proposal, Ethereum developers seek to differentiate between nodes that build blocks on the Ethereum blockchain and nodes that propose them.

This ensures that no single principal has control over which transactions are included or how they are ordered.

Ether focuses on 50-day EMA

Copy link to section

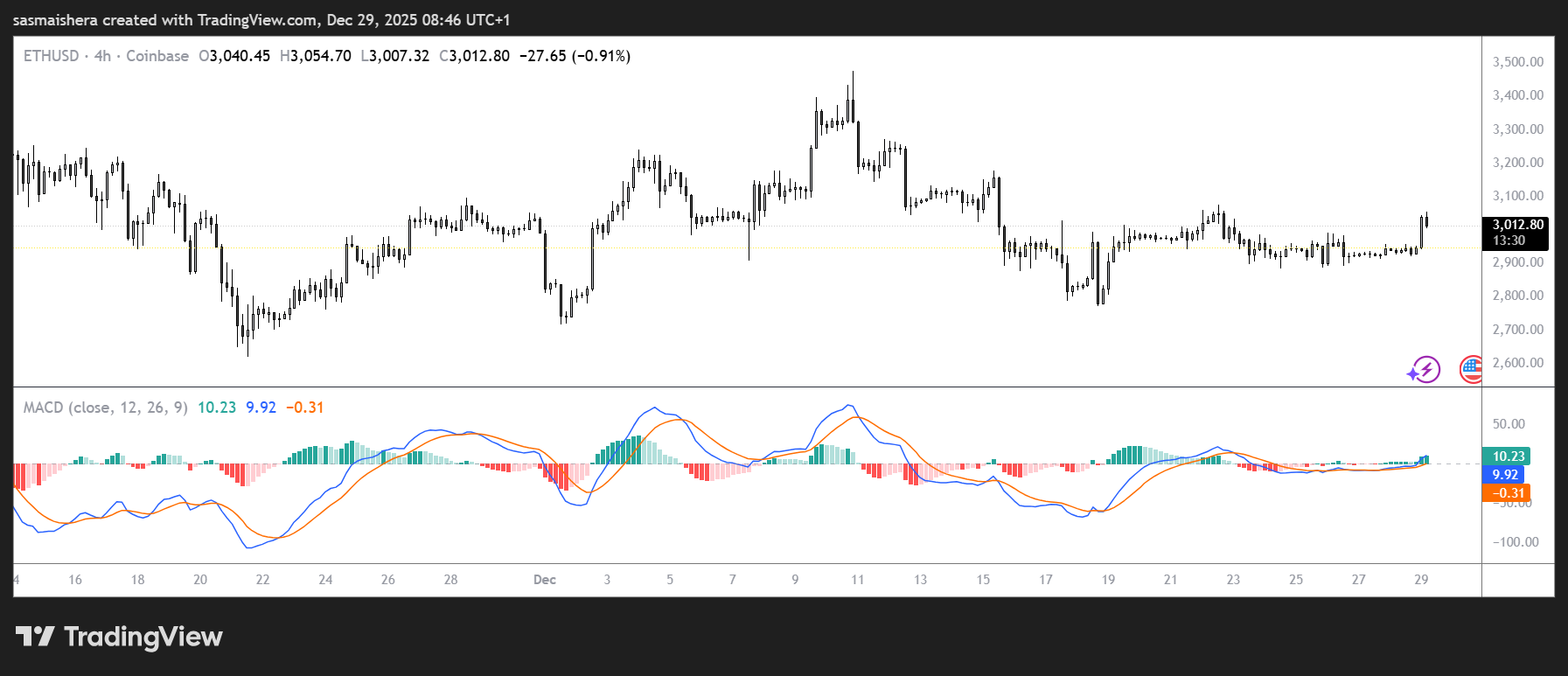

The 4-hour chart of ETH/USD is bearish and efficient as Ether has increased its value by 3% in the past 24 hours.

It is currently trading above $3,000 and has been on an uptrend for four consecutive days.

This rise means ETH is approaching the 50-day EMA of $3,136.

If Ether overcomes this resistance level, it could extend the rally towards the 200-day EMA of $3,374, which could represent an 11% upside from the current price.

Similar to other major cryptocurrencies, the momentum indicator on the ETH/USD chart switched to bullish on the 4-hour timeframe.

The RSI is at 62, indicating buying pressure.

ETH could rise further as the RSI attempts to enter overbought territory.

The MACD line also entered positive territory over the weekend, suggesting a strong bullish bias.

However, if the bulls are unable to push ETH above the 50-day EMA, the major altcoin could retest recent local support and potentially hit the December 18 low of $2,850.