Ethereum has made a notable rebound from the capitulation lows of $3.4,000, regaining ground above the psychological $4,000 level. Although this move marks a strong recovery, ETH remains capped below a major resistance zone, indicating that this pullback is the early stages of a structural repair rather than confirmation of continued bullishness.

technical analysis

Written by Shayan

daily chart

On the daily time frame, Ethereum has recovered from the $3.4 million to $3,500 demand zone, pushing the price above both the 100-day moving average ($4,000) and the lower trendline of the channel it broke earlier. This surge is supported by a bullish RSI divergence, indicating a decline in downside momentum and suggesting that sellers are losing control following the recent capitulation.

The price movement then regained the lower bound of the channel and now acts as a dynamic support, consolidating above this recovered level. However, the structure remains fragile. Continued acceptance above $4.3k is essential to re-establish a bullish bias and pave the way for the $4.6-4.7k supply zone. Conversely, a drop below $4,000 could negate the recovery and expose the $3.6-3.4k liquidity pool to another test.

4 hour chart

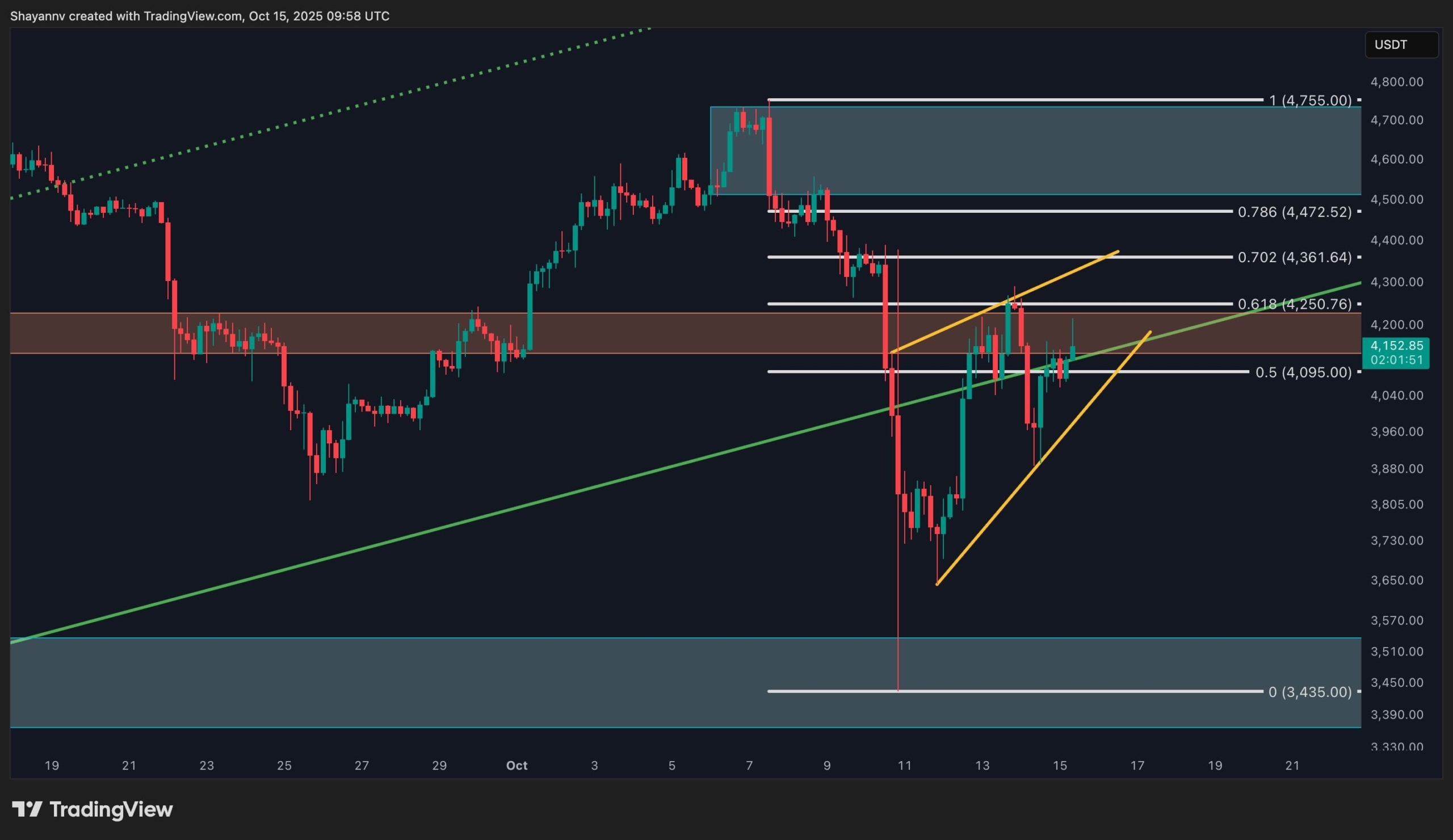

The 4-hour structure reveals that Ethereum is forming an ascending wedge pattern following a sharp V-shaped rebound from the $3.4,000 low. The asset is currently trading near the 0.618 Fibonacci retracement zone around $4.25K, which overlaps with the previous breakdown area ($4.2K to $4.3K), making this a key decision point for short-term direction.

A break above $4.3,000 will invalidate the wedge structure and confirm a bullish continuation from $4.45,000 to $4.7,000, consistent with the daily supply area. On the other hand, a breakdown below the wedge could trigger fresh weakness and push Ethereum back into the $3.8,000 to $3.4,000 demand range. Momentum remains cautiously constructive, but a directional widening could be imminent as volatility is compressed within the wedge.

sentiment analysis

Written by Shayan

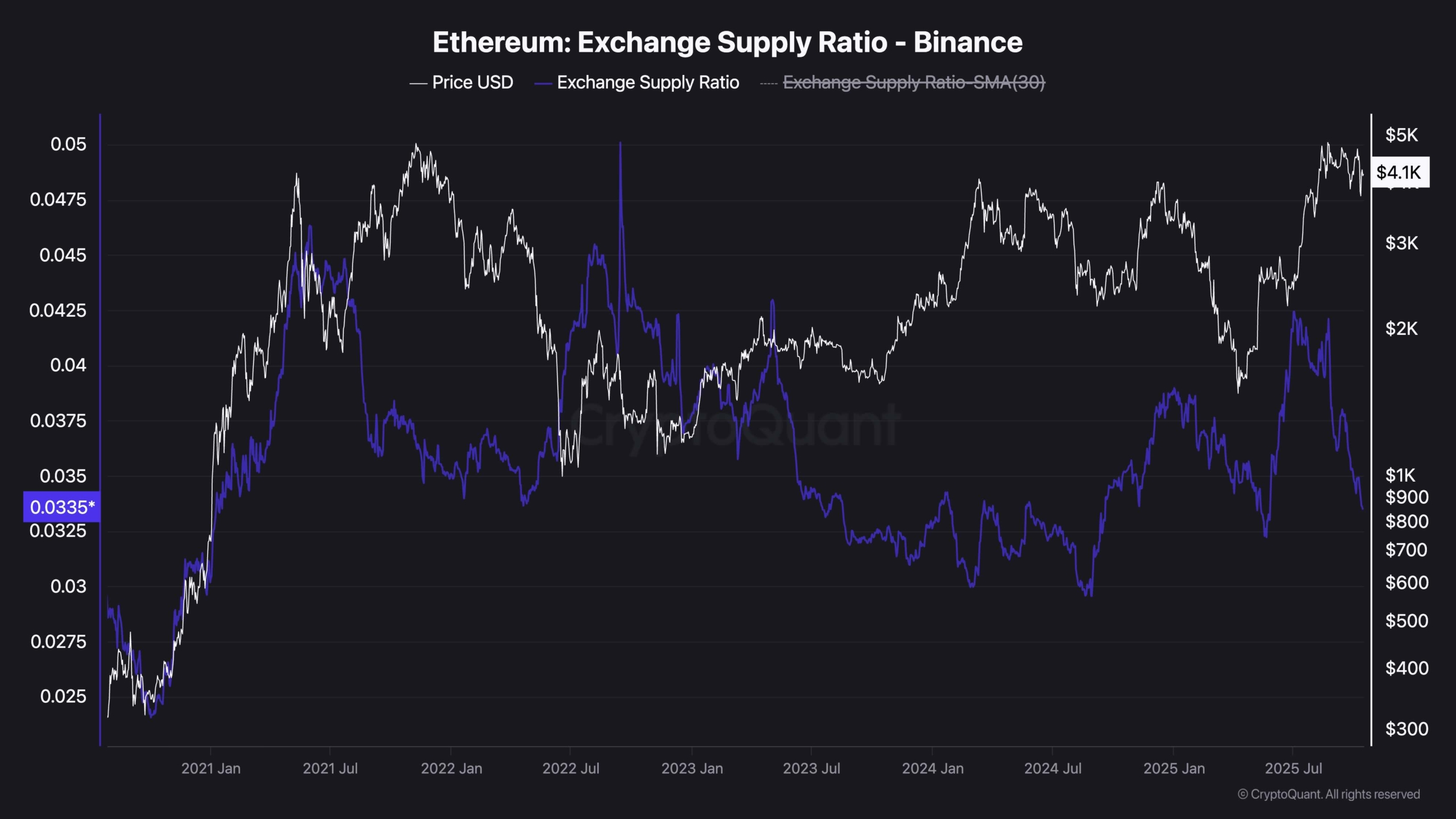

According to on-chain data from Binance, the largest Ethereum trading platform, the exchange supply ratio of ETH has fallen sharply, dropping to 0.33, nearing its lowest level since May. This decline follows a temporary increase in exchange balances while Ethereum was stable at around $4,000.

The decline in the exchange supply ratio indicates that holders are withdrawing ETH from exchanges into self-custody or cold wallets, a move widely seen as bullish. Fewer coins held on exchanges means less immediate selling pressure and tighter available liquidity, setting the stage for potential tighter supply if demand strengthens.

This trend suggests that Ethereum’s recovery is powered by true on-chain accumulation and not just a technical one. The shift towards holding behavior by both retail and institutional participants reinforces the idea that a structural demand base is forming at current price levels.

If this retreat trend persists and technical confirmation occurs with a definitive breakout above $4.3,000, Ethereum could be poised for a sustained mid-term rally supported by tightening currency liquidity and strengthening market fundamentals.