Ethereum is currently below the main resistance area after refusing in the $1,850 zone. Prices are relatively stable, but momentum is weaker.

Open interest and funding data refer to cautious optimism, but the continued rise depends on buyers defending key short-term levels.

Technical Analysis

Daily Charts

Following the aforementioned rejection in the supply zone, ETH has stagnated in a consolidated area where momentum is decreasing. Prices are still below both the 100-day and 200-day moving averages. This keeps tilted downwards and informs of bearish macrostructures.

The recent rally, starting at $1,500, has been strong, but with a lack of follow-through, prices have failed to surpass the $1,900 zone. If ETH loses a $1,700 pivot, the next major support would be around $1,500,000, which served as the basis for the previous inversion.

4-hour chart

The local structure has evolved into an upward channel, and after failing to break the $1,800 resistance zone, prices are now falling towards the lower boundary.

Rejection and false breakouts over resistance from the channel limit led to a sudden pullback, suggesting buyer fatigue. Currently, ETH is retesting previous demand around $1,740, and if it breaks it is expected to see a rapid decline to the $1,500 level.

Emotional analysis

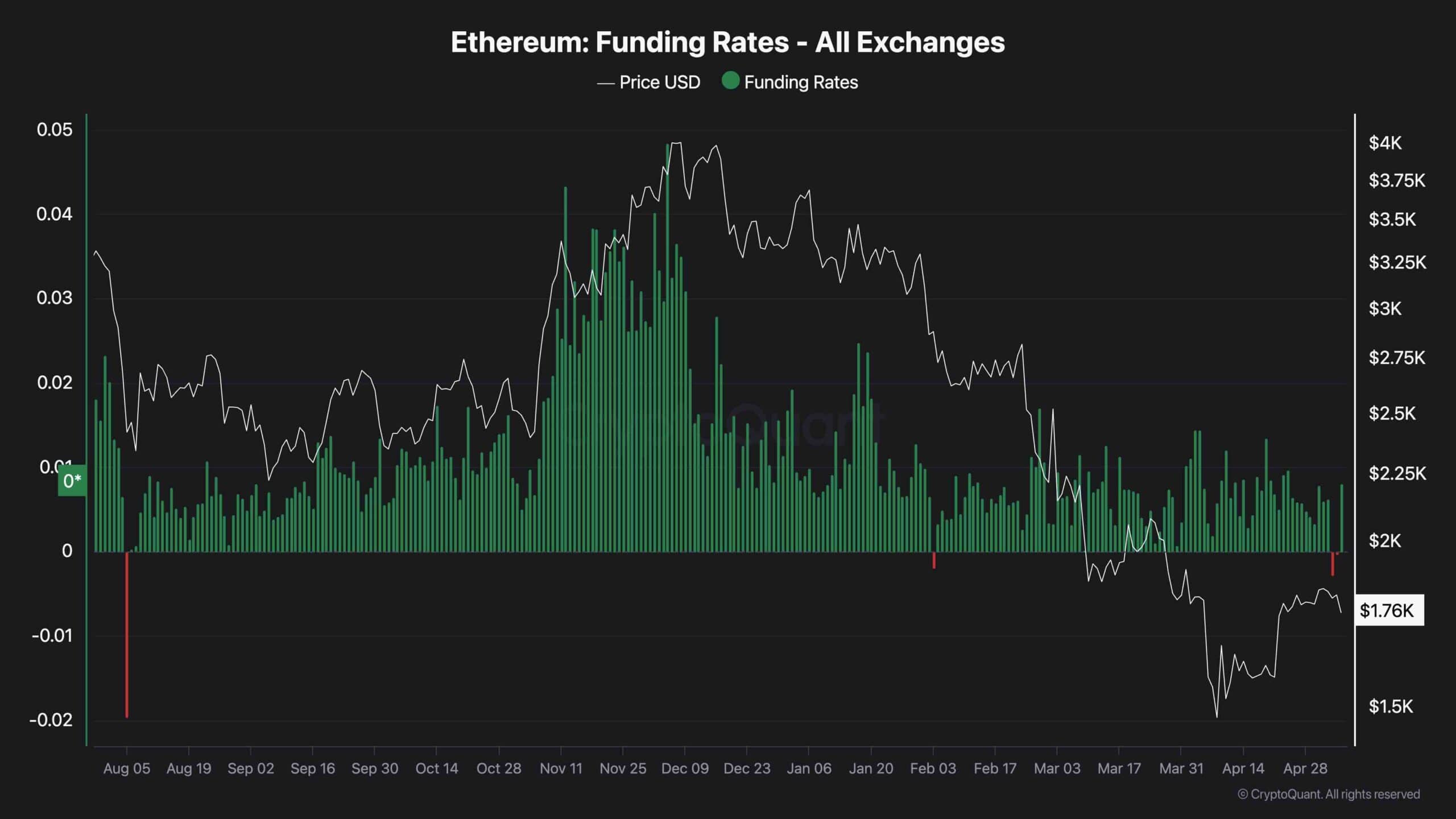

Funding rates remain largely neutral, with slight positive bias throughout the exchange. This reflects the lack of aggressive long exposures that are healthy in future gatherings but not indicative of immediate bullish convictions.

Over the past few days, open interest has been featured, suggesting new participation, but that is still far from the level of euphoria. As long as open interest is built while prices are being compressed, the risk of liquidation events is high unless the buyer intervene with force.

Meanwhile, ETH’s current funding rate structure suggests that most participants are still waiting for a bystander. The lack of severely distorted long positioning or short positioning indicates a market balance, but vulnerable to rapid emotional changes.

As assets continue to hover under resistance, offensive traders can begin to decline in long set-ups, leading to downward pressure. However, sudden upside-down breakouts beyond the $1,900 area can catch the market off guard and cause short waves of cover. Until then, emotions remained cautiously neutral with a slight bearish leaps in the short term.