Today’s Ethereum Price: $2,510

- Last week, major Ethereum on-chain data remains stifled.

- Geopolitical tensions in the Middle East make market participants less active.

- ETH expanded its integration after finding support for $2,450.

Ethereum (ETH) stabilized around $2,500 in its early Asian session on Thursday, following mixed activity across its on-chain data.

Following tensions in the Middle East War, Ethereum on-chain data remains muted

Ethereum has experienced a calming metric on the long-term chain metric of price consolidation over the past six days since it fell above $2,700.

According to data from SOSoValue, the US Spot Ethereum Exchange-Traded Funds (ETFs) have seen a significant decline in inflows, registering net inflows of just $32 million over the past two days. This contrasts with last week, when we saw more than $170 million in the first two days of the transaction.

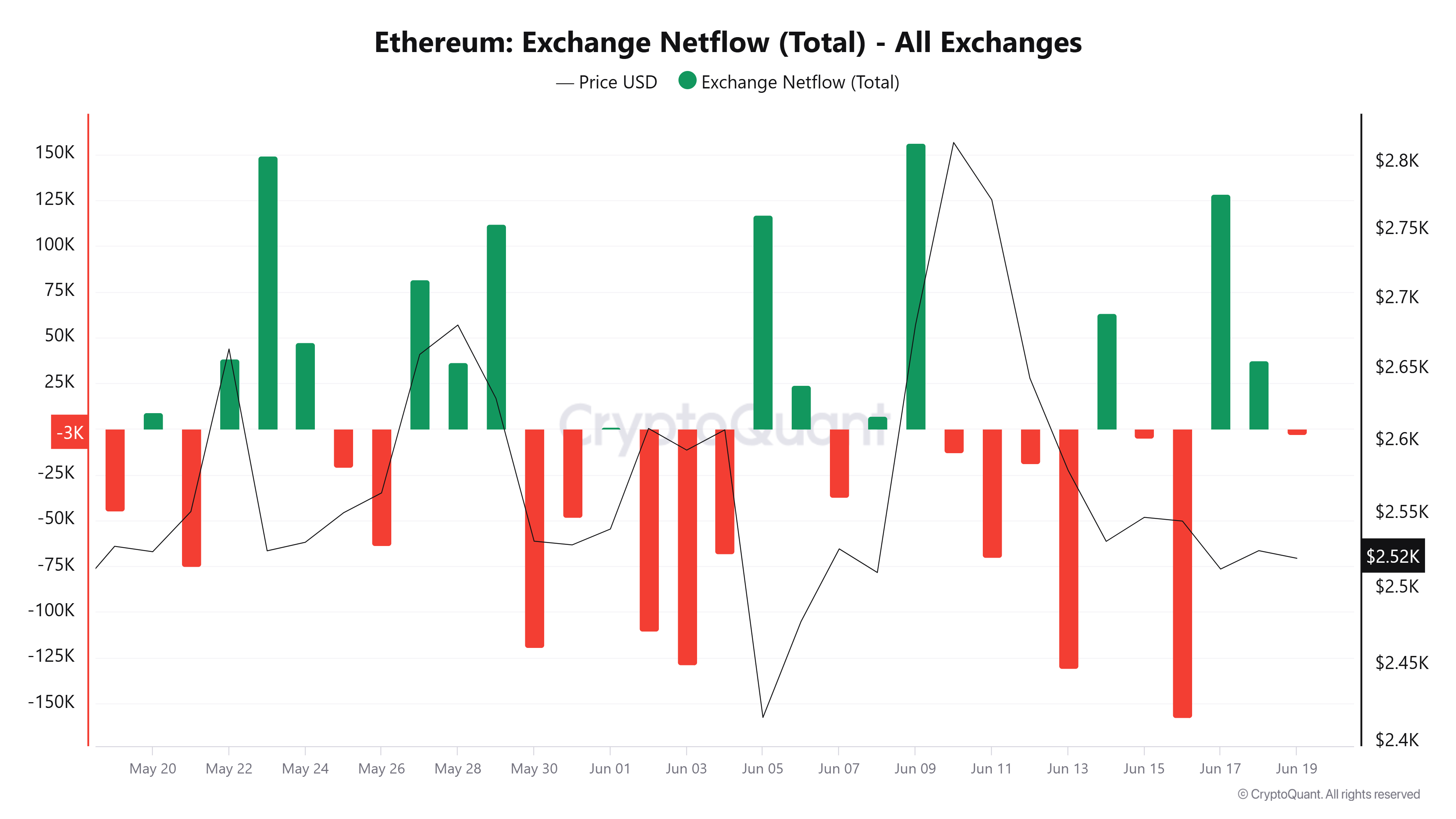

Net flow of exchanges, combined with a combination of inflow and outflow over the past week, also shows the struggle for market participants’ direction. A similar photo is evident in Ethereum futures, where interest opened over the past six days, flattened.

ETH replacement Netflows. Source: Cryptoquant

The calm in the market follows the US Federal Reserve decision to hold the rate steady at 4.25-4.50% on Wednesday amid continuing concerns about US tariffs and reopening tensions in the Middle East War.

“The market is increasingly focusing on the potential restructuring of the Middle East electricity structure and the impact this could have on regional geopolitics as the US, Russia and China are all involved in proxy,” QCP analysts said in a note to investors on Wednesday.

“Tehran will be cornered and this important chokepoint disruption or complete blockade will be a reliable tail risk. The straits account for a significant share of global crude oil flows, and supply shocks will have a significant inflationary impact,” they added.

As a result, investors are adopting risk-off strategies to hedge downside risk, while others remain stifled. With Delibit, the biggest option exchange, investors have increased strike prices from $2,450 to $2,500 over the past 24 hours, making this level an important volatility point in the coming days.

Put Options is not an obligation to sell the underlying assets at a specific price before the contract expires, but is not an obligation to grant the buyer the rights. This represents a price forecast for the drawback. If the price falls below the strike price of the put, the contract is “in money” or profitable.

“This geopolitical stress is layered on an already plagued global macro environment characterized by stubbornly rising inflation and a global reset of tariff regimes. The so-called tariff war may be barely dying in fanfare, but investors’ attention is rapidly moving to the Middle East.

Ethereum price forecast: ETH extends integration among weak quantities

According to Coinglas data, Ethereum has experienced $6461 million in Futures liquidation, with a long liquidation of $35.61 million and $29 million, respectively, over the past 24 hours.

Ethereum continued its consolidation on Wednesday, retaining $2,450 in support with a 38.2% Fibonacci retracement. Once ETH exceeds the 50-day exponential moving average (EMA), it could quickly rise to test $2,850 resistance. To overcome the $2,850 important resistance, ETH requires a surge in volume with strong bullish emotions.

ETH/USDT 8-hour chart

On the downside, a 38.2% Fibonacci level and movement below the lower key channel limit could send ETH to the $2,260-$2,110 range.

Relative Strength Index (RSI) and Stoch oscillators (Stoch) move sideways below neutral levels, indicating dominant bearish momentum.