Ethereum (ETH) trading volume continues to rise, and activity on Binance is also increasing. ETH activity is becoming more speculative as this token offers directional trading and fuels the derivatives market.

Ethereum is becoming a speculative asset due to increased Binance activity and the growth of the derivatives market overall. Compared to the previous cycle of Ether, the effect of derivative volume is more pronounced. Previously, ETH spot demand was driving up the price, directly reflecting the growth of the ecosystem.

The token fell to the $3,000 level before recovering to $3,615.63. Ether also showed a tendency to rapidly rebuild its open interest. After hitting a low of $18 billion in early November, Ethereum’s open interest has rebounded to over $18 billion. Over the past 24 hours, ETH open interest has recovered faster than BTC and increased more than BTC. 5.5%.

ETH still controls 11.9% of the market cap and is trading at 0.034 BTC.

ETH collects open interest immediately

The current ETH market cycle has far exceeded the 2021 bull market in terms of derivatives open interest. The growth of derivatives infrastructure and the demand for hedging through options are changing the ETH market, leading to more speculative price movements.

Binance remains the largest market, with $7.1 billion in open interest. However, the exchange has yet to recover its peak open interest from August 2025.

ETH is more volatile compared to BTC and also reflects general altcoin recoveries more quickly. However, as in past cycles, the price recovery does not necessarily reflect Ethereum adoption or on-chain activity. This time, the valuation of ETH may depend on derivatives exchanges, giving it new influence over Binance.

Binance has emerged as a leading venue for large-scale trading, including spot and derivatives markets. This exchange will absorb the majority of new token activity as well as speculative ETH activity. HyperLiquid is influential, but it only has $1.8 billion in open interest in Ether.

At the same time, more dramatic liquidations can occur if open interest is concentrated on one exchange. As a result, Ethereum short-term liquidations amounted to $90.64 million in the past 24 hours. Binance also led the day’s liquidation activity, with total liquidations totaling $7.8 million.

Can ETH revisit $4,000?

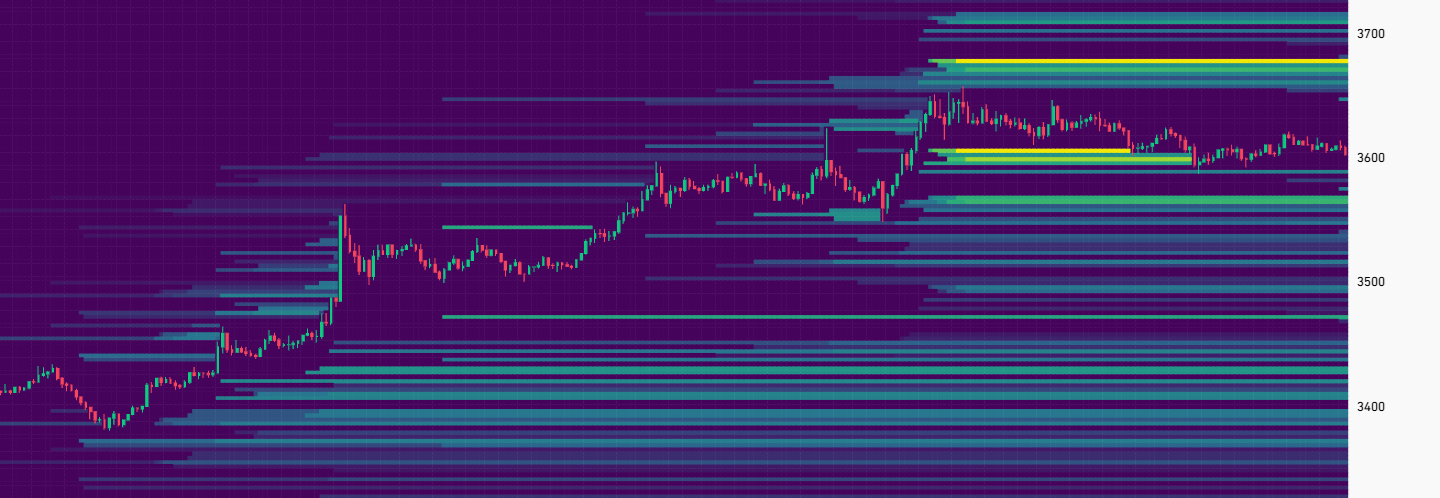

Based on liquidity in the derivatives market, ETH will be locked in a range due to the re-accumulation of long liquidity.

On the downside, ETH has positions up to $3,300. However, short positions have risen to around $3,700, suggesting that a rise to $4,000 is unlikely in the short term.

ETH liquidated almost all short positions and re-accumulated long liquidity supporting $3,300. |Source: Coinglass.

At its current price range, ETH is poised for both a rally to a new price range and a short-term crash.

Ether is trading at a slight premium in the futures market, suggesting a potential breakout. In perpetual futures, ETH received a slight discount and traded near $3,600.