After Ethereum (ETH) touched on the all-time high of $4,878 last week, the chain flow revealed a severe disparity in behavior before it returned to about $4,448. It suggests that retailers are in panic, but institutions are quietly stocking up.

Bitcoin and ether both cooled down after last week’s high. BTC prices fell about 5% from fresh ATH of over $124,400 to the $117,000 zone. This has brought the cumulative crypto market to print the red index on Saturday morning, dropping below the $4 trillion limit. 24-hour trading volume fell 32% to $180 billion.

ICO whales pay cash

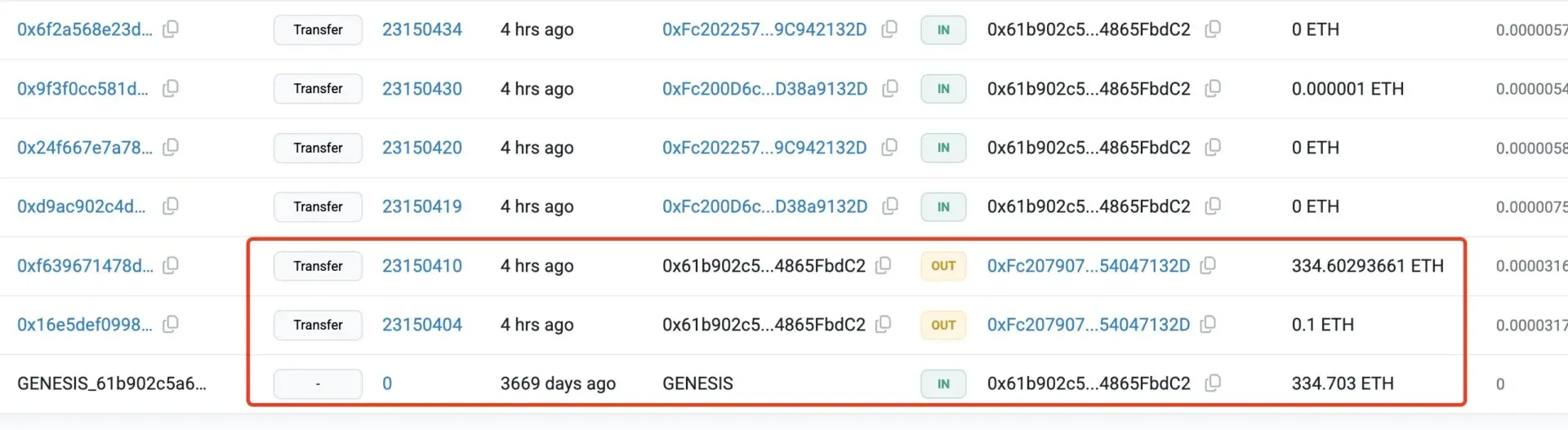

On-chain data shows that the whales are moving differently behind the red candle. One ICO attendant, who spent just $104 in 2015, finally moved 334.7 ETH (worth the day, about $1.48 million) after nearly a decade of dormant. That’s 14,200 times the return.

But companies like Bitmine have doubled while early investors are cashing out. The company has scooped up another 106,485 ETH (worth approximately $470 million) over the past 24 hours. The transport will bring the Treasury to 1.29 million ETH, worth nearly $5.8 billion. Another private institutional buyer has also been actively accumulating, pulling 92,899 ETH (worth around $412 million) from Kraken in just four days with his newly created wallet.

Source: Ethereum ICO participants: “0x61B9”.

At the same time, some large private funds use dips to adjust their positions. The Long Ring Capital-linked wallet sold 7,000 ETH, worth $31.8 million during the pullback, but still holds $352 million worth of ether. This restructuring suggests that sentiment metrics like Santiment’s greed index have peaked retail vitality at Bitcoin ATH, while institutions are treating ETH dips as their entry point.

Hackers earn cash on Ethereum run

Larry has also turned into an unexpected stairwell for hackers. The exploit of glowing capital, said to be linked to North Korea, sold around $44 million in ETH this week. This has increased the stolen funds to over $100 million, almost double the value of the original distance. The attacker ran out of $53 million last October, then flipped some of his booty into Stablecoins, pocketing more than $48 million in profits.

Similarly, Infini and Torcane attackers are exploits that utilize ETH surges. Infini hackers stole around $49.5 million in USDC in February and purchased 17,696 ETH at a price of $2,798. In addition to washing 5,000 ETH via tornado since July, hackers have sold 3,540 ETH for 133.18 million DAI, with an average price of $3,762.

Ethereum Price recorded a pullback after a short meeting. It fell 5% over the last 24 hours, but still rose 29% over the last 30 days. ETH trades at an average price of $4,455 at press time. The market capitalization is over $537 billion.